The Market Profile value areas and ShadowTrader Pivots for /ESZ18 and /NQZ18 Futures are posted free every morning

in the ShadowTrader Swing Trader newsletter.

Good Morning

WindoTrader 702-800-4628 (Terry) Reference ShadowTrader for discount

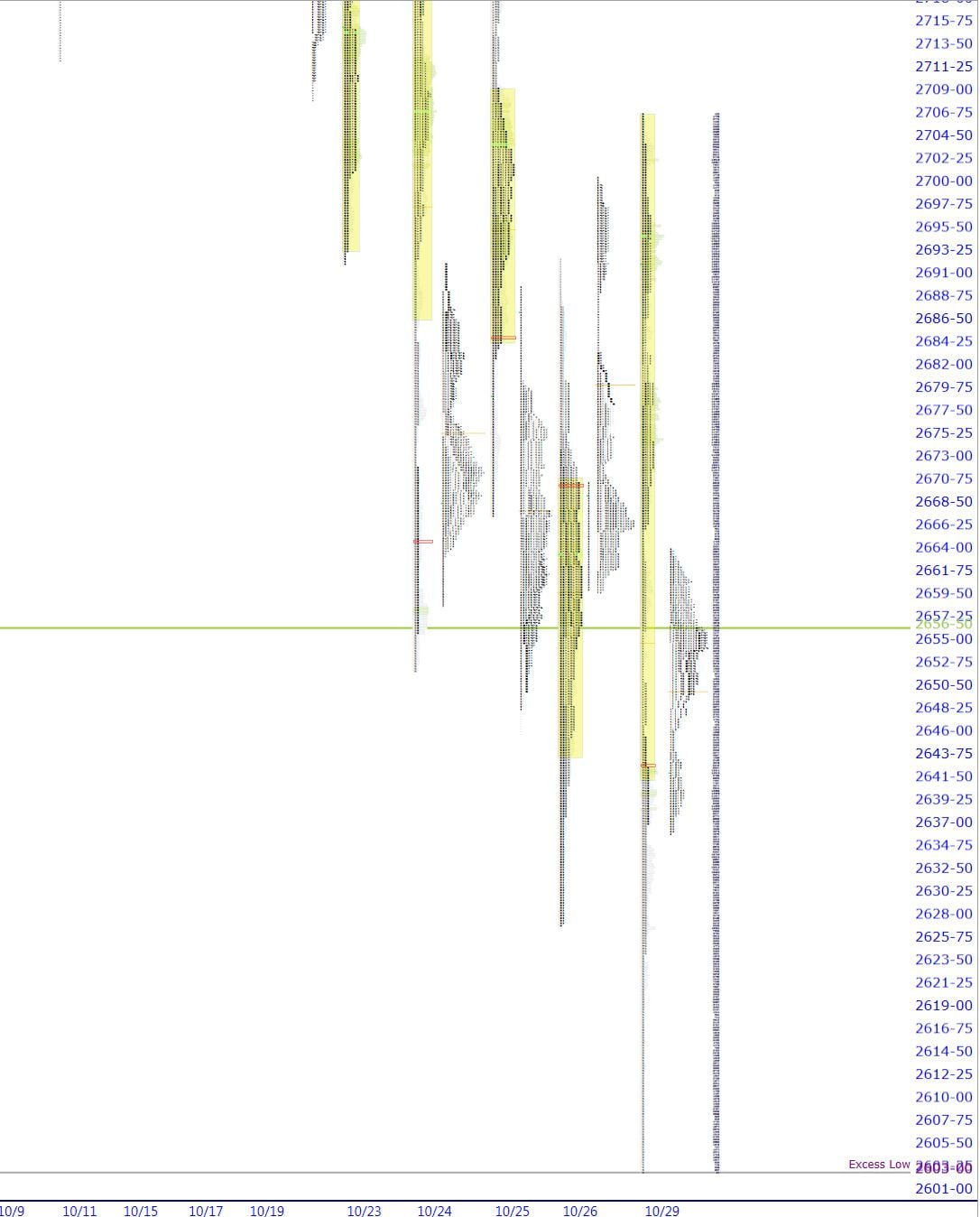

Let’s talk about spike rulesA framework for analyzing a spike on the next trading day after it is formed.

Because the spike forms late in the day, it is impossible to gauge whether or not the higher or lower prices that have run quickly away from value will be deemed fair later. Thus we employ the spike rules in the next session.

Everything below is assuming a spike at the TOP of a daily range (reverse for a spike at the BOTTOM of a range)

-If prices open above the spike, that is considered bullish and tells us that prices didn't auction high enough in the spike to attract sellers and cut off buying activity. Monitor to see if there is acceptance above the spike.

-Prices opening within the spike confirm the higher prices of the spike. This tells us that the prices are fair enough for two sided... again. Spike rulesA framework for analyzing a spike on the next trading day after it is formed.

Because the spike forms late in the day, it is impossible to gauge whether or not the higher or lower prices that have run quickly away from value will be deemed fair later. Thus we employ the spike rules in the next session.

Everything below is assuming a spike at the TOP of a daily range (reverse for a spike at the BOTTOM of a range)

-If prices open above the spike, that is considered bullish and tells us that prices didn't auction high enough in the spike to attract sellers and cut off buying activity. Monitor to see if there is acceptance above the spike.

-Prices opening within the spike confirm the higher prices of the spike. This tells us that the prices are fair enough for two sided... come into play when there is a set of single printsAny section of the market profile distribution that is only one TPO wide. Single prints are a sign of emotional buying or selling as very little time was spent at those levels and thus there is no value there. The endpoints of single print sections are considered to be potential support or resistance points., usually long in size, that occur during the last 30 minutes of trade. In the way that I have my market profile software configured, that would be N period. Note that N period is followed by O period (I watched a lot of Sesame Street), but O period is only 15 minutes long as the futures stop trading at 4:15. So, sometimes a spikeA set of single prints that are created in the last 30 minute session of the day which form at the top or bottom of a range. will have some “O”‘s mixed in with its “N”‘s but I still think of it as as spikeA set of single prints that are created in the last 30 minute session of the day which form at the top or bottom of a range.. Other than the obvious benefit of an alphabet refresher, why is any of this important?

When a spikeA set of single prints that are created in the last 30 minute session of the day which form at the top or bottom of a range. occurs it is a form of excess, and also price exploration. It is also a sign of selling (or buying at a top) that is very emotionally driven. Or is it? Well, it certainly is at the outset when the single printsAny section of the market profile distribution that is only one TPO wide. Single prints are a sign of emotional buying or selling as very little time was spent at those levels and thus there is no value there. The endpoints of single print sections are considered to be potential support or resistance points. are forming but normally you have the rest of the day to either fill in that area or leave an excess lowA low characterized by a number of single prints that ends a move and is at the bottom of a daily market profile distribution. The minimum number of TPO's that is necessary to define an excess low is two, however when the excess has only a few TPO's, it is said to be "lack of material excess". An excess low is the opposite of a poor low, which has no single prints and is flat along the low where the TPO's line up next to each other./high on the chart. Because the spikeA set of single prints that are created in the last 30 minute session of the day which form at the top or bottom of a range. occurs in the last 30 minute period, there is no further trade to either confirm or deny the spikeA set of single prints that are created in the last 30 minute session of the day which form at the top or bottom of a range.. And that’s why you need the spike rulesA framework for analyzing a spike on the next trading day after it is formed.

Because the spike forms late in the day, it is impossible to gauge whether or not the higher or lower prices that have run quickly away from value will be deemed fair later. Thus we employ the spike rules in the next session.

Everything below is assuming a spike at the TOP of a daily range (reverse for a spike at the BOTTOM of a range)

-If prices open above the spike, that is considered bullish and tells us that prices didn't auction high enough in the spike to attract sellers and cut off buying activity. Monitor to see if there is acceptance above the spike.

-Prices opening within the spike confirm the higher prices of the spike. This tells us that the prices are fair enough for two sided....

SPIKE RULESA framework for analyzing a spike on the next trading day after it is formed.

Because the spike forms late in the day, it is impossible to gauge whether or not the higher or lower prices that have run quickly away from value will be deemed fair later. Thus we employ the spike rules in the next session.

Everything below is assuming a spike at the TOP of a daily range (reverse for a spike at the BOTTOM of a range)

-If prices open above the spike, that is considered bullish and tells us that prices didn't auction high enough in the spike to attract sellers and cut off buying activity. Monitor to see if there is acceptance above the spike.

-Prices opening within the spike confirm the higher prices of the spike. This tells us that the prices are fair enough for two sided....

Opening within the spikeA set of single prints that are created in the last 30 minute session of the day which form at the top or bottom of a range. is bearish and at least for the time being confirms the lower prices.

Opening above the spikeA set of single prints that are created in the last 30 minute session of the day which form at the top or bottom of a range. is less bearish and is a rejectionPrices are rejected when they move away from a key area quickly in the market profile. For example, let's say that futures open below the value area and start to rise towards it. Upon breaching the low of the value area, they rise just a couple ticks higher and then fall quickly back out of the value area. That's rejection. Rejection is often noted when prices move into "make or break" areas such as an ONH or ONL or prior day's RTH high or low from outside of those areas.

Rejection is the opposite of acceptance. of the lower prices if it can stay above the spikeA set of single prints that are created in the last 30 minute session of the day which form at the top or bottom of a range..

Trading within the spikeA set of single prints that are created in the last 30 minute session of the day which form at the top or bottom of a range. and finding acceptanceWhen the market profile begins to build out or develop in a certain area, it is said that the market is accepting those prices. This can be measured either in time spent or amount of volume that is transacted. It is generally understood that ShadowTrader defines acceptance as more of a time dynamic than a volume one. A good rule of thumb is to look for at least two TPO periods to print in the accepted area. The acceptance confirms that a significant amount of market participants are transacting at those levels. Acceptance is the opposite of rejection. More deems the new spikeA set of single prints that are created in the last 30 minute session of the day which form at the top or bottom of a range. prices fair and confirms them.

Trading below the spikeA set of single prints that are created in the last 30 minute session of the day which form at the top or bottom of a range. is very bearish as it tells us that prices didn’t auction low enough in the spikeA set of single prints that are created in the last 30 minute session of the day which form at the top or bottom of a range. to attract any buyers.

Trading above the spikeA set of single prints that are created in the last 30 minute session of the day which form at the top or bottom of a range. and finding acceptanceWhen the market profile begins to build out or develop in a certain area, it is said that the market is accepting those prices. This can be measured either in time spent or amount of volume that is transacted. It is generally understood that ShadowTrader defines acceptance as more of a time dynamic than a volume one. A good rule of thumb is to look for at least two TPO periods to print in the accepted area. The acceptance confirms that a significant amount of market participants are transacting at those levels. Acceptance is the opposite of rejection. More there is more bullish and establishes the spikeA set of single prints that are created in the last 30 minute session of the day which form at the top or bottom of a range. as an excess lowA low characterized by a number of single prints that ends a move and is at the bottom of a daily market profile distribution. The minimum number of TPO's that is necessary to define an excess low is two, however when the excess has only a few TPO's, it is said to be "lack of material excess". An excess low is the opposite of a poor low, which has no single prints and is flat along the low where the TPO's line up next to each other..

Currently futures are gapping up 10.00 as of this writing and are slated to open above the spikeA set of single prints that are created in the last 30 minute session of the day which form at the top or bottom of a range. which I see as being from the low of 2603.00 to 2624.25. As the gap is well within yesterday’s range, gap rulesGuidelines to follow on any day that the futures open outside of the prior day's RTH range. Only opening outside of range is a true gap and puts gap rules in play. 1. Go with all gaps that don't fill right away. This means that if early trade doesn't start to correct the imbalance, then prices will probably move in the direction of the gap. 2. Larger gaps can often fail to fill on the first day or may fill only partially. 3. If the gap fills (meaning the prior day's RTH high is touched on a gap up or the prior day's RTH low is touched on a gap down) and value cannot get to at least overlapping, then the odds of a late day rally (on a gap up) or late day selloff (on a gap down) increase. 4. Gaps of larger than $20 in the /ES are difficult to trade and should be avoided early in the day as t... More are not in play which is good because you don’t have to keep two sets of rules in your head at the same time.

Some important nuances that we can glean from yesterday’s market generated information:

-No migration of POCPoint of Control, also known as the "fairest price to do business". It is the price level in the /ES where the greatest amount of volume in the prior RTH session traded. ShadowTrader measures the POC using volume but the traditional way is to mark off the widest point of the day's distribution where the most TPO's printed going across from left to right, indicating that that was the price where the most time was spent. It's important to pay attention to both the volume POC and the TPO POC. lower with price yesterday. The POCPoint of Control, also known as the "fairest price to do business". It is the price level in the /ES where the greatest amount of volume in the prior RTH session traded. ShadowTrader measures the POC using volume but the traditional way is to mark off the widest point of the day's distribution where the most TPO's printed going across from left to right, indicating that that was the price where the most time was spent. It's important to pay attention to both the volume POC and the TPO POC. is up at 2695.00 which is quite away from the LODLow of Day.

-The taperA market profile term that Peter often calls out in the Weekly Options room. The "taper" is the tapering off of contract volume in the /ES as it moves to either the high or low of the day. Almost all highs and lows of a session are characterized by a diminishing of volume as price gets closer to the ultimate low or high of the day. By the end of a regular trading hours session, almost every contract level will have at least 1,000 cotracts traded at it with many of the levels having over 10,000. The taper occurs when you start to see contract sizes per price level less than 1,000 and very often less than 100 on the exact high or low of the day. The taper is a strong trading signal that the move underway may be over and the high or low of the day has been put in. When the taper is punctuated... More of volume was huge; I’m not seeing any large blocks of volume at price until much higher up the distribution.

-Overall volume was down as market went up early which was a tell, but also never really increased on way down either. As the market spent more time down than up yesterday, I’m carrying that forward.

What makes sense to me now…

–The market is oversold and the late day selloff does not bode well for sellers. What “should” happen is a strong countertrend rally here to balance that off a bit. That being said, why are futures only up 8 handles right now. Note that they were up 10 handles two paragraphs ago.

–Yesterday’s distribution has two other sets of single printsAny section of the market profile distribution that is only one TPO wide. Single prints are a sign of emotional buying or selling as very little time was spent at those levels and thus there is no value there. The endpoints of single print sections are considered to be potential support or resistance points. in it besides the spikeA set of single prints that are created in the last 30 minute session of the day which form at the top or bottom of a range.. That adds on to my comment above that structure was poor on the way down.

–Yesterday was an outside day which means that the prior day’s range is completely inside of yesterday’s range. This is a longer term bearish signal but doesn’t have to play out today. It’s more of a swing (2-5 day) signal than a day timeframe one in my opinion. Carry it forward.

–A move over the ONHOvernight High. A term mostly used in describing the futures market which has an overnight session and trades almost around the clock. To be precise, in the /ES this is the high made between 4:30pm EST and 9:30am EST the next day. at 2664.25 isn’t necessarily a buy to me today because there is tons of valueThis value has nothing to do with valuation. It denotes prices that are "fair". Fair in this sense means a price that is common to a lot of participants. An item that you buy once per week in a store at a price that doesn't fluctuate has a "fair price". You can express this by a formula Value = Price + Time or Value = Price + Volume Either of the above are valid ways of expressing value. In the first equation, value is defined by price staying the same for a long period of time. In the futures market, this would be an area that is revisted a lot during a particular session or multiple sessions. The point of control is the price level where the most amount of time was spent during an RTH session. James Dalton refers to this level as "the fairest price to do business". Using vo... More to the left of that and I’m not sure just how much shock and aweA term Peter uses to describe what overnight futures traders may be feeling when faced with an open that is wildly divergent from what they expected. Large gaps in either direction that are opening well outside of range are examples of this. The approach is that when the market opens in such a manner, there is often opportunity to trade earlier rather than later because of the large contingent of traders who will be forced to reverse their positions quickly. that would create if any.

–Futures are now up only 6 and /NQ’s have gone negative. Again, we should be rejecting the spikeA set of single prints that are created in the last 30 minute session of the day which form at the top or bottom of a range. big time and while prices are still above it, I’m not impressed.

Have a great day,

-peter

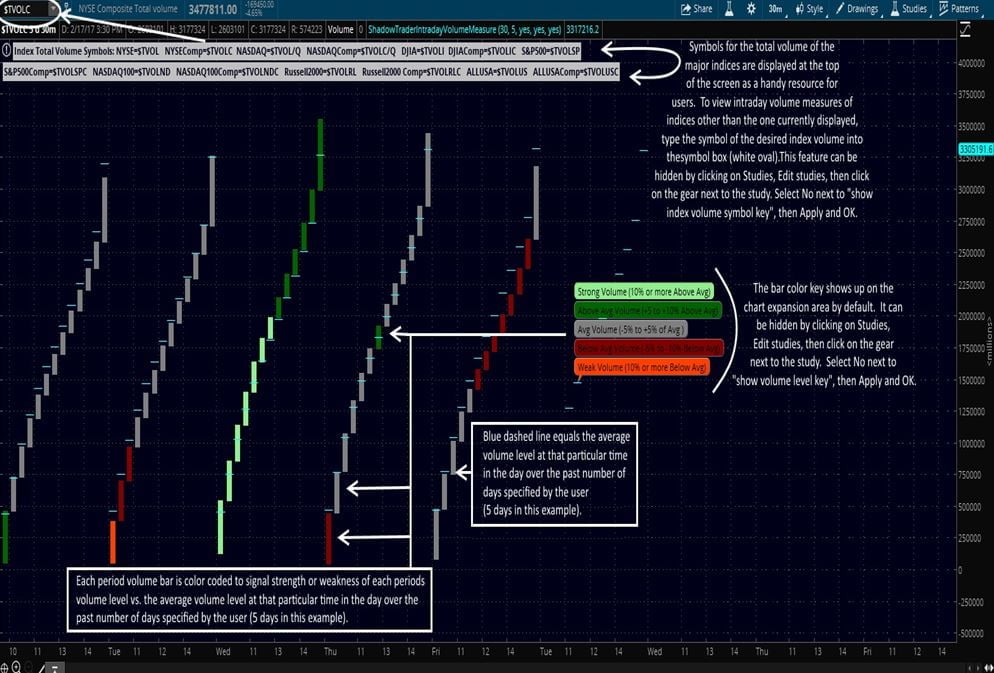

ShadowTrader Intraday Volume Measure

COMPARE INTRADAY VOLUME IN ANY TIMEFRAME

Fully Customizable Settings!

$20 Buy Now