The Market Profile value areas and ShadowTrader Pivots for /ESH21 and /NQH21 Futures are posted free every morning

in the ShadowTrader Swing Trader newsletter.

WindoTrader 702-800-4628 Speak with Terry about the ShadowTrader discount

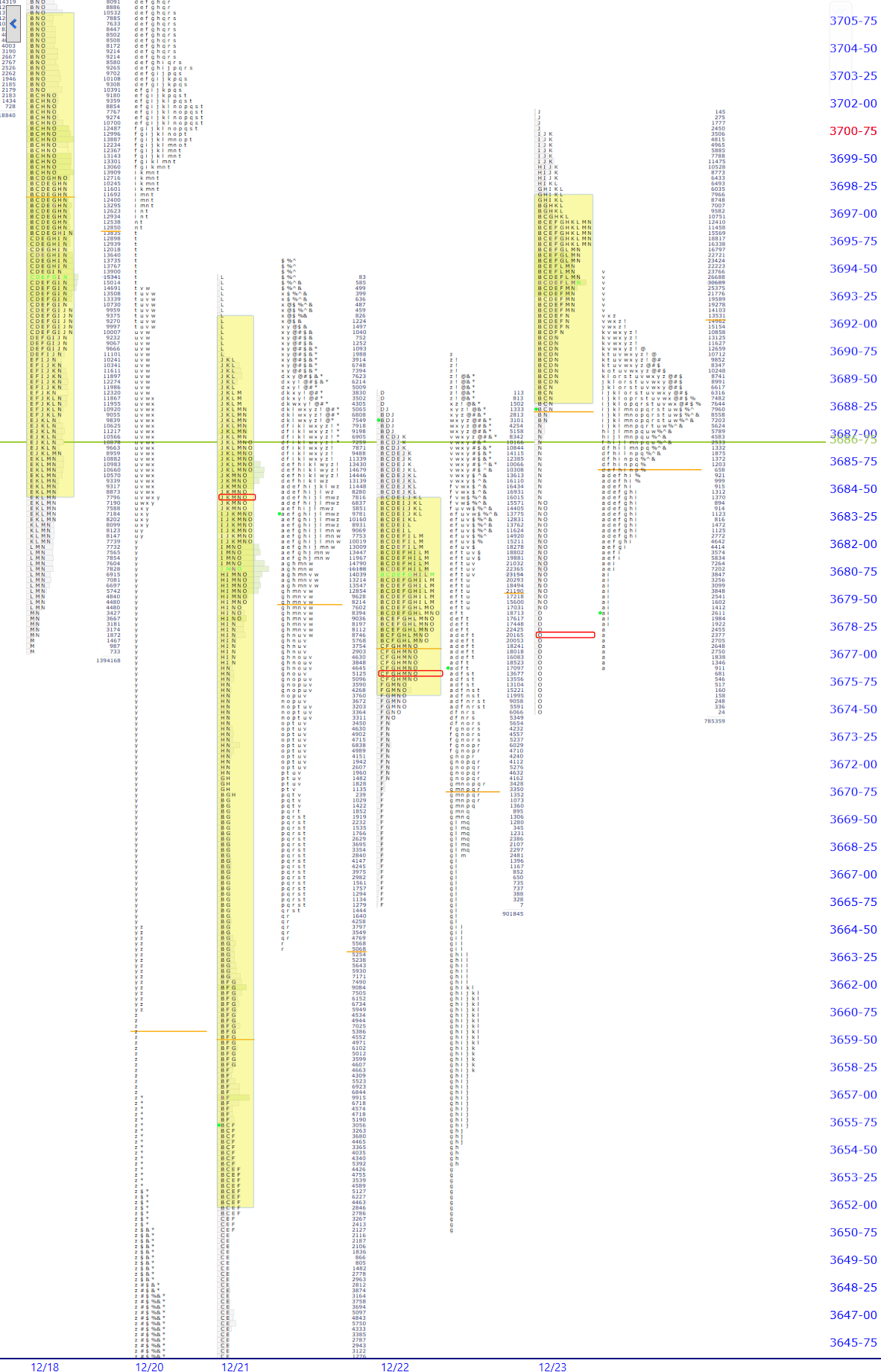

| 3701.75 | RTHRegular Trading Hours. In the /ES this means the price action from 9:30am EST to 4:15pm EST only. High |

|---|---|

| 3674.50 | RTHRegular Trading Hours. In the /ES this means the price action from 9:30am EST to 4:15pm EST only. Low |

Shortened session today as markets will close at 1pm EST.

Yesterday’s market profileA way of reading the market that recognizes either time spent or volume traded at a particular price level. A market profile can be either made up of “TPO’s” (time price opportunities), or volume. TPO’s measure how much time was spent at a particular price, while volume-based market profiles measure how much volume traded at a particular price. Generally, market profile is used in the trading of futures, especially the /ES. ShadowTrader utilizes volume based profiles. distribution was extremely symmetrical and also relatively squat with the market trading in a tight range for the RTHRegular Trading Hours. In the /ES this means the price action from 9:30am EST to 4:15pm EST only. session. Given today’s shortened session happening before a major holiday and three day weekend, I’m not expecting much in terms of larger initiative trade today. The entire overnight range is within the RTHRegular Trading Hours. In the /ES this means the price action from 9:30am EST to 4:15pm EST only. range.

Overnight inventoryA way of measuring overnight activity in the futures market by just noting how much of the overnight activity happens to fall above the prior day's settlement value (4:15pm EST close) and how much falls below. If more activity is above the settlement, then overnight inventory is said to be net long. If more is below, then it is said to be net short. If all of the overnight activity is above the settlement, then it is said to be 100% net long. If all of the activity is below the settlement then it is said to be 100% net short. The overnight inventory situation matters most and has the most impact on early trade when it is skewed 100% in either direction because when the imbalance is very large like that then the odds of an early correction increase greatly. This is due to the fact that most... is 100% net long which is not surprising given that traders were short in the holeA condition where late day sellers close price at or near lows but value and the volume POC remain much higher up in the RTH distribution. coming into the evening session. Note the spikeA set of single prints that are created in the last 30 minute session of the day which form at the top or bottom of a range. into the close. Spike rulesA framework for analyzing a spike on the next trading day after it is formed.

Because the spike forms late in the day, it is impossible to gauge whether or not the higher or lower prices that have run quickly away from value will be deemed fair later. Thus we employ the spike rules in the next session.

Everything below is assuming a spike at the TOP of a daily range (reverse for a spike at the BOTTOM of a range)

-If prices open above the spike, that is considered bullish and tells us that prices didn't auction high enough in the spike to attract sellers and cut off buying activity. Monitor to see if there is acceptance above the spike.

-Prices opening within the spike confirm the higher prices of the spike. This tells us that the prices are fair enough for two sided... are in play and as of now we are slated to open just above the spikeA set of single prints that are created in the last 30 minute session of the day which form at the top or bottom of a range.. While all that is technically true given that we had late day emotional selling that left single printsAny section of the market profile distribution that is only one TPO wide. Single prints are a sign of emotional buying or selling as very little time was spent at those levels and thus there is no value there. The endpoints of single print sections are considered to be potential support or resistance points. in it’s wake and closed near the low, the lower prices are in no way out of any larger range or “exploring” new territory.

In closing, the market is in balance currently and should remain so. Expect volume to be light today which can cause erratic moves. Hardcore futures traders should perhaps switch their focus on last minute gift wrapping, baking, cooking, or anything else festive that can prevent losses.

Scenarios

- Given that the spikeA set of single prints that are created in the last 30 minute session of the day which form at the top or bottom of a range. is well within a larger range, there is really little to go on as far as ascribing any meaning to the market profileA way of reading the market that recognizes either time spent or volume traded at a particular price level. A market profile can be either made up of “TPO’s” (time price opportunities), or volume. TPO’s measure how much time was spent at a particular price, while volume-based market profiles measure how much volume traded at a particular price. Generally, market profile is used in the trading of futures, especially the /ES. ShadowTrader utilizes volume based profiles. pattern at this time. The market remains balancing to higher with valueThis value has nothing to do with valuation. It denotes prices that are "fair". Fair in this sense means a price that is common to a lot of participants. An item that you buy once per week in a store at a price that doesn't fluctuate has a "fair price". You can express this by a formula Value = Price + Time or Value = Price + Volume Either of the above are valid ways of expressing value. In the first equation, value is defined by price staying the same for a long period of time. In the futures market, this would be an area that is revisted a lot during a particular session or multiple sessions. The point of control is the price level where the most amount of time was spent during an RTH session. James Dalton refers to this level as "the fairest price to do business". Using vo... More being overlapping for some time.

ST Holiday Sale

15% off all one-time purchases until midnight 12/31

Use Coupon Code: success2021 at checkout

Save 15% now