The Market Profile value areas and ShadowTrader Pivots for /ESM19 and /NQM19 Futures are posted free every morning

in the ShadowTrader Swing Trader newsletter.

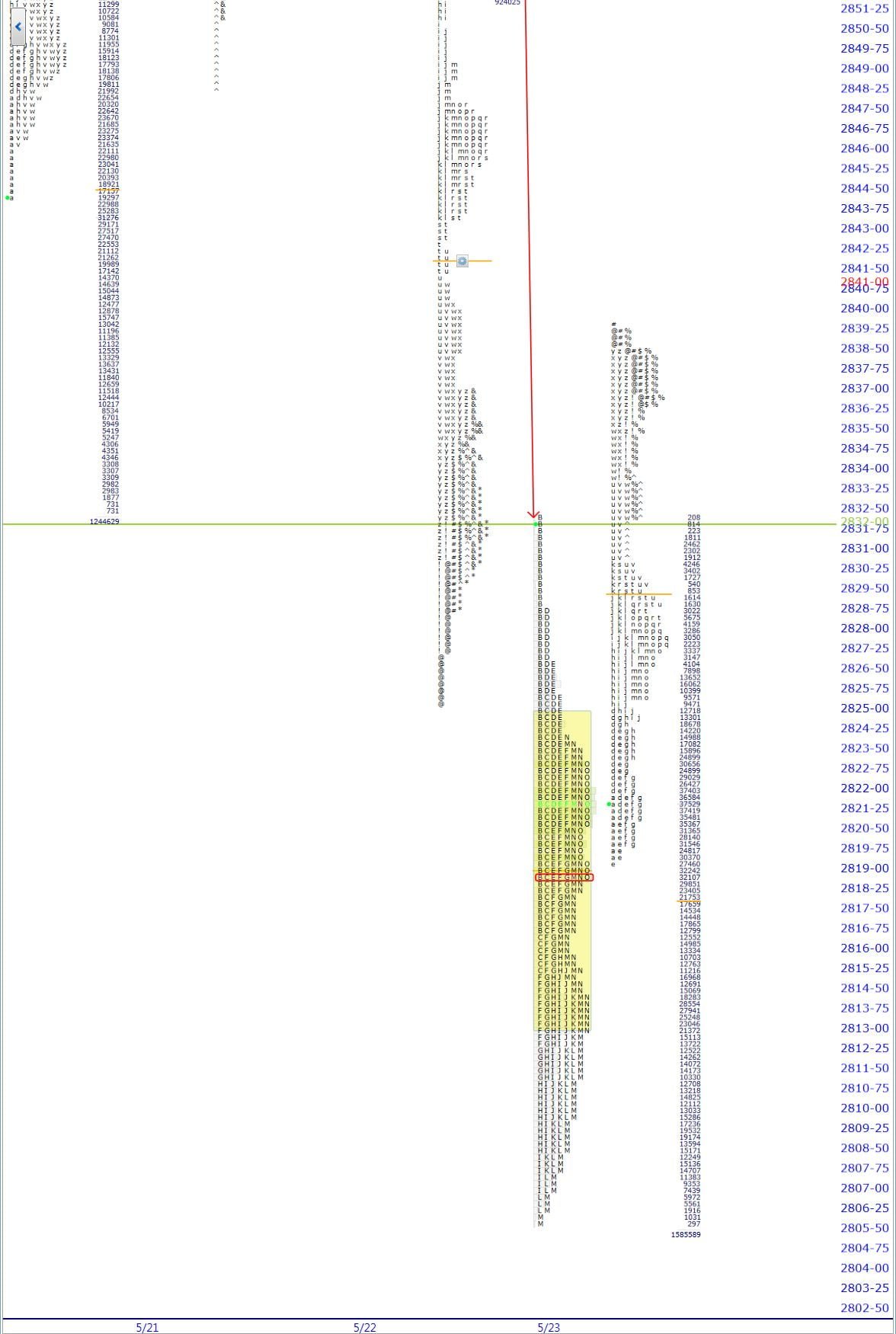

The “h” pattern which stands for “hell for shorts” reared it’s head again yesterday on the daily SPX chart. causing a sharp short covering rally from a poor-ish low that closed right at halfbackA term for the halfway point between the high and low of any session, could be a day session or an overnight session. On Peter's market profile charts it is always a dark yellow horizontal line at that level.. Let’s see how that played out in the market profile….

WindoTrader 702-800-4628 Speak with Terry about the ShadowTrader discount

| 2832.25 | RTHRegular Trading Hours. In the /ES this means the price action from 9:30am EST to 4:15pm EST only. high and 5/20 RTHRegular Trading Hours. In the /ES this means the price action from 9:30am EST to 4:15pm EST only. low |

|---|---|

| 2839.50 | ONHOvernight High. A term mostly used in describing the futures market which has an overnight session and trades almost around the clock. To be precise, in the /ES this is the high made between 4:30pm EST and 9:30am EST the next day. |

| 2825.00 | VAHValue Area High |

Decent sized gap this morning which I believe is just follow through off of oversold “h” pattern. As of right now, the gap is not true as we are trading just inside of yesterday’s RTHRegular Trading Hours. In the /ES this means the price action from 9:30am EST to 4:15pm EST only. high which is a key level. Note that it was listed as a key level yesterday and yesterday’s RTHRegular Trading Hours. In the /ES this means the price action from 9:30am EST to 4:15pm EST only. high was right to it.

Overnight inventoryA way of measuring overnight activity in the futures market by just noting how much of the overnight activity happens to fall above the prior day's settlement value (4:15pm EST close) and how much falls below. If more activity is above the settlement, then overnight inventory is said to be net long. If more is below, then it is said to be net short. If all of the overnight activity is above the settlement, then it is said to be 100% net long. If all of the activity is below the settlement then it is said to be 100% net short. The overnight inventory situation matters most and has the most impact on early trade when it is skewed 100% in either direction because when the imbalance is very large like that then the odds of an early correction increase greatly. This is due to the fact that most... is 100% net long. Beyond that, the ONHOvernight High. A term mostly used in describing the futures market which has an overnight session and trades almost around the clock. To be precise, in the /ES this is the high made between 4:30pm EST and 9:30am EST the next day. is also quite a bit higher than current price as well. This tells me that the short covering may have start to run its course and be dying out. Regardless, the signposts are the same for early trade. The RTHRegular Trading Hours. In the /ES this means the price action from 9:30am EST to 4:15pm EST only. high is the main focus just after the bell. Do we come back into range and start to drive lower, or reject out quickly as more shorts start to cover?

2800 in the SPX cash is still in play. It is noteworthy that yesterday’s low in that index was 2805.00. This, coupled with the pattern is what brought in the short covering. Note also that there was lack of material excess on yesterday’s low with only two ticks there.

Yesterday’s price action has left a large gap on the upside on the charts. Remember that any overnight activity does not contribute to filling this gap at all. A gap is only filled with day timeframe prices. I like how WindoTrader has added that feature that puts red or green arrows between the highs and lows to make the gaps stand out more. Kudos to Terry and Eric over there for that!

This upside gap is significantly large and should definitely be carried forward. The fact that overnight activity did not fill it fully is also a nuance to add to teh narrative. I think a stronger market should have actually been higher overnight as there is little resistance in that gap. Staying completely within yesterday’s RTHRegular Trading Hours. In the /ES this means the price action from 9:30am EST to 4:15pm EST only. range and not marking any prices inside of that gap today would be very bearish to me. A bullish scenario would be to reject immediately at yesterday’s RTHRegular Trading Hours. In the /ES this means the price action from 9:30am EST to 4:15pm EST only. high and move definitively towards the ONHOvernight High. A term mostly used in describing the futures market which has an overnight session and trades almost around the clock. To be precise, in the /ES this is the high made between 4:30pm EST and 9:30am EST the next day., break it and target the full gap fill which would be to 2852.00.

This is the last trading day before a market holiday. As such, volumes may taperA market profile term that Peter often calls out in the Weekly Options room. The "taper" is the tapering off of contract volume in the /ES as it moves to either the high or low of the day. Almost all highs and lows of a session are characterized by a diminishing of volume as price gets closer to the ultimate low or high of the day. By the end of a regular trading hours session, almost every contract level will have at least 1,000 cotracts traded at it with many of the levels having over 10,000. The taper occurs when you start to see contract sizes per price level less than 1,000 and very often less than 100 on the exact high or low of the day. The taper is a strong trading signal that the move underway may be over and the high or low of the day has been put in. When the taper is punctuated... More in the afternoon which can lead to erratic action.

Scenarios

- Double digit gap on 100% net long o/n inventory is always the potential for a fadeWhen a stock moves opposite the direction of its gap on an intraday basis. That being said, I don’t discount the fact that we are already well off of the ONHOvernight High. A term mostly used in describing the futures market which has an overnight session and trades almost around the clock. To be precise, in the /ES this is the high made between 4:30pm EST and 9:30am EST the next day. and that we are trading just inside of the prior day’s high which could be supportive. As the gap is not true, that also lessens its import and also the import of the inventory position.

- I’m going to focus my attention on the 2832.25 level and what price does in regard to it. Above more bullish stance, below more bearish stance. If the move is up, target at least the ONHOvernight High. A term mostly used in describing the futures market which has an overnight session and trades almost around the clock. To be precise, in the /ES this is the high made between 4:30pm EST and 9:30am EST the next day., if the move is down, target at least the VAHValue Area High.

- For what it’s worth, I don’t believe at all in the theory that before a holiday “people don’t want to go home long”. I just don’t think that markets work that way. Volume might be low and things could get choppy, but people don’t sell just because a weekend (be it long or regular) is coming.

Have a great day,

Peter

ShadowTrader Trading Psychology Series

7 Hours & 19 Minutes of Video Lessons:

8 Modules in HD streaming (rewatch as often as you like)

Extensive .pdf workbook to print out and follow along as you learn

Much More!