The Market Profile value areas and ShadowTrader Pivots for /ESM21 and /NQM21 Futures are posted free every morning

in the ShadowTrader Swing Trader newsletter.

WindoTrader 702-800-4628 Speak with Terry about the ShadowTrader discount

| 4183.50 | RTHRegular Trading Hours. In the /ES this means the price action from 9:30am EST to 4:15pm EST only. High / ATHAll Time High |

|---|---|

| 4160.50 | RTHRegular Trading Hours. In the /ES this means the price action from 9:30am EST to 4:15pm EST only. Low (Weak) / ONLOvernight Low. A term mostly used for the futures market as it trades almost around the clock. To be precise, in the /ES this would be the lowest price between 4:30pm EST and 9:30am EST the next day. |

| 4154.25 | ONLOvernight Low. A term mostly used for the futures market as it trades almost around the clock. To be precise, in the /ES this would be the lowest price between 4:30pm EST and 9:30am EST the next day. 4.15 (Weak LowA weak low should not be confused with a poor low. The latter speaks to a deficiency in structure and the former deals with the location of the low. A weak low is formed when a market falls and reverses right at a specific point which is often a technical or profile nuance. Some examples would be prior intraday lows, the lower extreme of a value area, the prior day's settlement, or the current day's open. In each case, the location is a mechanical and visual reference that is used by short term traders as an entry point. The low is deemed weak because it can be taken easily when retested due to the short term nature of the buyers who initiated their positions at that level.) |

| 4149.50 | Top of Single PrintsAny section of the market profile distribution that is only one TPO wide. Single prints are a sign of emotional buying or selling as very little time was spent at those levels and thus there is no value there. The endpoints of single print sections are considered to be potential support or resistance points. |

| 4137.50 | VPOCVirgin Point of Control. This is a point of control level that has not yet been tested (traded through) during an RTH session. If the POC gets tested during an overnight session, it does not count and remains "virgin" until it happens during a day session. 4.14 |

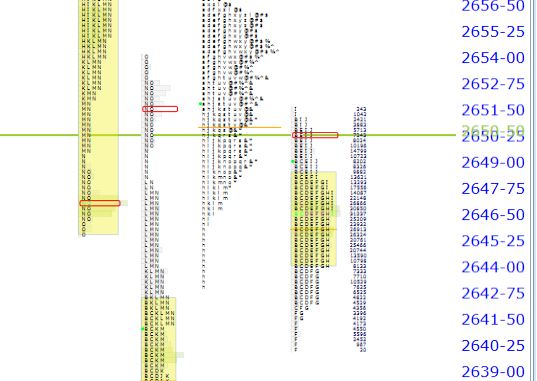

Gap lower this morning but still well within range. Not a true gapThere is a lot of discussion as to what constitutes a gap. Is it measured to the prior day's close, or to the prior day's high or low? Here at ShadowTrader, we believe that it is always and only to a prior day's high or low, thus creating a true gap or space on the chart between one day and the next. Thus a true gap is one that has price opening completely outside of the prior day's range (either above the high or below the low) and anything else is just a gap that has far less import. As a gap is a "reordering of thinking", only a true gap really changes the tone and creates opportunity to trade earlier (near the open) rather than later. More and gap rulesGuidelines to follow on any day that the futures open outside of the prior day's RTH range. Only opening outside of range is a true gap and puts gap rules in play. 1. Go with all gaps that don't fill right away. This means that if early trade doesn't start to correct the imbalance, then prices will probably move in the direction of the gap. 2. Larger gaps can often fail to fill on the first day or may fill only partially. 3. If the gap fills (meaning the prior day's RTH high is touched on a gap up or the prior day's RTH low is touched on a gap down) and value cannot get to at least overlapping, then the odds of a late day rally (on a gap up) or late day selloff (on a gap down) increase. 4. Gaps of larger than $20 in the /ES are difficult to trade and should be avoided early in the day as t... More do not apply. Overnight inventoryA way of measuring overnight activity in the futures market by just noting how much of the overnight activity happens to fall above the prior day's settlement value (4:15pm EST close) and how much falls below. If more activity is above the settlement, then overnight inventory is said to be net long. If more is below, then it is said to be net short. If all of the overnight activity is above the settlement, then it is said to be 100% net long. If all of the activity is below the settlement then it is said to be 100% net short. The overnight inventory situation matters most and has the most impact on early trade when it is skewed 100% in either direction because when the imbalance is very large like that then the odds of an early correction increase greatly. This is due to the fact that most... is close to 100% net shortThe concept of being more short than long in an options spread by creating options spreads where you are selling more structures than you are buying or selling wider structures than the ones you are buying. Example would be a broken wing butterfly. This spread is made up of two structures, one long vertical and one short vertical. In the BWB, the short vertical is wider than the long vertical. When you are long this spread, you are said to be in an options position that is "net short"

and current prices are just above overnight halfbackA term for the halfway point between the high and low of any session, could be a day session or an overnight session. On Peter's market profile charts it is always a dark yellow horizontal line at that level..

I think the first thing we have to add to our narratives is that Friday’s weak lowA weak low should not be confused with a poor low. The latter speaks to a deficiency in structure and the former deals with the location of the low. A weak low is formed when a market falls and reverses right at a specific point which is often a technical or profile nuance. Some examples would be prior intraday lows, the lower extreme of a value area, the prior day's settlement, or the current day's open. In each case, the location is a mechanical and visual reference that is used by short term traders as an entry point. The low is deemed weak because it can be taken easily when retested due to the short term nature of the buyers who initiated their positions at that level. was only taken out by four ticks in the overnight session. This is a WWSHDWhen What Should Happen Doesn't - A market dynamic where prices defy what is normally expected of them given the specific context they are in. A good example would be filling a larger gap only partially. The thinking is that the failure to do what should happen means prices are potentially headed in the other direction. moment to carry forward. The low was weak, it should have triggered a lot of sell stops, but it didn’t. In early trade today, assume that it is secure.

Should we get further selling that takes out that ONLOvernight Low. A term mostly used for the futures market as it trades almost around the clock. To be precise, in the /ES this would be the lowest price between 4:30pm EST and 9:30am EST the next day., make careful note of the structural nuances just below, all of which are listed as Key Levels for today. Work sequentially and targeting only one at a time before moving on to the next trade unless the internalsInternals refers to “market internals” and is a blanket term to collectively describe the advance decline, breadth, tick and cumulative tick. are overly bearish and tempoProbably one of the most important and yet overlooked concepts in the market. The tempo is simply the ‘speed’ at which the market is moving. This is also referred to as confidence. Slow tempo is typical of range bound days where there is lots of responsive activity. Fast tempo occurs when there is initiating activity, and market is breaking out of a range. This is not to say that the market can’t have fast tempo on days when it is rotational or moving between the extremes of a value area. It certainly can. Effective intraday futures trading involves gauging the tempo and knowing that opportunities are fewer and smaller when the tempo is slow. See S.O.H. is elevated.

On the upside, I’ve only noted the RTHRegular Trading Hours. In the /ES this means the price action from 9:30am EST to 4:15pm EST only. High as a Key Level because there is obviously no resistance above that level and anything between where we are now and there is not of major import.

Don’t make the mistake of assuming that if the ONLOvernight Low. A term mostly used for the futures market as it trades almost around the clock. To be precise, in the /ES this would be the lowest price between 4:30pm EST and 9:30am EST the next day. is secure then the move has to be higher. Balance is a valid outcome and at this stage of the rally would be very healthy for the market. As we often discuss in this space, shape and size of the overnight distribution can often set the tone and for the day timeframe that follows.

Scenarios

- The failure of sellers to get any real traction below the weak lowA weak low should not be confused with a poor low. The latter speaks to a deficiency in structure and the former deals with the location of the low. A weak low is formed when a market falls and reverses right at a specific point which is often a technical or profile nuance. Some examples would be prior intraday lows, the lower extreme of a value area, the prior day's settlement, or the current day's open. In each case, the location is a mechanical and visual reference that is used by short term traders as an entry point. The low is deemed weak because it can be taken easily when retested due to the short term nature of the buyers who initiated their positions at that level. is noteworthy and should be foremost in your thinking this morning. Pullbacks above that level should be buyable.

- The overnight distribution is relatively squat and current prices are at overnight halfbackA term for the halfway point between the high and low of any session, could be a day session or an overnight session. On Peter's market profile charts it is always a dark yellow horizontal line at that level.. This points to balance inn the RTHRegular Trading Hours. In the /ES this means the price action from 9:30am EST to 4:15pm EST only. session as a potential outcome. If so, smaller responsive tradeA responsive trade is a counter-trend trade taken against a specific level. The theory is that when two sided trade is taking place, there will not be enough momentum to push past key levels and buyers or sellers will respond to those areas, essentially pushing prices away from them. This is the opposite of breakout or initiative trade which is more directional in nature and is generally taken in the direction of the prevailing trend. is the M.O. for day timeframe and holding your positions without adjustment is the M.O. for longer timeframe.

- Should the RTHRegular Trading Hours. In the /ES this means the price action from 9:30am EST to 4:15pm EST only. session be wildly different in tone from the overnight session and take out the RTHRegular Trading Hours. In the /ES this means the price action from 9:30am EST to 4:15pm EST only. Low on fast tempoProbably one of the most important and yet overlooked concepts in the market. The tempo is simply the ‘speed’ at which the market is moving. This is also referred to as confidence. Slow tempo is typical of range bound days where there is lots of responsive activity. Fast tempo occurs when there is initiating activity, and market is breaking out of a range. This is not to say that the market can’t have fast tempo on days when it is rotational or moving between the extremes of a value area. It certainly can. Effective intraday futures trading involves gauging the tempo and knowing that opportunities are fewer and smaller when the tempo is slow. See S.O.H. and very bearish internalsInternals refers to “market internals” and is a blanket term to collectively describe the advance decline, breadth, tick and cumulative tick. then comport yourselves accordingly, noting my commentary above. The current overall tone doesn’t support this however every potential should be on the table whenever you trade.

The Best Market Profile Software on the Planet (mic drop)

Add the 3rd dimension to your charting with WindoTrader, the industry leader in Market ProfileA way of reading the market that recognizes either time spent or volume traded at a particular price level. A market profile can be either made up of “TPO’s” (time price opportunities), or volume. TPO’s measure how much time was spent at a particular price, while volume-based market profiles measure how much volume traded at a particular price. Generally, market profile is used in the trading of futures, especially the /ES. ShadowTrader utilizes volume based profiles. software

10% off ShadowTrader Discount