The Market Profile value areas and ShadowTrader Pivots for /ESM20 and /NQM20 Futures are posted free every morning

in the ShadowTrader Swing Trader newsletter.

WindoTrader 702-800-4628 Speak with Terry about the ShadowTrader discount

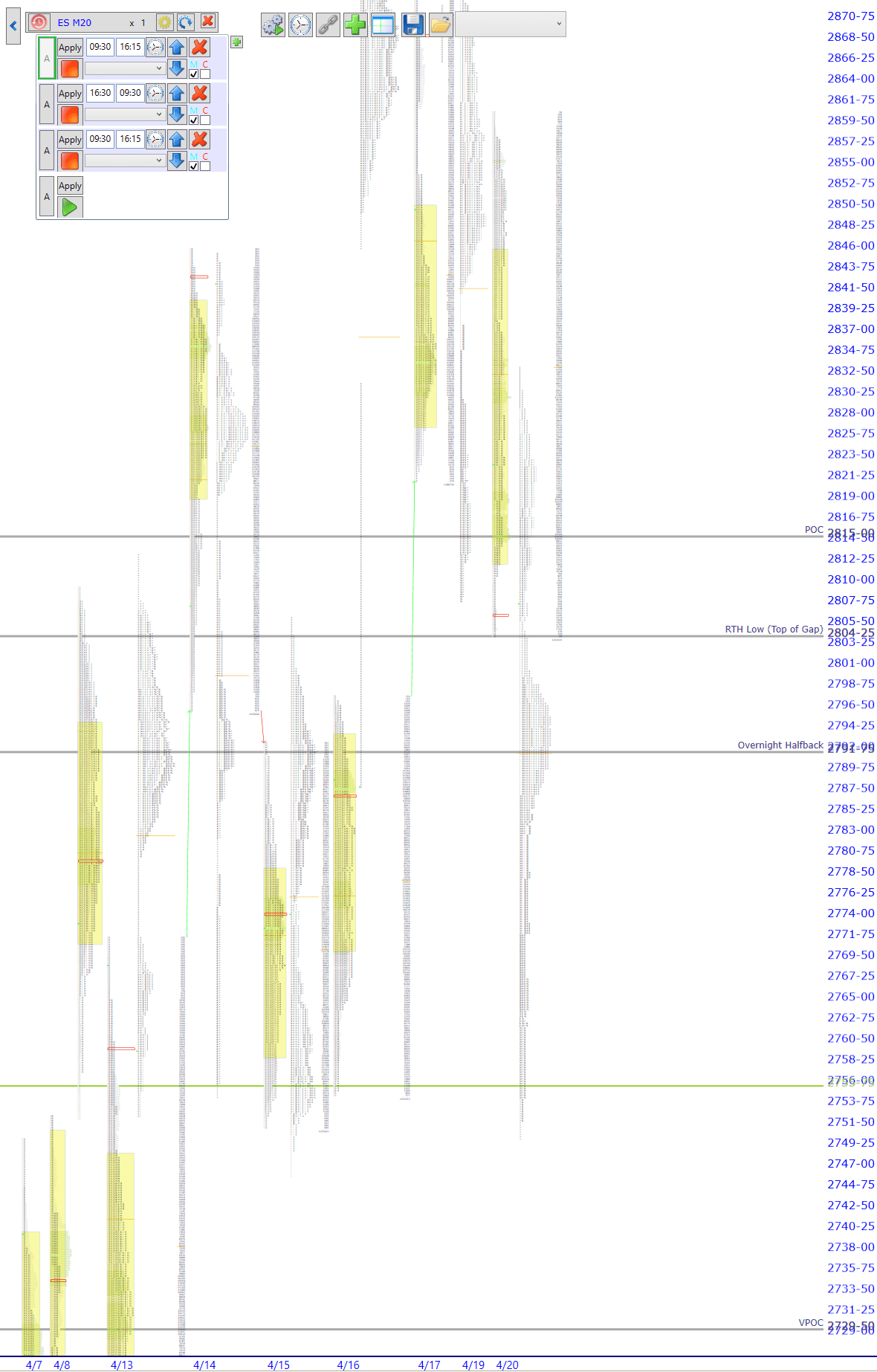

| 2815.00 | POCPoint of Control, also known as the "fairest price to do business". It is the price level in the /ES where the greatest amount of volume in the prior RTH session traded. ShadowTrader measures the POC using volume but the traditional way is to mark off the widest point of the day's distribution where the most TPO's printed going across from left to right, indicating that that was the price where the most time was spent. It's important to pay attention to both the volume POC and the TPO POC. |

|---|---|

| 2804.25 | RTHRegular Trading Hours. In the /ES this means the price action from 9:30am EST to 4:15pm EST only. Low / Top of Gap |

| 2791.50 | Overnight HalfbackA term for the halfway point between the high and low of any session, could be a day session or an overnight session. On Peter's market profile charts it is always a dark yellow horizontal line at that level. |

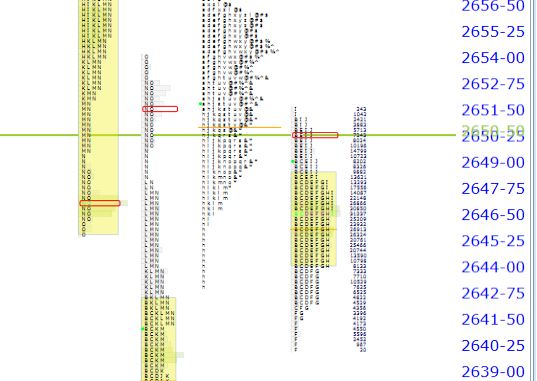

| 2750.00 | ONLOvernight Low. A term mostly used for the futures market as it trades almost around the clock. To be precise, in the /ES this would be the lowest price between 4:30pm EST and 9:30am EST the next day. |

| 2729.50 | VPOCVirgin Point of Control. This is a point of control level that has not yet been tested (traded through) during an RTH session. If the POC gets tested during an overnight session, it does not count and remains "virgin" until it happens during a day session. 4/13 |

As per a text yesterday, I bought a small position of USO at $3.83. As mentioned specifically in the text this was a starter position which means that I wanted to just dip a toe in the water. This morning I am waking up to realize that the water is extremely cold and I don’t want to swim just yet.

A word on how crude oil contracts and USO is structured would be in order here. The reason crude went negative yesterday is simply because it was already very close to the expiry of the May contract. There is rolling every month as the front month is sold and the next month is bought. That, along with the bear move in oil caused the futures contract to go negative. Only very recently did CME make this decision to allow contracts to trade at less than zero. Understand that this is only the front month contract and not the actual price of crude which is better reflected in the June contract.

Now, on to USO. As I said in a recent ShadowTrader Video Weekly, USO is not the best vehicle for a long term crude hold because it is mainly made up of the front month futures contracts. Therefore it is very sensitive to the type of price shock in those contracts that we saw yesterday. I bought a small piece in it because I felt that the crash of the front month would be short lived and soon the contract would start to reflect the longer term expiries. That is true, however, this morning we have the June contract down over $4 and trading sub $16 currently. With that, USO is down .80 cents.

I am resetting my thinking now back to what I was originally thinking which was that USO will only be viable for a short term trade if you are able to perfectly pick the bottom in crude which I am not that confident that I can do. As discussed in that earlier video, DBO and USL are the better long term bets on a crude recovery because they track longer term contracts as much as a year out.

I will be taking a small loss on the USO more than likely this morning as I will put a stop under the first 5 minute low. There are those of you who might think that “it can’t go negative”. Probably not, but it can go to close to zero and then get reinflated with some reverse split or whatever and trust me, you don’t want any part of that. I believe that the decreased demand could last for some time and there is potential for crude to trade in the single digits. I will still speculate using crude oil contracts if I see some levels that make sense but I do NOT recommend that newer traders do this. Remember that /CL is $1,000 per point per contract. Let that sink in if you didn’t know that. If you think $15 is the floor will you be ok with holding the when/if it goes to $9? Also keep in mind that the oil futures market is in an extreme form of contango currently which simply means that longer term contract are trading for far more than shorter term contracts. This is the normal state of things (as opposed to backwardation) Why this is important is because if you decide to speculate on those longer term futures contracts, you will be susceptible to the price slowly coming into parity with the front month. This is sometimes mistaken for “time value” like options. This time valueThis value has nothing to do with valuation. It denotes prices that are "fair". Fair in this sense means a price that is common to a lot of participants. An item that you buy once per week in a store at a price that doesn't fluctuate has a "fair price". You can express this by a formula Value = Price + Time or Value = Price + Volume Either of the above are valid ways of expressing value. In the first equation, value is defined by price staying the same for a long period of time. In the futures market, this would be an area that is revisted a lot during a particular session or multiple sessions. The point of control is the price level where the most amount of time was spent during an RTH session. James Dalton refers to this level as "the fairest price to do business". Using vo... More doesn’t really exist in futures, but as time goes on and traders continually roll the closer months into further months, your longer term contract loses valueThis value has nothing to do with valuation. It denotes prices that are "fair". Fair in this sense means a price that is common to a lot of participants. An item that you buy once per week in a store at a price that doesn't fluctuate has a "fair price". You can express this by a formula Value = Price + Time or Value = Price + Volume Either of the above are valid ways of expressing value. In the first equation, value is defined by price staying the same for a long period of time. In the futures market, this would be an area that is revisted a lot during a particular session or multiple sessions. The point of control is the price level where the most amount of time was spent during an RTH session. James Dalton refers to this level as "the fairest price to do business". Using vo... More. Again, multiply that by $1,000 per point, per contract!

So, what is Peter going to do? As stated above, I will abandon the small USO position today if it trades weak off the open and takes out the first 5 minute low. My initial thought was that I would leg in down to $1 or whatever it goes to and hold. Understanding now how violent these front month shocks can be I’m no longer interested in that play. I will continue to watch the price of crude closely and I will more than likely speculate with some futures contracts if I see some extreme levels. If I can text options advisory subscribers when it happens I will, if I can’t I won’t. Either way, that’s not what you signed up for. I am still looking into the options on DBO and USL but so far I don’t see them as all that liquid as the focus is usually on USO, so my initial thought is that there might not be a play there. Since our M.O. is to look at short term opportunities in weekly options, I will stay open to the possibility of a short term play in USO. Understand that the cheaper it gets, the more it makes sense to just buy the shares and not even do an options play. When something is trading for $3 or less, you don’t really need the leverage of options and why would you want to deal with the time decay anyway?

—————————————————————————————————————————————————————————–

Gap down of about $50 currently on overnight inventoryA way of measuring overnight activity in the futures market by just noting how much of the overnight activity happens to fall above the prior day's settlement value (4:15pm EST close) and how much falls below. If more activity is above the settlement, then overnight inventory is said to be net long. If more is below, then it is said to be net short. If all of the overnight activity is above the settlement, then it is said to be 100% net long. If all of the activity is below the settlement then it is said to be 100% net short. The overnight inventory situation matters most and has the most impact on early trade when it is skewed 100% in either direction because when the imbalance is very large like that then the odds of an early correction increase greatly. This is due to the fact that most... that is more balanced than it would seem at first glance. Definitely still net shortThe concept of being more short than long in an options spread by creating options spreads where you are selling more structures than you are buying or selling wider structures than the ones you are buying. Example would be a broken wing butterfly. This spread is made up of two structures, one long vertical and one short vertical. In the BWB, the short vertical is wider than the long vertical. When you are long this spread, you are said to be in an options position that is "net short"

but plenty of distribution above the settlement. Seeing that makes me believe that the futures are following oil more than anything. Those types of correlations last for a little while until they don’t. What’s important is to know when they are happening and be aware of them as they will tend to outshine everything else (internalsInternals refers to “market internals” and is a blanket term to collectively describe the advance decline, breadth, tick and cumulative tick. etc) and become the dominant force in moving prices.

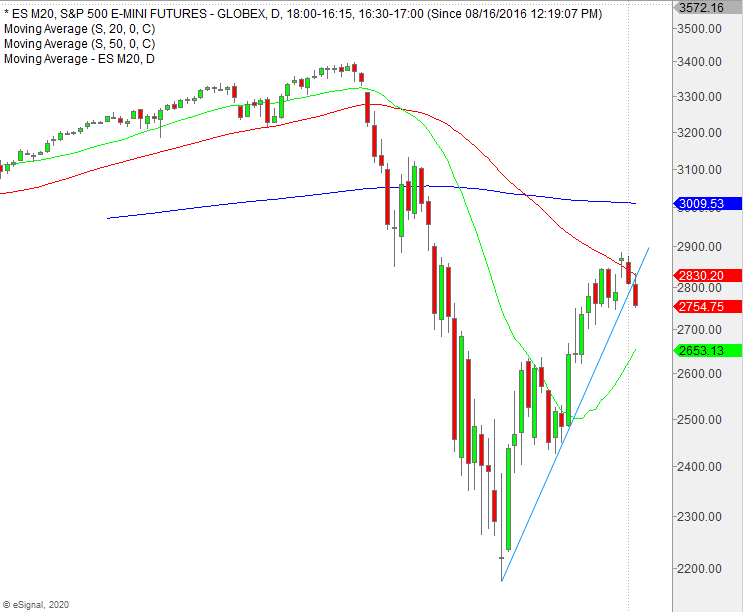

This morning’s true gapThere is a lot of discussion as to what constitutes a gap. Is it measured to the prior day's close, or to the prior day's high or low? Here at ShadowTrader, we believe that it is always and only to a prior day's high or low, thus creating a true gap or space on the chart between one day and the next. Thus a true gap is one that has price opening completely outside of the prior day's range (either above the high or below the low) and anything else is just a gap that has far less import. As a gap is a "reordering of thinking", only a true gap really changes the tone and creates opportunity to trade earlier (near the open) rather than later. More is important because it marks the first real break in the uptrend that started on 3/23/20.

/ESM20 Daily – Is this a return to regularly scheduled programming?

The chart above shows the clear break of trend. Trade going forward will obviously be all about whether or not stronger sellers emerge now due to this break. Note that the 20 SMA is still well below us and could potentially be a support.

In the more magnifying glass view, I am going to work from the framework this morning that the gap will have difficulty filling fully and that more downside could happen today given where we are opening in relation to the up trend line and the shock and aweA term Peter uses to describe what overnight futures traders may be feeling when faced with an open that is wildly divergent from what they expected. Large gaps in either direction that are opening well outside of range are examples of this. The approach is that when the market opens in such a manner, there is often opportunity to trade earlier rather than later because of the large contingent of traders who will be forced to reverse their positions quickly. of opening well below it. Thus I know how traders “should” react and I’m ready for either that or the classic “when what should happen doesn’t” scenario which signals the other way.

I will trade early this morning knowing that some portion of the overnight trade should get retraced for inventory to balance itself. Knowing that we are now below trend, I would also think that this could be short lived and provide good short location somewhere in the overnight range, hence the inclusion of Overnight HalfbackA term for the halfway point between the high and low of any session, could be a day session or an overnight session. On Peter's market profile charts it is always a dark yellow horizontal line at that level. in the Key Levels.

Scenarios

- Opening below trend gives the potential for further follow through lower. As with any large gap down this is the most difficult trade to get right early and hold for th day. While I would prefer a large retracement up into range, I am aware that I might not get it. If not, pick your spots VERY carefully as good location on the heels of a very large gap is hard to specify. The short under the first 1 or 5 minute low is always an option, as is the cross back down through the open on any short lived initial rally higher. The VPOCVirgin Point of Control. This is a point of control level that has not yet been tested (traded through) during an RTH session. If the POC gets tested during an overnight session, it does not count and remains "virgin" until it happens during a day session. from 4.13 would be in play on any such initiative move.

- If the ONLOvernight Low. A term mostly used for the futures market as it trades almost around the clock. To be precise, in the /ES this would be the lowest price between 4:30pm EST and 9:30am EST the next day. is not taken out early then the potential for fadeWhen a stock moves opposite the direction of its gap on an intraday basis is there. Again, opening below trend may mute this reaction. Hard stop is always under LODLow of Day and profits should be taken incrementally as you go.

The Best Market Profile Software on the Planet (mic drop)

Add the 3rd dimension to your charting with WindoTrader, the industry leader in Market ProfileA way of reading the market that recognizes either time spent or volume traded at a particular price level. A market profile can be either made up of “TPO’s” (time price opportunities), or volume. TPO’s measure how much time was spent at a particular price, while volume-based market profiles measure how much volume traded at a particular price. Generally, market profile is used in the trading of futures, especially the /ES. ShadowTrader utilizes volume based profiles. software

10% off ShadowTrader Discount