The Market Profile value areas and ShadowTrader Pivots for /ESH20 and /NQH20 Futures are posted free every morning

in the ShadowTrader Swing Trader newsletter.

WindoTrader 702-800-4628 Speak with Terry about the ShadowTrader discount

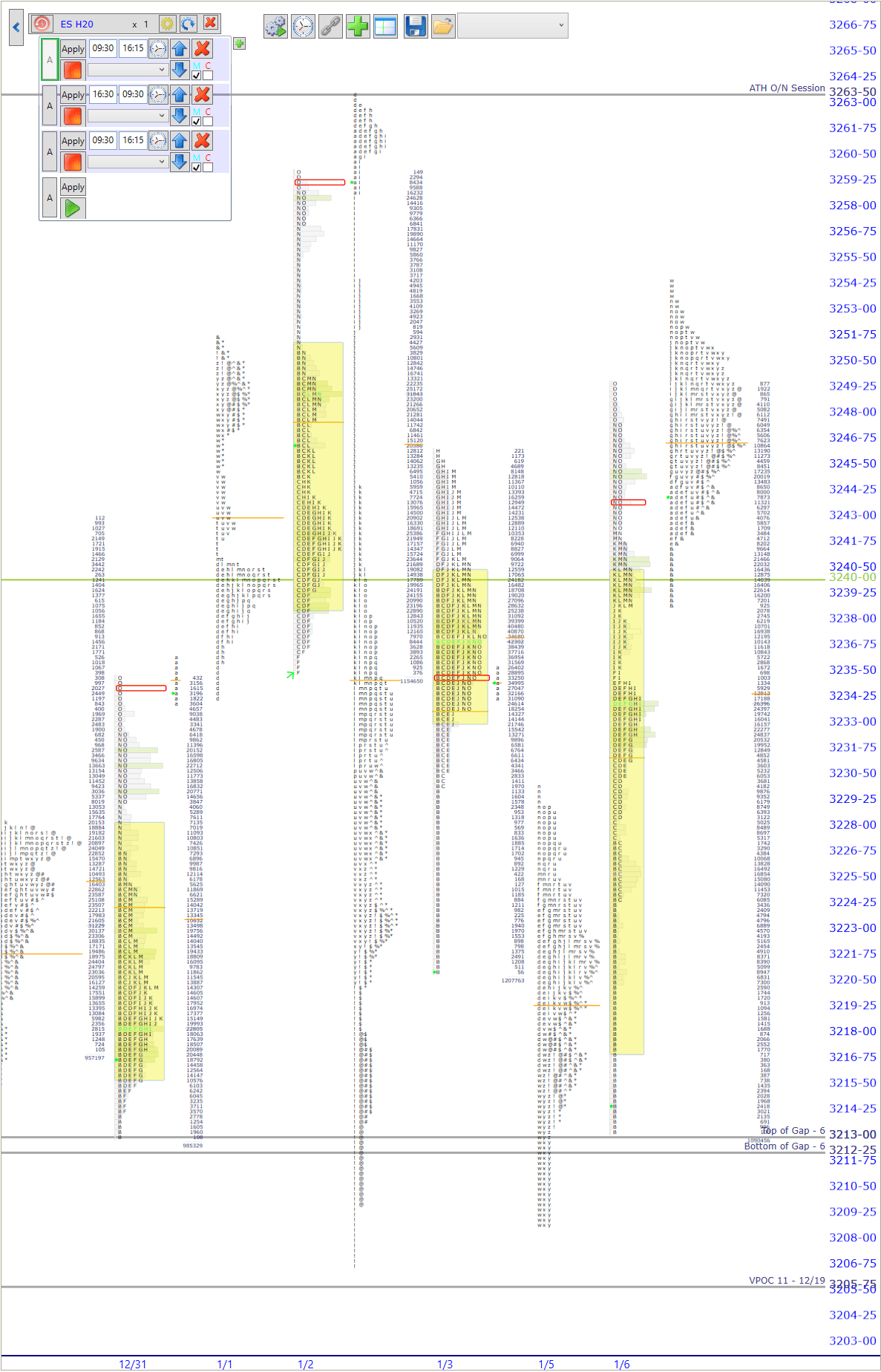

| 3249.50 | RTHRegular Trading Hours. In the /ES this means the price action from 9:30am EST to 4:15pm EST only. High |

|---|---|

| 3234.00 | POCPoint of Control, also known as the "fairest price to do business". It is the price level in the /ES where the greatest amount of volume in the prior RTH session traded. ShadowTrader measures the POC using volume but the traditional way is to mark off the widest point of the day's distribution where the most TPO's printed going across from left to right, indicating that that was the price where the most time was spent. It's important to pay attention to both the volume POC and the TPO POC. |

| 3228.25 | Start of Single PrintsAny section of the market profile distribution that is only one TPO wide. Single prints are a sign of emotional buying or selling as very little time was spent at those levels and thus there is no value there. The endpoints of single print sections are considered to be potential support or resistance points. |

| 3227.50 | End of Single PrintsAny section of the market profile distribution that is only one TPO wide. Single prints are a sign of emotional buying or selling as very little time was spent at those levels and thus there is no value there. The endpoints of single print sections are considered to be potential support or resistance points. |

Divergence is the name of the game this morning as the /NQ’s are solidly green while the /ES is just slightly underwater. That divergence is important to carry forward into the RTHRegular Trading Hours. In the /ES this means the price action from 9:30am EST to 4:15pm EST only. session because it usually sets the tone for a more choppy (read: responsive tradeA responsive trade is a counter-trend trade taken against a specific level. The theory is that when two sided trade is taking place, there will not be enough momentum to push past key levels and buyers or sellers will respond to those areas, essentially pushing prices away from them. This is the opposite of breakout or initiative trade which is more directional in nature and is generally taken in the direction of the prevailing trend. so go for smaller moves against inflection points) day that can be rangebound.

Yesterday’s all out reversal from lows that drove through the single print area like a hot knife through butter (Earth Balance vegan only) is bullish in the short term in that it seems to have negated any news driven weakness of late. One of the most important things that you can carry forward is the fact that liquidation breaks or whatever variety strengthen rather than weaken a market because they take potential sellers out. It’s common for these moves to be taken out quickly and then have the market continue much higher later.

Yesterday’s RTHRegular Trading Hours. In the /ES this means the price action from 9:30am EST to 4:15pm EST only. distribution didn’t have the greatest structure to it, leaving a short trunk of single printsAny section of the market profile distribution that is only one TPO wide. Single prints are a sign of emotional buying or selling as very little time was spent at those levels and thus there is no value there. The endpoints of single print sections are considered to be potential support or resistance points. in the middle of the session which I’ve identified in the Key Levels above. The endpoints of single printsAny section of the market profile distribution that is only one TPO wide. Single prints are a sign of emotional buying or selling as very little time was spent at those levels and thus there is no value there. The endpoints of single print sections are considered to be potential support or resistance points. are always potential supports or resistances.

The Key Levels listed are few this morning because as always I do my best to only put forth what I feel is relevant for the coming session. Anyone could list them all but that honestly doesn’t provide any edge. So for instance, I know that the ONHOvernight High. A term mostly used in describing the futures market which has an overnight session and trades almost around the clock. To be precise, in the /ES this is the high made between 4:30pm EST and 9:30am EST the next day. is higher than the RTHRegular Trading Hours. In the /ES this means the price action from 9:30am EST to 4:15pm EST only. but I believe that has little import. The huge divergence between the two futures right now is going to be more of a driver of action and tone today than any minor nuances that I could point out. Keep focused on the bigger picture that way and you’ll always be fine. Speaking of, the current activity (Iraq/Iran news notwithstanding) is more than likely balancing off the recent rally that started on 12/3/19. Keep that in mind as well.

Odds favor more responsive tradeA responsive trade is a counter-trend trade taken against a specific level. The theory is that when two sided trade is taking place, there will not be enough momentum to push past key levels and buyers or sellers will respond to those areas, essentially pushing prices away from them. This is the opposite of breakout or initiative trade which is more directional in nature and is generally taken in the direction of the prevailing trend. today given the divergence. Use FAANG’s as another internal today if you are looking at /ES.

Lastly, I want to point something out since I know that we have a lot of newer traders joining us for this free week. Take a close look at the marketIf ShadowTrader is initiating a position “at the market” it simply means that limit orders are not being used and the position is being entered with no regard to price. This is used much more often on more liquid Nasdaq issues.<market profileA way of reading the market that recognizes either time spent or volume traded at a particular price level. A market profile can be either made up of “TPO’s” (time price opportunities), or volume. TPO’s measure how much time was spent at a particular price, while volume-based market profiles measure how much volume traded at a particular price. Generally, market profile is used in the trading of futures, especially the /ES. ShadowTrader utilizes volume based profiles. picture above and note where the RTHRegular Trading Hours. In the /ES this means the price action from 9:30am EST to 4:15pm EST only. high of yesterday was. Just two ticks above the POCPoint of Control, also known as the "fairest price to do business". It is the price level in the /ES where the greatest amount of volume in the prior RTH session traded. ShadowTrader measures the POC using volume but the traditional way is to mark off the widest point of the day's distribution where the most TPO's printed going across from left to right, indicating that that was the price where the most time was spent. It's important to pay attention to both the volume POC and the TPO POC. (which was virgin until yesterday) from 1/2/20. These levels are real and they work. Very few people see them which is what makes them even more powerful for those in the know. Markets move from excess to balance and back to excess, pulling away from low volume areas to higher volume areas along the way. If you can continually just trade from that framework as your starting point, you’ll be in great shape.

Scenarios

- My focus today will be on yesterday’s range and where valueThis value has nothing to do with valuation. It denotes prices that are "fair". Fair in this sense means a price that is common to a lot of participants. An item that you buy once per week in a store at a price that doesn't fluctuate has a "fair price". You can express this by a formula Value = Price + Time or Value = Price + Volume Either of the above are valid ways of expressing value. In the first equation, value is defined by price staying the same for a long period of time. In the futures market, this would be an area that is revisted a lot during a particular session or multiple sessions. The point of control is the price level where the most amount of time was spent during an RTH session. James Dalton refers to this level as "the fairest price to do business". Using vo... More develops. As there was range expansion yesterday, ideally bullish traders should want to see valueThis value has nothing to do with valuation. It denotes prices that are "fair". Fair in this sense means a price that is common to a lot of participants. An item that you buy once per week in a store at a price that doesn't fluctuate has a "fair price". You can express this by a formula Value = Price + Time or Value = Price + Volume Either of the above are valid ways of expressing value. In the first equation, value is defined by price staying the same for a long period of time. In the futures market, this would be an area that is revisted a lot during a particular session or multiple sessions. The point of control is the price level where the most amount of time was spent during an RTH session. James Dalton refers to this level as "the fairest price to do business". Using vo... More developing in the upper part of yesterday’s distribution. The fact that the overnight session is very balanced and contained almost fully in the upper part of the distribution is a short term bullish sign and indicative of further balance in this area.

- Anything more meaningful (read: directional) would only develop with a drive above the RTHRegular Trading Hours. In the /ES this means the price action from 9:30am EST to 4:15pm EST only. high or a move below that single print section in the Key Levels above. I believe the reversal that characterized yesterday has sellers (shorts) a bit on edge coming into today’s session which may temper downside moves.

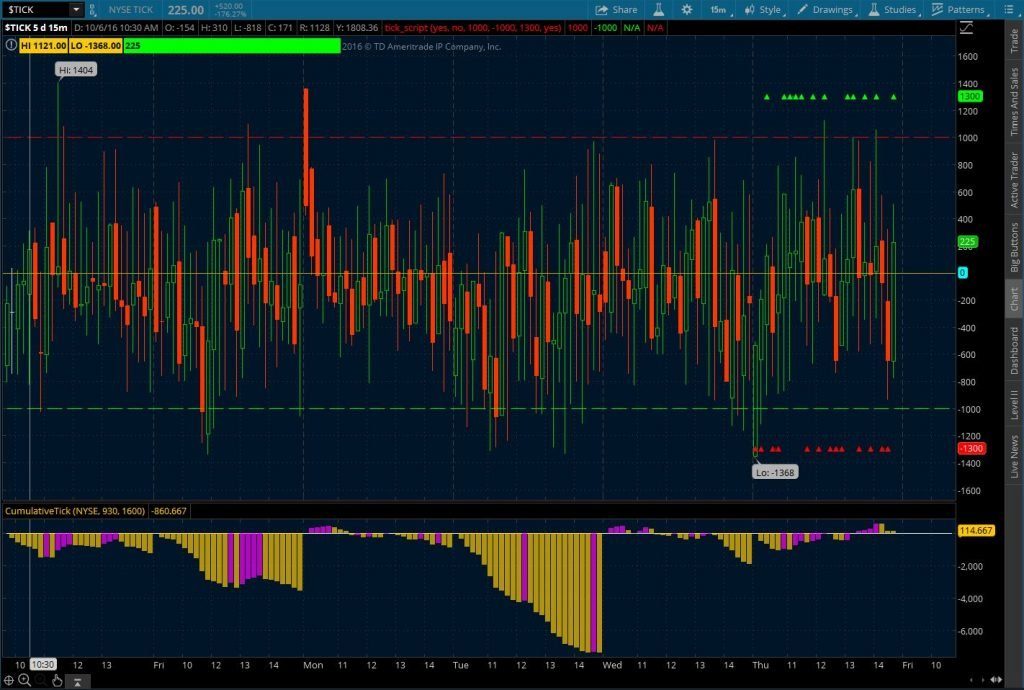

ShadowTrader Cumulative Tick

Beef up your "quad" and by putting your tickThe net cumulative tick reading on the NYSE or Nasdaq Composite. This is measured by the number of stocks ticking up minus the number of stocks ticking down at any given moment. It is the least used of the internal indicators but is discussed from time to time. Generally the tick readings are only helpful when they are at extremes such as +1000 on the NYSE to indicate that program trading is ensuing. indicator on steroids!

Learn More