The Market Profile value areas and ShadowTrader Pivots for /ESH20 and /NQH20 Futures are posted free every morning

in the ShadowTrader Swing Trader newsletter.

WindoTrader 702-800-4628 Speak with Terry about the ShadowTrader discount

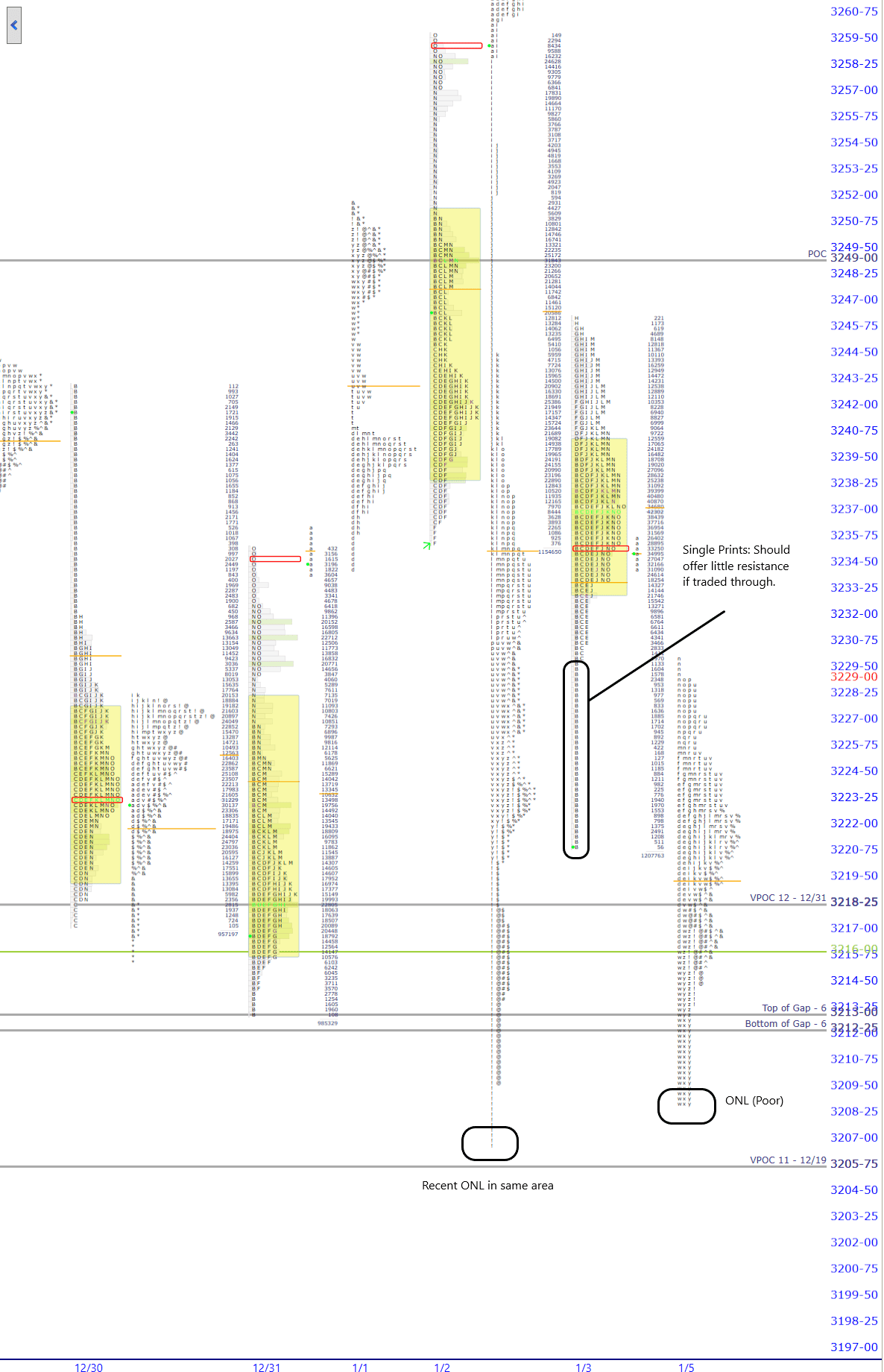

| 3221.00 | RTHRegular Trading Hours. In the /ES this means the price action from 9:30am EST to 4:15pm EST only. Low / Start of Single PrintsAny section of the market profile distribution that is only one TPO wide. Single prints are a sign of emotional buying or selling as very little time was spent at those levels and thus there is no value there. The endpoints of single print sections are considered to be potential support or resistance points. |

|---|---|

| 3229.75 | End of Single PrintsAny section of the market profile distribution that is only one TPO wide. Single prints are a sign of emotional buying or selling as very little time was spent at those levels and thus there is no value there. The endpoints of single print sections are considered to be potential support or resistance points. |

| 3208.75 | ONLOvernight Low. A term mostly used for the futures market as it trades almost around the clock. To be precise, in the /ES this would be the lowest price between 4:30pm EST and 9:30am EST the next day. (poor) |

| 3205.75 | VPOCVirgin Point of Control. This is a point of control level that has not yet been tested (traded through) during an RTH session. If the POC gets tested during an overnight session, it does not count and remains "virgin" until it happens during a day session. #11 (12/19) |

Solid gap lower this morning to just outside of Friday’s RTHRegular Trading Hours. In the /ES this means the price action from 9:30am EST to 4:15pm EST only. range which puts gap rulesGuidelines to follow on any day that the futures open outside of the prior day's RTH range. Only opening outside of range is a true gap and puts gap rules in play. 1. Go with all gaps that don't fill right away. This means that if early trade doesn't start to correct the imbalance, then prices will probably move in the direction of the gap. 2. Larger gaps can often fail to fill on the first day or may fill only partially. 3. If the gap fills (meaning the prior day's RTH high is touched on a gap up or the prior day's RTH low is touched on a gap down) and value cannot get to at least overlapping, then the odds of a late day rally (on a gap up) or late day selloff (on a gap down) increase. 4. Gaps of larger than $20 in the /ES are difficult to trade and should be avoided early in the day as t... More into play. Overnight inventoryA way of measuring overnight activity in the futures market by just noting how much of the overnight activity happens to fall above the prior day's settlement value (4:15pm EST close) and how much falls below. If more activity is above the settlement, then overnight inventory is said to be net long. If more is below, then it is said to be net short. If all of the overnight activity is above the settlement, then it is said to be 100% net long. If all of the activity is below the settlement then it is said to be 100% net short. The overnight inventory situation matters most and has the most impact on early trade when it is skewed 100% in either direction because when the imbalance is very large like that then the odds of an early correction increase greatly. This is due to the fact that most... is 100% net shortThe concept of being more short than long in an options spread by creating options spreads where you are selling more structures than you are buying or selling wider structures than the ones you are buying. Example would be a broken wing butterfly. This spread is made up of two structures, one long vertical and one short vertical. In the BWB, the short vertical is wider than the long vertical. When you are long this spread, you are said to be in an options position that is "net short"

.

The overnight range is quite large coming into today’s session which makes the premarket read a bit more cloudy as there was plenty of activity inside of Friday’s range and also outside of it. As with any larger true gapThere is a lot of discussion as to what constitutes a gap. Is it measured to the prior day's close, or to the prior day's high or low? Here at ShadowTrader, we believe that it is always and only to a prior day's high or low, thus creating a true gap or space on the chart between one day and the next. Thus a true gap is one that has price opening completely outside of the prior day's range (either above the high or below the low) and anything else is just a gap that has far less import. As a gap is a "reordering of thinking", only a true gap really changes the tone and creates opportunity to trade earlier (near the open) rather than later. More, your first focus should be on the preceding session’s RTHRegular Trading Hours. In the /ES this means the price action from 9:30am EST to 4:15pm EST only. Low. That is the first line in the sand that will either bring in larger (read: playable to upside with a buy) short covering or not. Remaining below the RTHRegular Trading Hours. In the /ES this means the price action from 9:30am EST to 4:15pm EST only. Low is more bearish, finding acceptanceWhen the market profile begins to build out or develop in a certain area, it is said that the market is accepting those prices. This can be measured either in time spent or amount of volume that is transacted. It is generally understood that ShadowTrader defines acceptance as more of a time dynamic than a volume one. A good rule of thumb is to look for at least two TPO periods to print in the accepted area. The acceptance confirms that a significant amount of market participants are transacting at those levels. Acceptance is the opposite of rejection. More back in range is less so. This particular open has an extra twist to it in that it is against the context of a long line of single printsAny section of the market profile distribution that is only one TPO wide. Single prints are a sign of emotional buying or selling as very little time was spent at those levels and thus there is no value there. The endpoints of single print sections are considered to be potential support or resistance points. from Friday. The low of those prints (RTHRegular Trading Hours. In the /ES this means the price action from 9:30am EST to 4:15pm EST only. Low) is also Friday’s open. Movement into these prints should offer little resistance and traders should target the End of the Single PrintsAny section of the market profile distribution that is only one TPO wide. Single prints are a sign of emotional buying or selling as very little time was spent at those levels and thus there is no value there. The endpoints of single print sections are considered to be potential support or resistance points. if upside continuation is in the cards. As long as we open outside of Friday’s range, gap rulesGuidelines to follow on any day that the futures open outside of the prior day's RTH range. Only opening outside of range is a true gap and puts gap rules in play. 1. Go with all gaps that don't fill right away. This means that if early trade doesn't start to correct the imbalance, then prices will probably move in the direction of the gap. 2. Larger gaps can often fail to fill on the first day or may fill only partially. 3. If the gap fills (meaning the prior day's RTH high is touched on a gap up or the prior day's RTH low is touched on a gap down) and value cannot get to at least overlapping, then the odds of a late day rally (on a gap up) or late day selloff (on a gap down) increase. 4. Gaps of larger than $20 in the /ES are difficult to trade and should be avoided early in the day as t... More are in play.

On the downside we have a reference point in the ONLOvernight Low. A term mostly used for the futures market as it trades almost around the clock. To be precise, in the /ES this would be the lowest price between 4:30pm EST and 9:30am EST the next day. which was also poor. I always say the same thing about overnight patterns which is that they have far less predictive power than RTHRegular Trading Hours. In the /ES this means the price action from 9:30am EST to 4:15pm EST only. ones but at the same time should not be ignored. For those of you new to this line of thinking, the poor lowA poor low is one which lacks excess and is the opposite of an excess low. A poor low will have less than two TPO's of excess at the bottom of a daily range with at least 2-3 columns of TPO's lining up to form a flat looking bottom. It indicates that there are short term or weak handed shorts at that low of day area. We know this because every time prices sell off to the low, they get covered quickly, thus forming the poor low.

The poor low has two forward looking indications. The first is that prices should bounce away from the poor low as there are a number of shorts trapped at poor location. The second is that if the next day or in some subsequent session, the poor low is revisited, then the odds are strong that it will break and move lower. This is called repair as it repairs the ... is an indication that sellers are nervous at that level and have not been able to find more players to further their campaign lower at that level. It’s almost always a sign of rejectionPrices are rejected when they move away from a key area quickly in the market profile. For example, let's say that futures open below the value area and start to rise towards it. Upon breaching the low of the value area, they rise just a couple ticks higher and then fall quickly back out of the value area. That's rejection. Rejection is often noted when prices move into "make or break" areas such as an ONH or ONL or prior day's RTH high or low from outside of those areas.

Rejection is the opposite of acceptance. of a certain price and the short term bias is in the other direction. Some of that has already happened in the overnight session with futures bouncing well away from that poor lowA poor low is one which lacks excess and is the opposite of an excess low. A poor low will have less than two TPO's of excess at the bottom of a daily range with at least 2-3 columns of TPO's lining up to form a flat looking bottom. It indicates that there are short term or weak handed shorts at that low of day area. We know this because every time prices sell off to the low, they get covered quickly, thus forming the poor low.

The poor low has two forward looking indications. The first is that prices should bounce away from the poor low as there are a number of shorts trapped at poor location. The second is that if the next day or in some subsequent session, the poor low is revisited, then the odds are strong that it will break and move lower. This is called repair as it repairs the ... and settling back into the middle of the overnight range currently.

Note that there are two overnight lows (between 1/2 and 1/3 and last night) that are at almost the same level. I would watch this more as an “area” today rather than a specific level for that reason. AcceptanceWhen the market profile begins to build out or develop in a certain area, it is said that the market is accepting those prices. This can be measured either in time spent or amount of volume that is transacted. It is generally understood that ShadowTrader defines acceptance as more of a time dynamic than a volume one. A good rule of thumb is to look for at least two TPO periods to print in the accepted area. The acceptance confirms that a significant amount of market participants are transacting at those levels. Acceptance is the opposite of rejection. More below this area would fill the first gap below us (#6) and then target the VPOCVirgin Point of Control. This is a point of control level that has not yet been tested (traded through) during an RTH session. If the POC gets tested during an overnight session, it does not count and remains "virgin" until it happens during a day session. #11 at 3205.75.

Scenarios

- My first focus today will be whether or not there will be any playable fadeWhen a stock moves opposite the direction of its gap on an intraday basis off of the gap down to take prices to the RTHRegular Trading Hours. In the /ES this means the price action from 9:30am EST to 4:15pm EST only. Low as a gap fill or not. If so, the play is to monitor for continuation into the single printsAny section of the market profile distribution that is only one TPO wide. Single prints are a sign of emotional buying or selling as very little time was spent at those levels and thus there is no value there. The endpoints of single print sections are considered to be potential support or resistance points., eventually targeting the End of the Single PrintsAny section of the market profile distribution that is only one TPO wide. Single prints are a sign of emotional buying or selling as very little time was spent at those levels and thus there is no value there. The endpoints of single print sections are considered to be potential support or resistance points. and potentially higher. This will be not be an easy read today because we are so far off of the ONLOvernight Low. A term mostly used for the futures market as it trades almost around the clock. To be precise, in the /ES this would be the lowest price between 4:30pm EST and 9:30am EST the next day. already and slated to open at about the midpoint of an expanded overnight range.

- A weaker market (read: shortable) today will be characterized by either a failure to fill the gap or a fill that rejects quickly at the RTHRegular Trading Hours. In the /ES this means the price action from 9:30am EST to 4:15pm EST only. Low and comes back down to the open. In such a scenario, the RTHRegular Trading Hours. In the /ES this means the price action from 9:30am EST to 4:15pm EST only. Low can be a short entry point with stop over HODHigh of Day, or the subsequent retest of the open can be an your entry point with a stop over the RTHRegular Trading Hours. In the /ES this means the price action from 9:30am EST to 4:15pm EST only. Low.

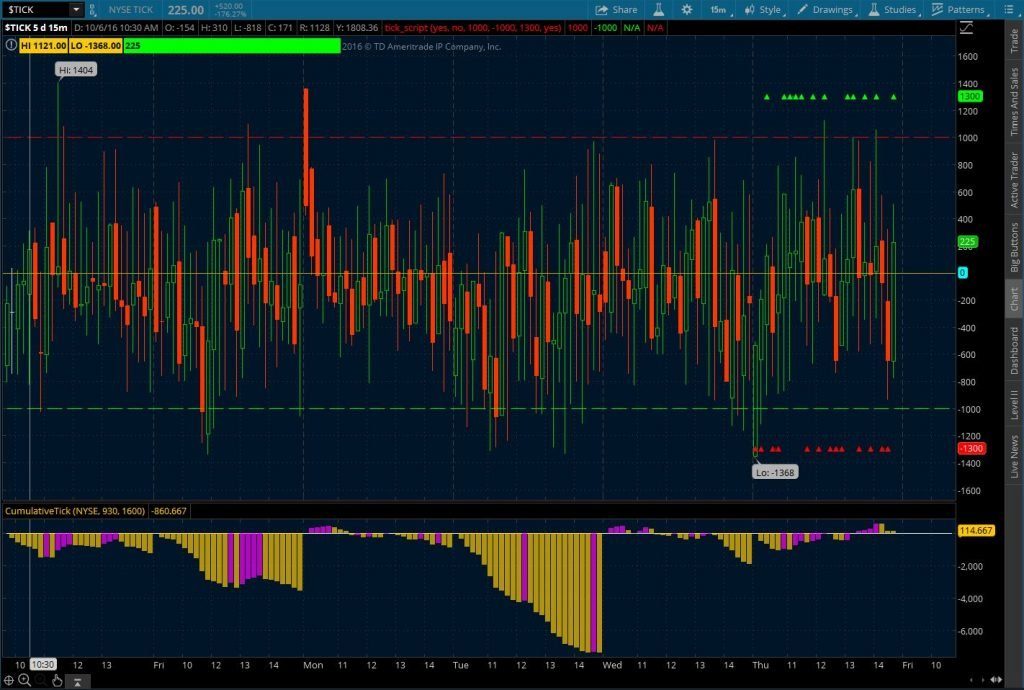

ShadowTrader Cumulative Tick

Beef up your "quad" and by putting your tickThe net cumulative tick reading on the NYSE or Nasdaq Composite. This is measured by the number of stocks ticking up minus the number of stocks ticking down at any given moment. It is the least used of the internal indicators but is discussed from time to time. Generally the tick readings are only helpful when they are at extremes such as +1000 on the NYSE to indicate that program trading is ensuing. indicator on steroids!

Learn More