The Market Profile value areas and ShadowTrader Pivots for /ESH19 and /NQH19 Futures are posted free every morning

in the ShadowTrader Swing Trader newsletter.

Good Morning

WindoTrader (702)800-4628 (Terry) Ask for the ShadowTrader Discount

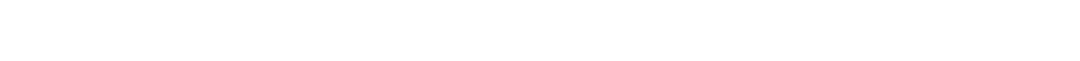

The 45 degree lineThe 45 degree line is an interesting market profile nuance. It occurs when a 45 degree line can be drawn from the lowest point of a distribution to its widest point (TPO POC). This is a sign that sellers have painted themselves into a corner near the lows of the session and creates potential for an upward reversal in the next session. As less and less time is spent the closer you get to the low of the session, sellers are essentially initiating shorts at less and less value. 45 degree line lows should be assumed to be secure until they are breached. The pattern is generally only noted in RTH sessions but they have shown to be relatively reliable signals in overnight sessions as well. The obvious question is always whether or not the 45 degree line can be drawn in from the high of the day t... in the overnight trade is significant. As always, not as significant as if it happened in an RTHRegular Trading Hours. In the /ES this means the price action from 9:30am EST to 4:15pm EST only. session but significant nonetheless. Think of the bottom point of the pattern as the corner of a room. Sellers are the painters and they have painted themselves into the corner. The only way out of that is to jump the other way. 2560.50 is the ONLOvernight Low. A term mostly used for the futures market as it trades almost around the clock. To be precise, in the /ES this would be the lowest price between 4:30pm EST and 9:30am EST the next day. and has some decent odds of holding today, given the pattern.

Overnight inventoryA way of measuring overnight activity in the futures market by just noting how much of the overnight activity happens to fall above the prior day's settlement value (4:15pm EST close) and how much falls below. If more activity is above the settlement, then overnight inventory is said to be net long. If more is below, then it is said to be net short. If all of the overnight activity is above the settlement, then it is said to be 100% net long. If all of the activity is below the settlement then it is said to be 100% net short. The overnight inventory situation matters most and has the most impact on early trade when it is skewed 100% in either direction because when the imbalance is very large like that then the odds of an early correction increase greatly. This is due to the fact that most... is 100% net shortThe concept of being more short than long in an options spread by creating options spreads where you are selling more structures than you are buying or selling wider structures than the ones you are buying. Example would be a broken wing butterfly. This spread is made up of two structures, one long vertical and one short vertical. In the BWB, the short vertical is wider than the long vertical. When you are long this spread, you are said to be in an options position that is "net short"

which also bodes well for an upswing early today. Currently we are trading just at yesterday’s RTHRegular Trading Hours. In the /ES this means the price action from 9:30am EST to 4:15pm EST only. low at 2569.00. That and the aforementioned ONLOvernight Low. A term mostly used for the futures market as it trades almost around the clock. To be precise, in the /ES this would be the lowest price between 4:30pm EST and 9:30am EST the next day. are the downside references that will be most important in today’s session.

In the wider view, I still believe that buyers are setting themselves up for a fall soon as I’m just not seeing any real confidence out there. In yesterday’s RTHRegular Trading Hours. In the /ES this means the price action from 9:30am EST to 4:15pm EST only. session we made a higher high again but the tone was more rotational than trending and the volume POCPoint of Control, also known as the "fairest price to do business". It is the price level in the /ES where the greatest amount of volume in the prior RTH session traded. ShadowTrader measures the POC using volume but the traditional way is to mark off the widest point of the day's distribution where the most TPO's printed going across from left to right, indicating that that was the price where the most time was spent. It's important to pay attention to both the volume POC and the TPO POC. failed to migrate higher. That being said, I don’t see any indication that the up auction is definitively over yet either. Yesterday’s excess highA high characterized by a number of single prints that ends a move and is at the top of a daily market profile distribution. The minimum number of TPO's that is necessary to define an excess high is two, however when the excess has only a few TPO's, it is said to be "lack of material excess". An excess high is the opposite of a poor high, which has no single prints and is flat along the high where the TPO's line up next to each other. was a scant 4 ticks, so if that was it, then we are truly going out on a whimper rather than a bang. For what it’s worth, I’m just not seeing it yet. As I discussed on the ShadowTrader SquawkBox with Scott yesterday, I’d rather see some real excess or a very poor highA poor high is one which lacks excess and is the opposite of an excess high. A poor high will have less than two TPO's of excess at the top of a daily range with at least 2-3 columns of TPO's lining up to form a flat looking top. It indicates that there are short term or weak handed longs at that high of day area. We know this because every time prices rise to the top, they get sold quickly, thus forming the poor high.

The poor high has two forward looking indications. The first is that prices should back away from the poor high as there are a number of longs trapped at poor location. The second is that if the next day or in some subsequent session, the poor high is revisited, then the odds are strong that it will break and move higher. This is called repair as it repairs the structur... which would both indicate a significant number of buyers at poor location that would then kick off the firecracker effect of stops. For now the market is still trading like it’s on a mission to tag the round number 2600.

A Bet and a Victor eBook

Best way to dip your toe into the ocean of Trading Psychology for a tiny price. Follow protagonist Victor and see how many of his trading psychology pitfalls you recognize!

$20 - Get Yours TodayHave a nice day,

-peter