The Market Profile value areas and ShadowTrader Pivots for /ESH19 and /NQH19 Futures are posted free every morning

in the ShadowTrader Swing Trader newsletter.

Good Morning

WindoTrader (702) 800-4628 (Terry) Ask for the ShadowTrader discount

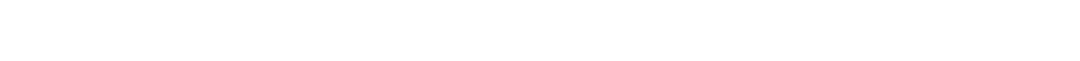

Check out the notes on the market profileA way of reading the market that recognizes either time spent or volume traded at a particular price level. A market profile can be either made up of “TPO’s” (time price opportunities), or volume. TPO’s measure how much time was spent at a particular price, while volume-based market profiles measure how much volume traded at a particular price. Generally, market profile is used in the trading of futures, especially the /ES. ShadowTrader utilizes volume based profiles. graphic of the S&P futures above. It really jumped out at me when I turned on my monitors this morning. I believe this is the most classic example of “what should be happening isn’t”. Last night, after the close, Apple cut their revenue outlook for the first time in 15 years. To me, and especially against the backdrop of current jitters from a whole slew of areas that are worrying the market, this news could not be worse. When Apple was halted last evening, I thought for sure that we would see NQ’s down 250 or so and /ES off like 50 coming into today’s session. For one short moment in time, I was correct on that as the low in the S&P futures overnight was 2462, exactly 48.50 down from the settlement.

What happened next is where we should all be focusing our attention. While it’s not quite fat enough (think: wide) for a true 45 degree lineThe 45 degree line is an interesting market profile nuance. It occurs when a 45 degree line can be drawn from the lowest point of a distribution to its widest point (TPO POC). This is a sign that sellers have painted themselves into a corner near the lows of the session and creates potential for an upward reversal in the next session. As less and less time is spent the closer you get to the low of the session, sellers are essentially initiating shorts at less and less value. 45 degree line lows should be assumed to be secure until they are breached. The pattern is generally only noted in RTH sessions but they have shown to be relatively reliable signals in overnight sessions as well. The obvious question is always whether or not the 45 degree line can be drawn in from the high of the day t..., it has definitely built out in that direction overnight. This tells us that sellers incrementally painted themselves into a corner by selling at less and less valueThis value has nothing to do with valuation. It denotes prices that are "fair". Fair in this sense means a price that is common to a lot of participants. An item that you buy once per week in a store at a price that doesn't fluctuate has a "fair price". You can express this by a formula Value = Price + Time or Value = Price + Volume Either of the above are valid ways of expressing value. In the first equation, value is defined by price staying the same for a long period of time. In the futures market, this would be an area that is revisted a lot during a particular session or multiple sessions. The point of control is the price level where the most amount of time was spent during an RTH session. James Dalton refers to this level as "the fairest price to do business". Using vo... More as the evening wore on. If you don’t want to think about the implications of what buyers and sellers are thinking or doing, then just know that this is simply not a short pattern. Pretend that you are seeing the overnight distribution as an RTHRegular Trading Hours. In the /ES this means the price action from 9:30am EST to 4:15pm EST only. one. You would focus on the width of the profile, the 45 degree line-ish connection from low to POCPoint of Control, also known as the "fairest price to do business". It is the price level in the /ES where the greatest amount of volume in the prior RTH session traded. ShadowTrader measures the POC using volume but the traditional way is to mark off the widest point of the day's distribution where the most TPO's printed going across from left to right, indicating that that was the price where the most time was spent. It's important to pay attention to both the volume POC and the TPO POC., and the fact that there is a clear excess lowA low characterized by a number of single prints that ends a move and is at the bottom of a daily market profile distribution. The minimum number of TPO's that is necessary to define an excess low is two, however when the excess has only a few TPO's, it is said to be "lack of material excess". An excess low is the opposite of a poor low, which has no single prints and is flat along the low where the TPO's line up next to each other.. Beyond all that, you would also note that the meat of the move is within the prior day’s range and also that the excess lowA low characterized by a number of single prints that ends a move and is at the bottom of a daily market profile distribution. The minimum number of TPO's that is necessary to define an excess low is two, however when the excess has only a few TPO's, it is said to be "lack of material excess". An excess low is the opposite of a poor low, which has no single prints and is flat along the low where the TPO's line up next to each other. cleared the prior day’s RTHRegular Trading Hours. In the /ES this means the price action from 9:30am EST to 4:15pm EST only. low but only by a few ticks and was quickly rejected. All of that happened in the overnight session. Overnight sessions, of course, have less predictive power and import than RTHRegular Trading Hours. In the /ES this means the price action from 9:30am EST to 4:15pm EST only. ones but I strongly feel that traders who avoid analyzing them do so at their own peril.

Coming towards today’s open, overnight inventoryA way of measuring overnight activity in the futures market by just noting how much of the overnight activity happens to fall above the prior day's settlement value (4:15pm EST close) and how much falls below. If more activity is above the settlement, then overnight inventory is said to be net long. If more is below, then it is said to be net short. If all of the overnight activity is above the settlement, then it is said to be 100% net long. If all of the activity is below the settlement then it is said to be 100% net short. The overnight inventory situation matters most and has the most impact on early trade when it is skewed 100% in either direction because when the imbalance is very large like that then the odds of an early correction increase greatly. This is due to the fact that most... is 100% net shortThe concept of being more short than long in an options spread by creating options spreads where you are selling more structures than you are buying or selling wider structures than the ones you are buying. Example would be a broken wing butterfly. This spread is made up of two structures, one long vertical and one short vertical. In the BWB, the short vertical is wider than the long vertical. When you are long this spread, you are said to be in an options position that is "net short"

but we are trading squarely within yesterday’s RTHRegular Trading Hours. In the /ES this means the price action from 9:30am EST to 4:15pm EST only. range and thus there is no true gapThere is a lot of discussion as to what constitutes a gap. Is it measured to the prior day's close, or to the prior day's high or low? Here at ShadowTrader, we believe that it is always and only to a prior day's high or low, thus creating a true gap or space on the chart between one day and the next. Thus a true gap is one that has price opening completely outside of the prior day's range (either above the high or below the low) and anything else is just a gap that has far less import. As a gap is a "reordering of thinking", only a true gap really changes the tone and creates opportunity to trade earlier (near the open) rather than later. More. As I’ve already laid out above, we are also well off of the lows so there is far less to correct than one would think if they just look at the absolute number of how much we are down which is currently 25 in the /ES and 108 in the /NQ.

Opening up in he middle of a range is always a more difficult trade than if we were outside. Momentum is generally hampered within prior day’s ranges and more untethered and free to roam when outside. We are currently just a few ticks below halfbackA term for the halfway point between the high and low of any session, could be a day session or an overnight session. On Peter's market profile charts it is always a dark yellow horizontal line at that level. which underscores how middling this open really is.

ValueThis value has nothing to do with valuation. It denotes prices that are "fair". Fair in this sense means a price that is common to a lot of participants. An item that you buy once per week in a store at a price that doesn't fluctuate has a "fair price". You can express this by a formula Value = Price + Time or Value = Price + Volume Either of the above are valid ways of expressing value. In the first equation, value is defined by price staying the same for a long period of time. In the futures market, this would be an area that is revisted a lot during a particular session or multiple sessions. The point of control is the price level where the most amount of time was spent during an RTH session. James Dalton refers to this level as "the fairest price to do business". Using vo... More has been overlapping to up for the last two RTHRegular Trading Hours. In the /ES this means the price action from 9:30am EST to 4:15pm EST only. sessions which confirms that the market is struggling to find new buyers outside of the “old business” of short covering that is currently in vogue.

Just give it to me in a nutshell:

-On horrible news from AAPL last night, I feel that futures should be much lower and should not have made the overnight pattern that they did if they were really finding new sellers. As such, traders may be surprised today by a market that is stronger than they think it should be.

-We are currently slated to open very close to the middle of yesterday’s RTHRegular Trading Hours. In the /ES this means the price action from 9:30am EST to 4:15pm EST only. range. As such, we have very little information to go on as to whether or not traders will perceive this as bullish or bearish and thus early trade may be choppy. Caution is warranted.

-The market is not making any definitive (expansion of range, valueThis value has nothing to do with valuation. It denotes prices that are "fair". Fair in this sense means a price that is common to a lot of participants. An item that you buy once per week in a store at a price that doesn't fluctuate has a "fair price". You can express this by a formula Value = Price + Time or Value = Price + Volume Either of the above are valid ways of expressing value. In the first equation, value is defined by price staying the same for a long period of time. In the futures market, this would be an area that is revisted a lot during a particular session or multiple sessions. The point of control is the price level where the most amount of time was spent during an RTH session. James Dalton refers to this level as "the fairest price to do business". Using vo... More clean to upside) bullish moves, however it is apparent that there aren’t any stronger sellers either. If S&P futures can get past the 2520 area which has been resistant for a couple of sessions recently, then it could set up a move to the 2600 (low end of the box range) area.

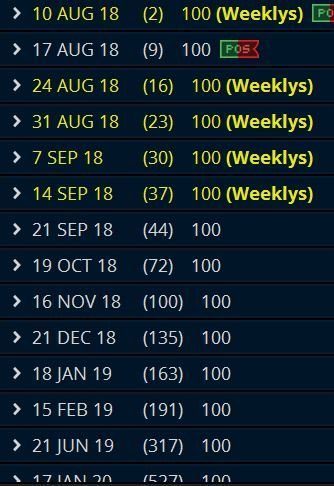

ShadowTrader Weekly Options Advisory

-Real time text messages on all entries, exits, and adjustments

-Private, members-only webinars every Thursday

-Includes 2-3 "What's Peter Thinking" recorded audio updates daily!

$49 per monthHave a great day,

-peter