Today’s ES and NQ Market Profile and Pivot Point Numbers

| Value Area HighThe high end of the range of the value area. | 4287.00 | 14511.00 |

| Point of ControlAlso called “POC” for short. The level in the futures inside the value area where either the greatest amount of volume traded in the prior session, or the greatest amount of time was spent as measured by the number of TPO’s going across. Measured this way, the POC would be the widest part of any given market profile. While ShadowTrader calculates its value areas and points of control using volume exclusively, we are always very aware of where the TPO POC is and it’s relation to current prices or patterns in the profile. Both are very important. | 4274.50 | 14356.00 |

| Value Area LowThe low end of the range of the value area. | 4270.50 | 14310.00 |

| R3 | 4332.25 | 14938.50 |

| R2 | 4318.50 | 14806.75 |

| R1 | 4296.75 | 14569.00 |

| Pivot | 4283.00 | 14437.25 |

| S1 | 4261.25 | 14199.50 |

| S2 | 4247.50 | 14067.75 |

| S3 | 4225.75 | 13830.00 |

Today’s Market Profile Chart

The above chart is from WindoTrader | Call 702-800-4628 and speak with Terry about the ShadowTrader discount or CLICK HERE to learn more.

Click HERE for a market profile key that will help you interpret the chart above.

Pre market indications

| Opening In/Out Balance | in balance |

|---|---|

| Overnight InventoryA way of measuring overnight activity in the futures market by just noting how much of the overnight activity happens to fall above the prior day's settlement value (4:15pm EST close) and how much falls below. If more activity is above the settlement, then overnight inventory is said to be net long. If more is below, then it is said to be net short. If all of the overnight activity is above the settlement, then it is said to be 100% net long. If all of the activity is below the settlement then it is said to be 100% net short. The overnight inventory situation matters most and has the most impact on early trade when it is skewed 100% in either direction because when the imbalance is very large like that then the odds of an early correction increase greatly. This is due to the fact that most... | balanced |

| Current Price/Overnight Range | middle third |

| Shock and AweA term Peter uses to describe what overnight futures traders may be feeling when faced with an open that is wildly divergent from what they expected. Large gaps in either direction that are opening well outside of range are examples of this. The approach is that when the market opens in such a manner, there is often opportunity to trade earlier rather than later because of the large contingent of traders who will be forced to reverse their positions quickly. | no |

| Potential for Early Trade | no |

| Short Term Bias | pulling back in context of bullish pattern |

Key Levels for Today

| 4305.75 | RTHRegular Trading Hours. In the /ES this means the price action from 9:30am EST to 4:15pm EST only. High / Weak HighA weak high should not be confused with a poor high. The latter speaks to a deficiency in structure and the former deals with the location of the high. A weak high is formed when a market rises and reverses right at a specific point which is often a technical or profile nuance. Some examples would be prior intraday highs, the upper extreme of a value area, the prior day's settlement, or the current day's open. In each case, the location is a mechanical and visual reference that is used by short term traders as an entry point. The high is deemed weak because it can be taken easily when retested due to the short term nature of the sellers who initiated their positions at that level. / Swing High |

|---|---|

| 4287.00 | VAHValue Area High / HalfbackA term for the halfway point between the high and low of any session, could be a day session or an overnight session. On Peter's market profile charts it is always a dark yellow horizontal line at that level. |

| 4268.50 | RTHRegular Trading Hours. In the /ES this means the price action from 9:30am EST to 4:15pm EST only. Low / Weak LowA weak low should not be confused with a poor low. The latter speaks to a deficiency in structure and the former deals with the location of the low. A weak low is formed when a market falls and reverses right at a specific point which is often a technical or profile nuance. Some examples would be prior intraday lows, the lower extreme of a value area, the prior day's settlement, or the current day's open. In each case, the location is a mechanical and visual reference that is used by short term traders as an entry point. The low is deemed weak because it can be taken easily when retested due to the short term nature of the buyers who initiated their positions at that level. / Poor LowA poor low is one which lacks excess and is the opposite of an excess low. A poor low will have less than two TPO's of excess at the bottom of a daily range with at least 2-3 columns of TPO's lining up to form a flat looking bottom. It indicates that there are short term or weak handed shorts at that low of day area. We know this because every time prices sell off to the low, they get covered quickly, thus forming the poor low. The poor low has two forward looking indications. The first is that prices should bounce away from the poor low as there are a number of shorts trapped at poor location. The second is that if the next day or in some subsequent session, the poor low is revisited, then the odds are strong that it will break and move lower. This is called repair as it repairs the ... |

| 4262.75 | ONLOvernight Low. A term mostly used for the futures market as it trades almost around the clock. To be precise, in the /ES this would be the lowest price between 4:30pm EST and 9:30am EST the next day. |

| 4249.00 | Top of Gap |

| 4239.75 | Bottom of Gap |

Ongoing Narrative / Commentary

We enter this Thursday with three days or relatively unchanged valueThis value has nothing to do with valuation. It denotes prices that are "fair". Fair in this sense means a price that is common to a lot of participants. An item that you buy once per week in a store at a price that doesn't fluctuate has a "fair price". You can express this by a formula Value = Price + Time or Value = Price + Volume Either of the above are valid ways of expressing value. In the first equation, value is defined by price staying the same for a long period of time. In the futures market, this would be an area that is revisted a lot during a particular session or multiple sessions. The point of control is the price level where the most amount of time was spent during an RTH session. James Dalton refers to this level as "the fairest price to do business". Using vo... More. Yesterday saw the /NQ much weaker than the /ES as it came down to a key moving average and breached it by a small margin, closing at the lows.

This morning’s premarket indications are not much changed with some price exploration below the RTHRegular Trading Hours. In the /ES this means the price action from 9:30am EST to 4:15pm EST only. Low but currently trading within range.

There is structure to be repaired on both ends of yesterday’s RTHRegular Trading Hours. In the /ES this means the price action from 9:30am EST to 4:15pm EST only. range. The high is now weak as it came to within a few ticks of the recent 6.5 swing high. The low is also weak as it came within ticks of the 6.6 low. The low is also poor as it lacks excess.

I discuss scenarios more in detail in the video below.

Click HERE To view today’s video

VPOC’s

- 6.01 4228.00

- 5.04 4075.00

- 3.29 4041.50

- 3.27 4010.00

- 3.28 3993.00

- 3.24 3957.50

- 3.15 3890.00

Scenarios

- My focus today is on the poor/weak low and the fact that we went below it in overnight trade which does not count towards repairA market profile term for "fixing" profile distributions that are missing parts that would make them complete or more symmetrical. This concept is most often applied to poor highs and poor lows which are profile distributions that lack excess on their endpoints and have two or more TPO's across creating tops or bottoms that look flat. Once a new session trades through these levels then it is as though the current activity was "pasted onto" the prior activity to complete the picture. It should be noted that repair can only occur in an RTH session. Overnight activity that trades through areas of poor RTH structure does not repair that structure. More. Go over the bullish scenarios that I laid out in the video.

- Only acceptanceWhen the market profile begins to build out or develop in a certain area, it is said that the market is accepting those prices. This can be measured either in time spent or amount of volume that is transacted. It is generally understood that ShadowTrader defines acceptance as more of a time dynamic than a volume one. A good rule of thumb is to look for at least two TPO periods to print in the accepted area. The acceptance confirms that a significant amount of market participants are transacting at those levels. Acceptance is the opposite of rejection. More below the RTHRegular Trading Hours. In the /ES this means the price action from 9:30am EST to 4:15pm EST only. Low that fails to come back into range is bearish today. First target is the ONLOvernight Low. A term mostly used for the futures market as it trades almost around the clock. To be precise, in the /ES this would be the lowest price between 4:30pm EST and 9:30am EST the next day. and then you should monitor for continuation.

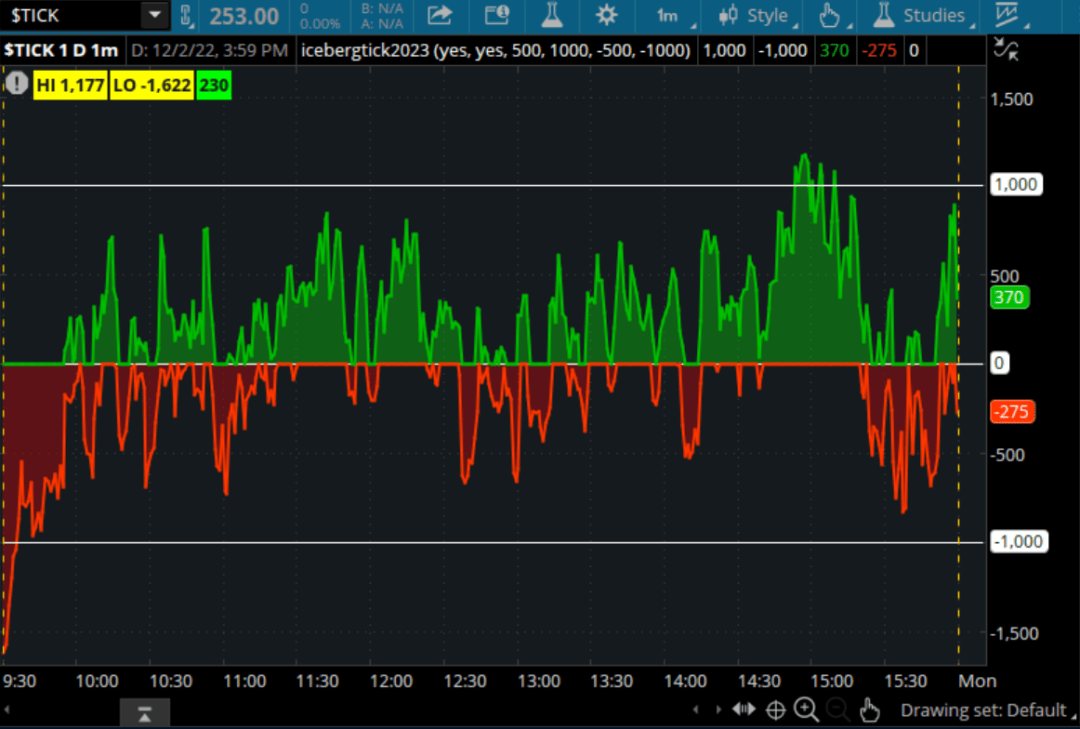

Iceberg Tick

A game changer if you use the TICKThe net cumulative tick reading on the NYSE or Nasdaq Composite. This is measured by the number of stocks ticking up minus the number of stocks ticking down at any given moment. It is the least used of the internal indicators but is discussed from time to time. Generally the tick readings are only helpful when they are at extremes such as +1000 on the NYSE to indicate that program trading is ensuing. as a market internal. Paints time spent above zero in green and time below in red. Traders who know how to use the TICKThe net cumulative tick reading on the NYSE or Nasdaq Composite. This is measured by the number of stocks ticking up minus the number of stocks ticking down at any given moment. It is the least used of the internal indicators but is discussed from time to time. Generally the tick readings are only helpful when they are at extremes such as +1000 on the NYSE to indicate that program trading is ensuing. know that this is what really matters in terms of sustaining intraday direction, not how high or low the extremes are.

LEARN MORE