The Market ProfileA way of reading the market that recognizes either time spent or volume traded at a particular price level. A market profile can be either made up of “TPO’s” (time price opportunities), or volume. TPO’s measure how much time was spent at a particular price, while volume-based market profiles measure how much volume traded at a particular price. Generally, market profile is used in the trading of futures, especially the /ES. ShadowTrader utilizes volume based profiles. valueThis value has nothing to do with valuation. It denotes prices that are "fair". Fair in this sense means a price that is common to a lot of participants. An item that you buy once per week in a store at a price that doesn't fluctuate has a "fair price". You can express this by a formula Value = Price + Time or Value = Price + Volume Either of the above are valid ways of expressing value. In the first equation, value is defined by price staying the same for a long period of time. In the futures market, this would be an area that is revisted a lot during a particular session or multiple sessions. The point of control is the price level where the most amount of time was spent during an RTH session. James Dalton refers to this level as "the fairest price to do business". Using vo... More areas and ShadowTrader Pivots for /ESH22 and /NQH22 Futures are posted free every morning in the ShadowTrader Swing Trader newsletter.

WindoTrader 702-800-4628 Speak with Terry about the ShadowTrader discount or CLICK HERE to learn more.

Click HERE for a market profile key that will help you interpret the chart above.

Pre market indications

| Opening In/Out Balance | in balance |

|---|---|

| Overnight InventoryA way of measuring overnight activity in the futures market by just noting how much of the overnight activity happens to fall above the prior day's settlement value (4:15pm EST close) and how much falls below. If more activity is above the settlement, then overnight inventory is said to be net long. If more is below, then it is said to be net short. If all of the overnight activity is above the settlement, then it is said to be 100% net long. If all of the activity is below the settlement then it is said to be 100% net short. The overnight inventory situation matters most and has the most impact on early trade when it is skewed 100% in either direction because when the imbalance is very large like that then the odds of an early correction increase greatly. This is due to the fact that most... | balanced |

| Current Price/Overnight Range | upper third |

| Shock and AweA term Peter uses to describe what overnight futures traders may be feeling when faced with an open that is wildly divergent from what they expected. Large gaps in either direction that are opening well outside of range are examples of this. The approach is that when the market opens in such a manner, there is often opportunity to trade earlier rather than later because of the large contingent of traders who will be forced to reverse their positions quickly. | no |

| Potential for Early Trade | no |

| Short Term Bias | bearish, confirmed downtrend |

Key Levels for Today

| 4420.00 | POCPoint of Control, also known as the "fairest price to do business". It is the price level in the /ES where the greatest amount of volume in the prior RTH session traded. ShadowTrader measures the POC using volume but the traditional way is to mark off the widest point of the day's distribution where the most TPO's printed going across from left to right, indicating that that was the price where the most time was spent. It's important to pay attention to both the volume POC and the TPO POC. |

|---|---|

| 4380.75 | Top of Single PrintsAny section of the market profile distribution that is only one TPO wide. Single prints are a sign of emotional buying or selling as very little time was spent at those levels and thus there is no value there. The endpoints of single print sections are considered to be potential support or resistance points. |

| 4369.50 | Bottom of Single PrintsAny section of the market profile distribution that is only one TPO wide. Single prints are a sign of emotional buying or selling as very little time was spent at those levels and thus there is no value there. The endpoints of single print sections are considered to be potential support or resistance points. |

| 4329.25 | Settlement |

| 4275.00 | VPOCVirgin Point of Control. This is a point of control level that has not yet been tested (traded through) during an RTH session. If the POC gets tested during an overnight session, it does not count and remains "virgin" until it happens during a day session. 01.24 / RTHRegular Trading Hours. In the /ES this means the price action from 9:30am EST to 4:15pm EST only. Low 1.25 |

Ongoing Narrative / Commentary

Wild overnight again, but beyond the obvious should we be asking ourselves if the market is hammering out a bottom here? I think we should.

Yesterday’s FOMC did not deliver on the hope that there would be a more dovish stance. It actually delivered the opposite, which was to lay out a roadmap for four to five rate hikes this year as opposed to three which were in the cards earlier. This took markets down considerably yesterday and further overnight but neither of these actions took out the swing low of 1.24. In fact, yesterday’s RTHRegular Trading Hours. In the /ES this means the price action from 9:30am EST to 4:15pm EST only. Low was a higher low than the previous two sessions even though the overnight activity was notably lower.

All of which brings us to an opening gap today that is green and not red. Have any trendlines been broken yet?The answer to that is still no, but we have to at the very least start looking at the 1.24 RTHRegular Trading Hours. In the /ES this means the price action from 9:30am EST to 4:15pm EST only. low as a the potential low of this move. I’m not pounding the table here, calling for that, I’m saying to consider it. Higher lows are undeniable and if they lead to a trendline breaks, then it is prudent to reverse course. Simple as that.

VPOC’s

- 01.05 4780.00

- 01.14 4632.00

- 01.20 4570.00

- 01.21 4448.00

- 01.24 4275.00

Scenarios

- Opening well within range after a very balanced and large overnight range tell us little about how prices will trade near the open. The better trades will present themselves later rather than earlier in the session.

- Current prices are within the single print section that has created yesterday’s double distributionA market profile distribution that is split into two distributions that are separated by single prints. The general rule of thumb is to treat each distribution as if it were a separate day. Judge the current day's bullishness or bearishness by which of the prior day's distributions you find acceptance in. The end points of the single prints are often support or resistant points as well.. AS single printsAny section of the market profile distribution that is only one TPO wide. Single prints are a sign of emotional buying or selling as very little time was spent at those levels and thus there is no value there. The endpoints of single print sections are considered to be potential support or resistance points. tend to act like gaps where there is a void of price action, treat this area as such and target the Top of the Single PrintsAny section of the market profile distribution that is only one TPO wide. Single prints are a sign of emotional buying or selling as very little time was spent at those levels and thus there is no value there. The endpoints of single print sections are considered to be potential support or resistance points. on any longs.

- Pursuant to my commentary above, it may be prudent to favor longs today. I am going to be watching the Settlement to see if “screens stay green” which I believe may bring in more short covering. I believe that bottoming in the context of a shift in monetary policy is a process and no larger commitment to the long side should be made until downtrends start to break which they haven’t as of yet.

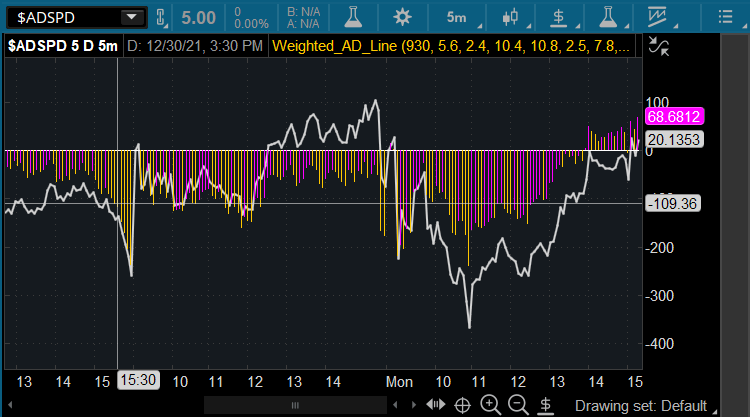

Weighted S&P A/D Line Indicator

This script plots both an unweighted and a weighted A/D line using the 11 S&P sectors and their respective weights. This gives the trader a huge edge in discerning the strength of moves and also knowing when there is positive or negative divergence in heavier versus lighter weighted sectors as the day unfolds.

GET YOURS NOW