The Market ProfileA way of reading the market that recognizes either time spent or volume traded at a particular price level. A market profile can be either made up of “TPO’s” (time price opportunities), or volume. TPO’s measure how much time was spent at a particular price, while volume-based market profiles measure how much volume traded at a particular price. Generally, market profile is used in the trading of futures, especially the /ES. ShadowTrader utilizes volume based profiles. valueThis value has nothing to do with valuation. It denotes prices that are "fair". Fair in this sense means a price that is common to a lot of participants. An item that you buy once per week in a store at a price that doesn't fluctuate has a "fair price". You can express this by a formula Value = Price + Time or Value = Price + Volume Either of the above are valid ways of expressing value. In the first equation, value is defined by price staying the same for a long period of time. In the futures market, this would be an area that is revisted a lot during a particular session or multiple sessions. The point of control is the price level where the most amount of time was spent during an RTH session. James Dalton refers to this level as "the fairest price to do business". Using vo... More areas and ShadowTrader Pivots for /ESM21 and /NQM21 Futures are posted free every morning in the ShadowTrader Swing Trader newsletter.

WindoTrader 702-800-4628 Speak with Terry about the ShadowTrader discount or CLICK HERE to learn more.

Pre market indications

| Opening In/Out Balance | in balance, lower end of range |

|---|---|

| Overnight InventoryA way of measuring overnight activity in the futures market by just noting how much of the overnight activity happens to fall above the prior day's settlement value (4:15pm EST close) and how much falls below. If more activity is above the settlement, then overnight inventory is said to be net long. If more is below, then it is said to be net short. If all of the overnight activity is above the settlement, then it is said to be 100% net long. If all of the activity is below the settlement then it is said to be 100% net short. The overnight inventory situation matters most and has the most impact on early trade when it is skewed 100% in either direction because when the imbalance is very large like that then the odds of an early correction increase greatly. This is due to the fact that most... | 100% net shortThe concept of being more short than long in an options spread by creating options spreads where you are selling more structures than you are buying or selling wider structures than the ones you are buying. Example would be a broken wing butterfly. This spread is made up of two structures, one long vertical and one short vertical. In the BWB, the short vertical is wider than the long vertical. When you are long this spread, you are said to be in an options position that is "net short" |

| Current Price/Overnight Range | in lower third, close to ONLOvernight Low. A term mostly used for the futures market as it trades almost around the clock. To be precise, in the /ES this would be the lowest price between 4:30pm EST and 9:30am EST the next day. |

| Shock and AweA term Peter uses to describe what overnight futures traders may be feeling when faced with an open that is wildly divergent from what they expected. Large gaps in either direction that are opening well outside of range are examples of this. The approach is that when the market opens in such a manner, there is often opportunity to trade earlier rather than later because of the large contingent of traders who will be forced to reverse their positions quickly. | yes |

| Potential for Early Trade | yes |

| Short Term Bias | above trend but look above and failA specific type of market movement where prices rise above the high of a balance area and then fall back into the balance area. The theory is that if this happens, there are strong odds that there will be price rotation back down to the low of the balance area. Look above and fail is specific to activity around balance areas only. Rising above a prior day's high or any technical level and falling back below is not a "look above and fail". More yesterday |

Key Levels for Today

| 4211.0 | RTHRegular Trading Hours. In the /ES this means the price action from 9:30am EST to 4:15pm EST only. High / ATH |

|---|---|

| 4193.75 | Top of Balance Area |

| 4166.75 | Bottom of Balance Area |

| 4160.00 | Top of Single PrintsAny section of the market profile distribution that is only one TPO wide. Single prints are a sign of emotional buying or selling as very little time was spent at those levels and thus there is no value there. The endpoints of single print sections are considered to be potential support or resistance points. |

| 4127.25 | VPOCVirgin Point of Control. This is a point of control level that has not yet been tested (traded through) during an RTH session. If the POC gets tested during an overnight session, it does not count and remains "virgin" until it happens during a day session. 4.22 |

Ongoing Narrative / Commentary

Yesterday and last night have provided us with a lot of M.G.I.Market Generated Information. to add to the narrative. Firstly, the RTHRegular Trading Hours. In the /ES this means the price action from 9:30am EST to 4:15pm EST only. action was a look above and failA specific type of market movement where prices rise above the high of a balance area and then fall back into the balance area. The theory is that if this happens, there are strong odds that there will be price rotation back down to the low of the balance area. Look above and fail is specific to activity around balance areas only. Rising above a prior day's high or any technical level and falling back below is not a "look above and fail". More per the balance rulesWhen a market is in balance, meaning that it is consolidating in a tight range of two or more days, then balance rules apply. The balance rules are nothing more than a framework of scenarios that could happen which prepare us for every possible outcome.

The possible outcomes and how to trade them are:

1. Look above and go. Prices move above the high of balance and find acceptance and continue higher. The target should be double the balance area.

2. Look above and fail. Prices move above the balance high but fail to find acceptance and reverse back into the balance area. This is now a short with a stop above the high just outside of balance that was recently made, with a target to the opposing low end of the balance area.

3. Look below and go. Prices move below the .... That means that there is potential for a rotation back down to the opposing end of balance. This would put the Bottom of the Balance Area into play.

Secondly, you’ll note that in the Premarket Indications above, I am calling shock and aweA term Peter uses to describe what overnight futures traders may be feeling when faced with an open that is wildly divergent from what they expected. Large gaps in either direction that are opening well outside of range are examples of this. The approach is that when the market opens in such a manner, there is often opportunity to trade earlier rather than later because of the large contingent of traders who will be forced to reverse their positions quickly. even though we are within yesterday’s range and also within the larger recent balance area. This is because our close was outside of the balance area which was bullish but now overnight activity has brought prices back into range. For this reason, I believe there may be longs trapped above the balance area who are “in shock and awe” (hence the term) that we are now opening lower. Remember that breakouts from balance are something that almost every trader does. Everyone sees the same horizontal resistances and has buy stops just above. I believe there is potential for at least some of this faction to be disappointed today.

It’s the last trading day of the month which could bring on added volatility in addition to everyone digesting the AMZN gap today and other FANGMAN+T that are still reacting to their own reports.

Scenarios

- The look above and failA specific type of market movement where prices rise above the high of a balance area and then fall back into the balance area. The theory is that if this happens, there are strong odds that there will be price rotation back down to the low of the balance area. Look above and fail is specific to activity around balance areas only. Rising above a prior day's high or any technical level and falling back below is not a "look above and fail". More yesterday puts the Bottom of the Balance Area into play as a downside target today. As we are opening within range it’s not easy to pinpoint an exact entry at this time but trade from the framework that sellers could be in control. Target that balance area low first, then the Top of the Single PrintsAny section of the market profile distribution that is only one TPO wide. Single prints are a sign of emotional buying or selling as very little time was spent at those levels and thus there is no value there. The endpoints of single print sections are considered to be potential support or resistance points. and beyond that the VPOCVirgin Point of Control. This is a point of control level that has not yet been tested (traded through) during an RTH session. If the POC gets tested during an overnight session, it does not count and remains "virgin" until it happens during a day session. of 4.22. How much of this that happens (if any of it) will tell us a lot about the state of the market going into May.

- Failing to test the low end of balance would be a more bullish sign and should be carried forward as a WWSHDWhen What Should Happen Doesn't - A market dynamic where prices defy what is normally expected of them given the specific context they are in. A good example would be filling a larger gap only partially. The thinking is that the failure to do what should happen means prices are potentially headed in the other direction..

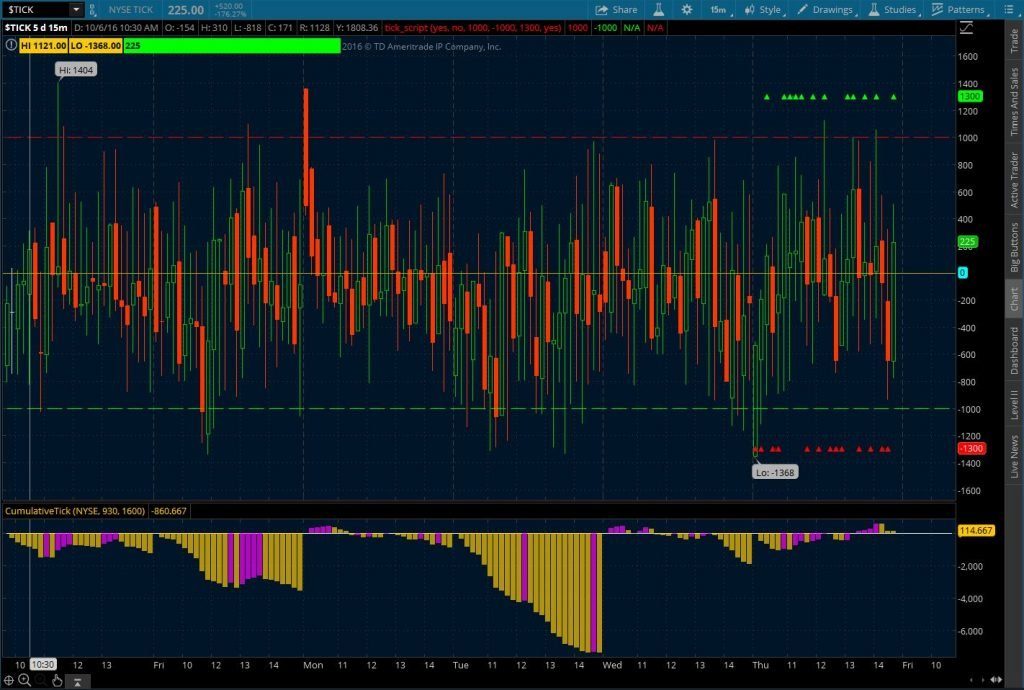

ShadowTrader Cumulative Tick

Beef up your "quad" and by putting your tickThe net cumulative tick reading on the NYSE or Nasdaq Composite. This is measured by the number of stocks ticking up minus the number of stocks ticking down at any given moment. It is the least used of the internal indicators but is discussed from time to time. Generally the tick readings are only helpful when they are at extremes such as +1000 on the NYSE to indicate that program trading is ensuing. indicator on steroids!

Learn More