The Market Profile value areas and ShadowTrader Pivots for /ESU19 and /NQU19 Futures are posted free every morning

in the ShadowTrader Swing Trader newsletter.

WindoTrader 702-800-4628 Speak with Terry about the ShadowTrader discount

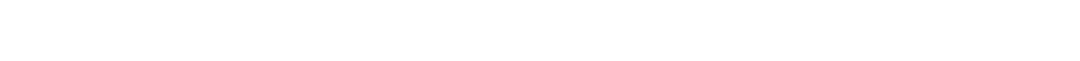

| 2984.50 | RTHRegular Trading Hours. In the /ES this means the price action from 9:30am EST to 4:15pm EST only. Low |

|---|---|

| 2989.50 | VALValue Area Low |

| 2998.75 | POCPoint of Control, also known as the "fairest price to do business". It is the price level in the /ES where the greatest amount of volume in the prior RTH session traded. ShadowTrader measures the POC using volume but the traditional way is to mark off the widest point of the day's distribution where the most TPO's printed going across from left to right, indicating that that was the price where the most time was spent. It's important to pay attention to both the volume POC and the TPO POC. |

| 2974.50 | ONLOvernight Low. A term mostly used for the futures market as it trades almost around the clock. To be precise, in the /ES this would be the lowest price between 4:30pm EST and 9:30am EST the next day. |

Yesterday’s move although trending in price didn’t feel that way when put against the backdrop of its internalsInternals refers to “market internals” and is a blanket term to collectively describe the advance decline, breadth, tick and cumulative tick., tempoProbably one of the most important and yet overlooked concepts in the market. The tempo is simply the ‘speed’ at which the market is moving. This is also referred to as confidence. Slow tempo is typical of range bound days where there is lots of responsive activity. Fast tempo occurs when there is initiating activity, and market is breaking out of a range. This is not to say that the market can’t have fast tempo on days when it is rotational or moving between the extremes of a value area. It certainly can. Effective intraday futures trading involves gauging the tempo and knowing that opportunities are fewer and smaller when the tempo is slow. See S.O.H., and volume. Everything was just barely bearish with most readings pointing to weak selling. The volume POCPoint of Control, also known as the "fairest price to do business". It is the price level in the /ES where the greatest amount of volume in the prior RTH session traded. ShadowTrader measures the POC using volume but the traditional way is to mark off the widest point of the day's distribution where the most TPO's printed going across from left to right, indicating that that was the price where the most time was spent. It's important to pay attention to both the volume POC and the TPO POC. didn’t migrate downward with price even though the settlement was almost dead on the low. I carry all this forward in my narrative.

Coming into today’s session, we are opening about flat but on overnight inventoryA way of measuring overnight activity in the futures market by just noting how much of the overnight activity happens to fall above the prior day's settlement value (4:15pm EST close) and how much falls below. If more activity is above the settlement, then overnight inventory is said to be net long. If more is below, then it is said to be net short. If all of the overnight activity is above the settlement, then it is said to be 100% net long. If all of the activity is below the settlement then it is said to be 100% net short. The overnight inventory situation matters most and has the most impact on early trade when it is skewed 100% in either direction because when the imbalance is very large like that then the odds of an early correction increase greatly. This is due to the fact that most... that is basically 100% net shortThe concept of being more short than long in an options spread by creating options spreads where you are selling more structures than you are buying or selling wider structures than the ones you are buying. Example would be a broken wing butterfly. This spread is made up of two structures, one long vertical and one short vertical. In the BWB, the short vertical is wider than the long vertical. When you are long this spread, you are said to be in an options position that is "net short"

and with a 45 degree lineThe 45 degree line is an interesting market profile nuance. It occurs when a 45 degree line can be drawn from the lowest point of a distribution to its widest point (TPO POC). This is a sign that sellers have painted themselves into a corner near the lows of the session and creates potential for an upward reversal in the next session. As less and less time is spent the closer you get to the low of the session, sellers are essentially initiating shorts at less and less value. 45 degree line lows should be assumed to be secure until they are breached. The pattern is generally only noted in RTH sessions but they have shown to be relatively reliable signals in overnight sessions as well. The obvious question is always whether or not the 45 degree line can be drawn in from the high of the day t... at the base of its distribution. As always, there is less import to overnight patterns in the market profileA way of reading the market that recognizes either time spent or volume traded at a particular price level. A market profile can be either made up of “TPO’s” (time price opportunities), or volume. TPO’s measure how much time was spent at a particular price, while volume-based market profiles measure how much volume traded at a particular price. Generally, market profile is used in the trading of futures, especially the /ES. ShadowTrader utilizes volume based profiles. but they are also not to be ignored. Read the 45 degree lineThe 45 degree line is an interesting market profile nuance. It occurs when a 45 degree line can be drawn from the lowest point of a distribution to its widest point (TPO POC). This is a sign that sellers have painted themselves into a corner near the lows of the session and creates potential for an upward reversal in the next session. As less and less time is spent the closer you get to the low of the session, sellers are essentially initiating shorts at less and less value. 45 degree line lows should be assumed to be secure until they are breached. The pattern is generally only noted in RTH sessions but they have shown to be relatively reliable signals in overnight sessions as well. The obvious question is always whether or not the 45 degree line can be drawn in from the high of the day t... the same way you would in an RTHRegular Trading Hours. In the /ES this means the price action from 9:30am EST to 4:15pm EST only. session in that it is a “secure” (definitely note the quote marks which in this case mean ‘sort of but not totally’) type of low.

Given the pattern and recovery of the overnight trade, my first inclination is that we will travel somewhat into yesterday’s RTHRegular Trading Hours. In the /ES this means the price action from 9:30am EST to 4:15pm EST only. range. As such, I’ve curated the key levels accordingly. The RTHRegular Trading Hours. In the /ES this means the price action from 9:30am EST to 4:15pm EST only. low is purposely the first key level on the list because it will define today’s trade more than any other. We will either be able to hold inside of yesterday’s range or we won’t. Just that one piece of M.G.I.Market Generated Information. will be very valuable today. Holding inside of yesterday’s range increases the odds of short covering due to yesterday’s wide range red bar and overnight inventoryA way of measuring overnight activity in the futures market by just noting how much of the overnight activity happens to fall above the prior day's settlement value (4:15pm EST close) and how much falls below. If more activity is above the settlement, then overnight inventory is said to be net long. If more is below, then it is said to be net short. If all of the overnight activity is above the settlement, then it is said to be 100% net long. If all of the activity is below the settlement then it is said to be 100% net short. The overnight inventory situation matters most and has the most impact on early trade when it is skewed 100% in either direction because when the imbalance is very large like that then the odds of an early correction increase greatly. This is due to the fact that most... situation while holding below may embolden sellers and stave off short covering, even possibly attracting new sellers. If so, then obviously the ONLOvernight Low. A term mostly used for the futures market as it trades almost around the clock. To be precise, in the /ES this would be the lowest price between 4:30pm EST and 9:30am EST the next day. is in play and is the target and also the door to further weakness.

Scenarios

- As with any 100% net shortThe concept of being more short than long in an options spread by creating options spreads where you are selling more structures than you are buying or selling wider structures than the ones you are buying. Example would be a broken wing butterfly. This spread is made up of two structures, one long vertical and one short vertical. In the BWB, the short vertical is wider than the long vertical. When you are long this spread, you are said to be in an options position that is "net short"

o/n inventory, the move to look for is the upside one. Today there is slightly more potential for that given the trending down on not so weak internalsInternals refers to “market internals” and is a blanket term to collectively describe the advance decline, breadth, tick and cumulative tick. yesterday. I’ve listed the key levels accordingly as the signposts (targets) of where the market would go on such a move. - A market that can be shorted today would only be defined by holding below the RTHRegular Trading Hours. In the /ES this means the price action from 9:30am EST to 4:15pm EST only. low on weak internalsInternals refers to “market internals” and is a blanket term to collectively describe the advance decline, breadth, tick and cumulative tick. and stronger tempoProbably one of the most important and yet overlooked concepts in the market. The tempo is simply the ‘speed’ at which the market is moving. This is also referred to as confidence. Slow tempo is typical of range bound days where there is lots of responsive activity. Fast tempo occurs when there is initiating activity, and market is breaking out of a range. This is not to say that the market can’t have fast tempo on days when it is rotational or moving between the extremes of a value area. It certainly can. Effective intraday futures trading involves gauging the tempo and knowing that opportunities are fewer and smaller when the tempo is slow. See S.O.H.. If so, target the ONLOvernight Low. A term mostly used for the futures market as it trades almost around the clock. To be precise, in the /ES this would be the lowest price between 4:30pm EST and 9:30am EST the next day. first and then beyond if momentum is strong.

Have a great day,

Peter

ShadowTrader Cumulative Tick

Beef up your "quad" and by putting your tickThe net cumulative tick reading on the NYSE or Nasdaq Composite. This is measured by the number of stocks ticking up minus the number of stocks ticking down at any given moment. It is the least used of the internal indicators but is discussed from time to time. Generally the tick readings are only helpful when they are at extremes such as +1000 on the NYSE to indicate that program trading is ensuing. indicator on steroids!

Learn More