The Market Profile value areas and ShadowTrader Pivots for /ESM19 and /NQM19 Futures are posted free every morning

in the ShadowTrader Swing Trader newsletter.

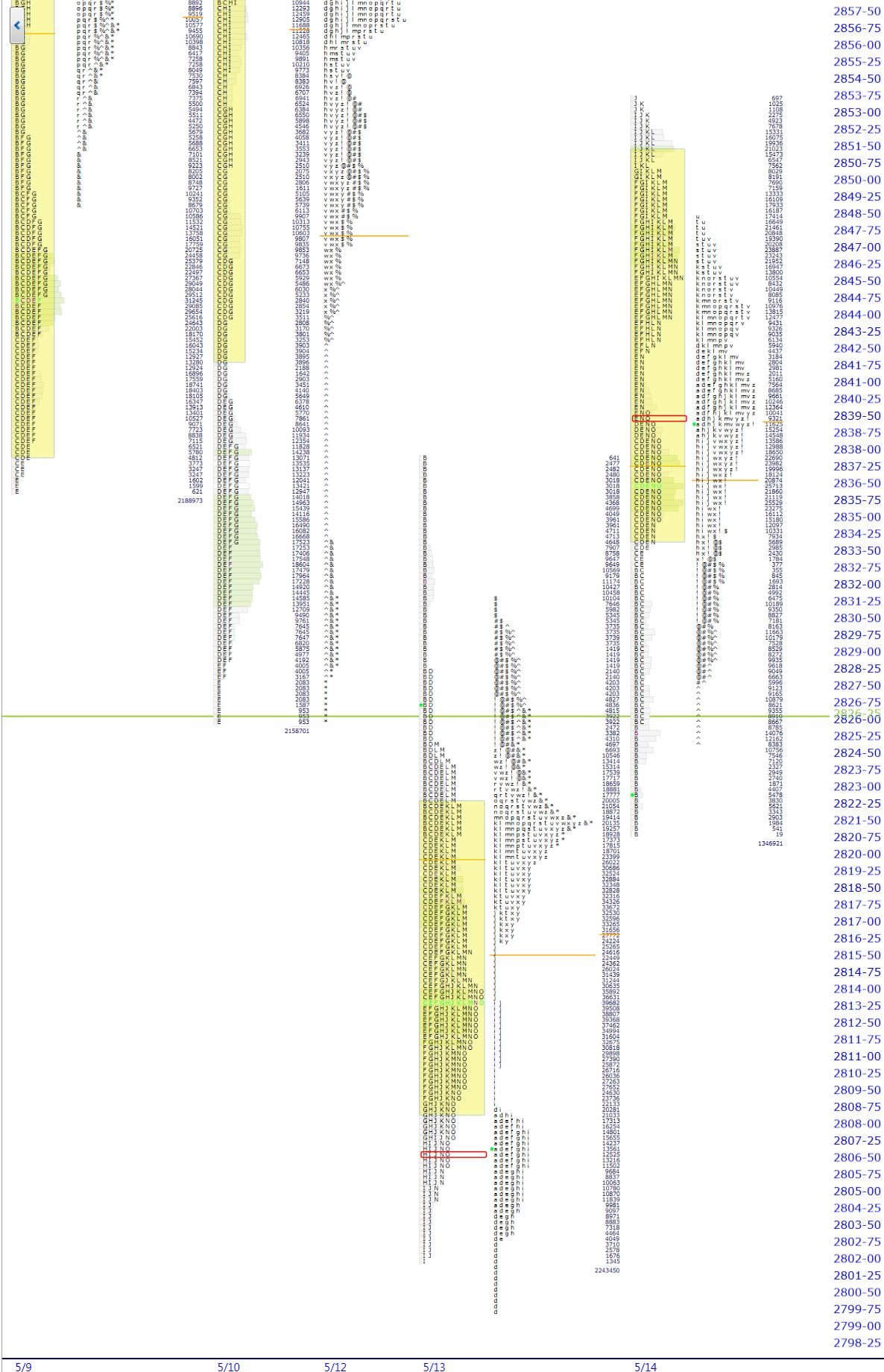

Strong gap back down as poor highs and lows come into play on the market profileA way of reading the market that recognizes either time spent or volume traded at a particular price level. A market profile can be either made up of “TPO’s” (time price opportunities), or volume. TPO’s measure how much time was spent at a particular price, while volume-based market profiles measure how much volume traded at a particular price. Generally, market profile is used in the trading of futures, especially the /ES. ShadowTrader utilizes volume based profiles.. Let’s unpack it together….

WindoTrader 702-800-4628 Speak with Terry about the ShadowTrader discount

| 2834.00 | VALValue Area Low – could be resistant on a rally |

|---|---|

| 2837.25 – 2833.00 | Halfbacks of RTHRegular Trading Hours. In the /ES this means the price action from 9:30am EST to 4:15pm EST only. and O/N sessions respectively. Could also be resistant on a rally |

| 2813.50 | Volume POCPoint of Control, also known as the "fairest price to do business". It is the price level in the /ES where the greatest amount of volume in the prior RTH session traded. ShadowTrader measures the POC using volume but the traditional way is to mark off the widest point of the day's distribution where the most TPO's printed going across from left to right, indicating that that was the price where the most time was spent. It's important to pay attention to both the volume POC and the TPO POC., a good first target for any down move |

| 2800.00 | Known strong support of psychological level |

Decent sized gap of -20.25 currently that is just outside of yesterday’s range but just barely. By the time you receive this report gap rulesGuidelines to follow on any day that the futures open outside of the prior day's RTH range. Only opening outside of range is a true gap and puts gap rules in play. 1. Go with all gaps that don't fill right away. This means that if early trade doesn't start to correct the imbalance, then prices will probably move in the direction of the gap. 2. Larger gaps can often fail to fill on the first day or may fill only partially. 3. If the gap fills (meaning the prior day's RTH high is touched on a gap up or the prior day's RTH low is touched on a gap down) and value cannot get to at least overlapping, then the odds of a late day rally (on a gap up) or late day selloff (on a gap down) increase. 4. Gaps of larger than $20 in the /ES are difficult to trade and should be avoided early in the day as t... More might be in play or might not as prices may move back into range. There is little early indication today as to how prices could react to the opening bell as overnight inventoryA way of measuring overnight activity in the futures market by just noting how much of the overnight activity happens to fall above the prior day's settlement value (4:15pm EST close) and how much falls below. If more activity is above the settlement, then overnight inventory is said to be net long. If more is below, then it is said to be net short. If all of the overnight activity is above the settlement, then it is said to be 100% net long. If all of the activity is below the settlement then it is said to be 100% net short. The overnight inventory situation matters most and has the most impact on early trade when it is skewed 100% in either direction because when the imbalance is very large like that then the odds of an early correction increase greatly. This is due to the fact that most... is very balanced. Furthermore even though we are opening out of balance, we are squarely between the extremes of the last two sessions, both of which were poor.

I would say my overall feel here is that the market is not done selling. The poor lowA poor low is one which lacks excess and is the opposite of an excess low. A poor low will have less than two TPO's of excess at the bottom of a daily range with at least 2-3 columns of TPO's lining up to form a flat looking bottom. It indicates that there are short term or weak handed shorts at that low of day area. We know this because every time prices sell off to the low, they get covered quickly, thus forming the poor low.

The poor low has two forward looking indications. The first is that prices should bounce away from the poor low as there are a number of shorts trapped at poor location. The second is that if the next day or in some subsequent session, the poor low is revisited, then the odds are strong that it will break and move lower. This is called repair as it repairs the ... from 5/13 was simply a response to being oversold. But the poor highA poor high is one which lacks excess and is the opposite of an excess high. A poor high will have less than two TPO's of excess at the top of a daily range with at least 2-3 columns of TPO's lining up to form a flat looking top. It indicates that there are short term or weak handed longs at that high of day area. We know this because every time prices rise to the top, they get sold quickly, thus forming the poor high.

The poor high has two forward looking indications. The first is that prices should back away from the poor high as there are a number of longs trapped at poor location. The second is that if the next day or in some subsequent session, the poor high is revisited, then the odds are strong that it will break and move higher. This is called repair as it repairs the structur... from yesterday gives a bit more information, I believe in that it happened after just one session upwards. You can’t really make the argument that buyers were just exhausted yesterday. I’m going to work within the framework that rallies into yesterday’s range should be sold.

Scenarios

- As we are in the middle of the two ranges, it’s tricky. My tone is bearish from my comments above. Overnight inventoryA way of measuring overnight activity in the futures market by just noting how much of the overnight activity happens to fall above the prior day's settlement value (4:15pm EST close) and how much falls below. If more activity is above the settlement, then overnight inventory is said to be net long. If more is below, then it is said to be net short. If all of the overnight activity is above the settlement, then it is said to be 100% net long. If all of the activity is below the settlement then it is said to be 100% net short. The overnight inventory situation matters most and has the most impact on early trade when it is skewed 100% in either direction because when the imbalance is very large like that then the odds of an early correction increase greatly. This is due to the fact that most... is balanced but also more spiky on the bottom, so an early rise is possible. I would look to fadeWhen a stock moves opposite the direction of its gap on an intraday basis that, especially if it was to move up to the VALValue Area Low.

- I would change my mind about the bias only if I saw a strong opening drive higher than yesterday’s volume POCPoint of Control, also known as the "fairest price to do business". It is the price level in the /ES where the greatest amount of volume in the prior RTH session traded. ShadowTrader measures the POC using volume but the traditional way is to mark off the widest point of the day's distribution where the most TPO's printed going across from left to right, indicating that that was the price where the most time was spent. It's important to pay attention to both the volume POC and the TPO POC. and subsequent acceptanceWhen the market profile begins to build out or develop in a certain area, it is said that the market is accepting those prices. This can be measured either in time spent or amount of volume that is transacted. It is generally understood that ShadowTrader defines acceptance as more of a time dynamic than a volume one. A good rule of thumb is to look for at least two TPO periods to print in the accepted area. The acceptance confirms that a significant amount of market participants are transacting at those levels. Acceptance is the opposite of rejection. More on bullish internalsInternals refers to “market internals” and is a blanket term to collectively describe the advance decline, breadth, tick and cumulative tick..

Have a great day,

Peter