The Market Profile value areas and ShadowTrader Pivots for /ESM19 and /NQM19 Futures are posted free every morning

in the ShadowTrader Swing Trader newsletter.

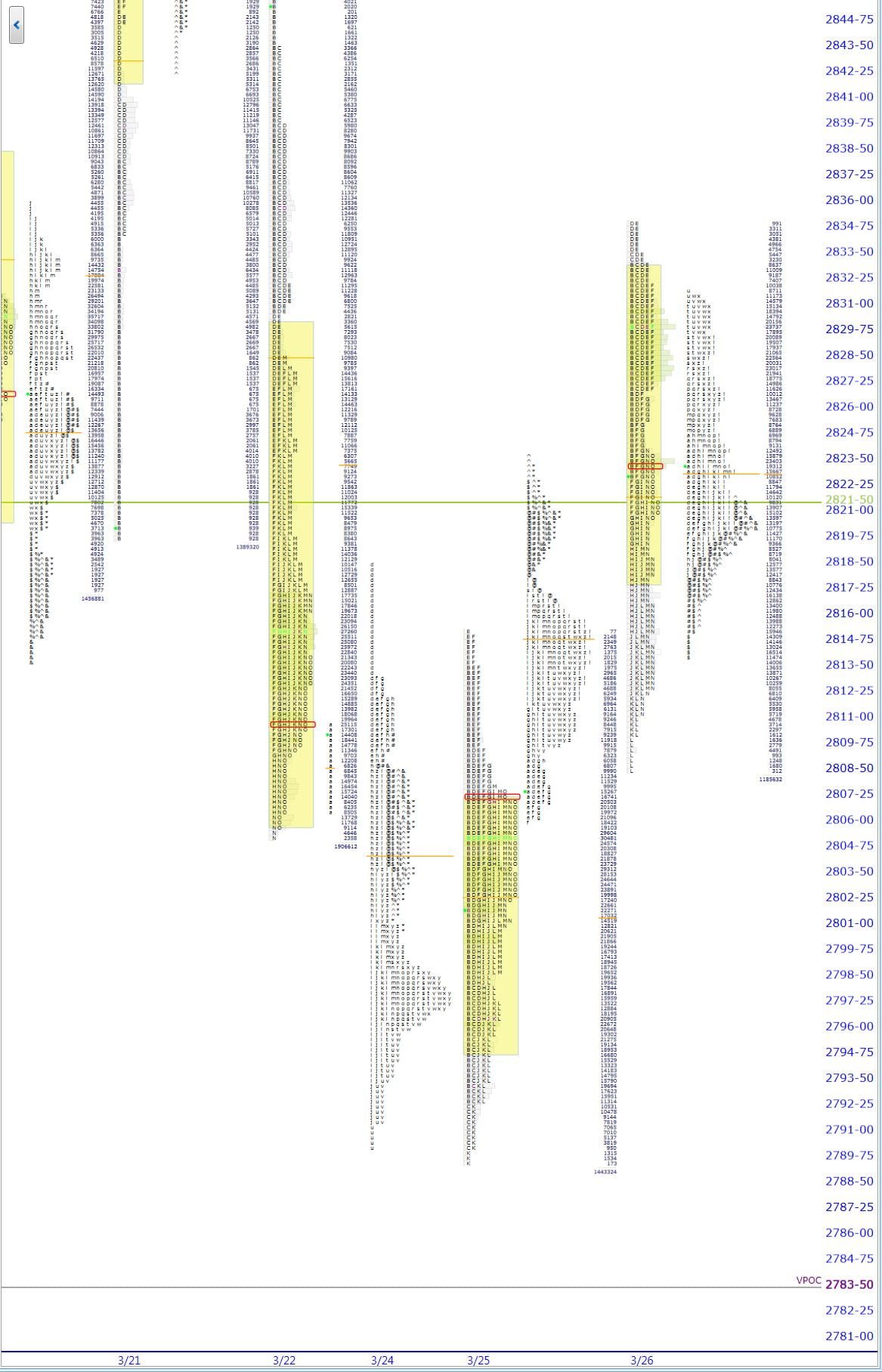

An all over the place day yesterday with gap and hold, then gap and fill, then finding some acceptanceWhen the market profile begins to build out or develop in a certain area, it is said that the market is accepting those prices. This can be measured either in time spent or amount of volume that is transacted. It is generally understood that ShadowTrader defines acceptance as more of a time dynamic than a volume one. A good rule of thumb is to look for at least two TPO periods to print in the accepted area. The acceptance confirms that a significant amount of market participants are transacting at those levels. Acceptance is the opposite of rejection. More within Tuesday’s range, all while leaving a poor highA poor high is one which lacks excess and is the opposite of an excess high. A poor high will have less than two TPO's of excess at the top of a daily range with at least 2-3 columns of TPO's lining up to form a flat looking top. It indicates that there are short term or weak handed longs at that high of day area. We know this because every time prices rise to the top, they get sold quickly, thus forming the poor high.

The poor high has two forward looking indications. The first is that prices should back away from the poor high as there are a number of longs trapped at poor location. The second is that if the next day or in some subsequent session, the poor high is revisited, then the odds are strong that it will break and move higher. This is called repair as it repairs the structur... and an excess lowA low characterized by a number of single prints that ends a move and is at the bottom of a daily market profile distribution. The minimum number of TPO's that is necessary to define an excess low is two, however when the excess has only a few TPO's, it is said to be "lack of material excess". An excess low is the opposite of a poor low, which has no single prints and is flat along the low where the TPO's line up next to each other. on the market profileA way of reading the market that recognizes either time spent or volume traded at a particular price level. A market profile can be either made up of “TPO’s” (time price opportunities), or volume. TPO’s measure how much time was spent at a particular price, while volume-based market profiles measure how much volume traded at a particular price. Generally, market profile is used in the trading of futures, especially the /ES. ShadowTrader utilizes volume based profiles.. Let’s have a closer look….

WindoTrader 702-800-4628 Speak to Terry about the ShadowTrader discount

Futures currently trading flat and very close to halfbackA term for the halfway point between the high and low of any session, could be a day session or an overnight session. On Peter's market profile charts it is always a dark yellow horizontal line at that level.. Overnight inventoryA way of measuring overnight activity in the futures market by just noting how much of the overnight activity happens to fall above the prior day's settlement value (4:15pm EST close) and how much falls below. If more activity is above the settlement, then overnight inventory is said to be net long. If more is below, then it is said to be net short. If all of the overnight activity is above the settlement, then it is said to be 100% net long. If all of the activity is below the settlement then it is said to be 100% net short. The overnight inventory situation matters most and has the most impact on early trade when it is skewed 100% in either direction because when the imbalance is very large like that then the odds of an early correction increase greatly. This is due to the fact that most... is also very balanced. Thus there is little M.G.I.Market Generated Information. to go on right now as to how prices will move from the open because the market is in balance. The entire overnight range is within the RTHRegular Trading Hours. In the /ES this means the price action from 9:30am EST to 4:15pm EST only. range as well. I truly believe that if you start every day with just what we just determined in those first four sentences and nothing else, you will understand the market better and trade it more successfully regardless of your timeframe. Get into the habit. Identify overnight inventoryA way of measuring overnight activity in the futures market by just noting how much of the overnight activity happens to fall above the prior day's settlement value (4:15pm EST close) and how much falls below. If more activity is above the settlement, then overnight inventory is said to be net long. If more is below, then it is said to be net short. If all of the overnight activity is above the settlement, then it is said to be 100% net long. If all of the activity is below the settlement then it is said to be 100% net short. The overnight inventory situation matters most and has the most impact on early trade when it is skewed 100% in either direction because when the imbalance is very large like that then the odds of an early correction increase greatly. This is due to the fact that most... and where the open will be in relation to the prior day’s range first every morning.

Once you’ve done that, then move on to identifying any market profileA way of reading the market that recognizes either time spent or volume traded at a particular price level. A market profile can be either made up of “TPO’s” (time price opportunities), or volume. TPO’s measure how much time was spent at a particular price, while volume-based market profiles measure how much volume traded at a particular price. Generally, market profile is used in the trading of futures, especially the /ES. ShadowTrader utilizes volume based profiles. dynamics and nuances that were part of the prior day’s distribution or any recent prior day’s before as well. You do this because you want to know what is potentially “up ahead” if the market travels in one direction or the other.

That being said, yesterday’s high was poor. Since the market has already completed the move away from the poor highA poor high is one which lacks excess and is the opposite of an excess high. A poor high will have less than two TPO's of excess at the top of a daily range with at least 2-3 columns of TPO's lining up to form a flat looking top. It indicates that there are short term or weak handed longs at that high of day area. We know this because every time prices rise to the top, they get sold quickly, thus forming the poor high.

The poor high has two forward looking indications. The first is that prices should back away from the poor high as there are a number of longs trapped at poor location. The second is that if the next day or in some subsequent session, the poor high is revisited, then the odds are strong that it will break and move higher. This is called repair as it repairs the structur... (both in yesterday’s RTHRegular Trading Hours. In the /ES this means the price action from 9:30am EST to 4:15pm EST only. session and overnight), I would expect that there are increased odds of repairA market profile term for "fixing" profile distributions that are missing parts that would make them complete or more symmetrical. This concept is most often applied to poor highs and poor lows which are profile distributions that lack excess on their endpoints and have two or more TPO's across creating tops or bottoms that look flat. Once a new session trades through these levels then it is as though the current activity was "pasted onto" the prior activity to complete the picture. It should be noted that repair can only occur in an RTH session. Overnight activity that trades through areas of poor RTH structure does not repair that structure. More today. That means that 2835.00 and higher could be in play.

Yesterday’s low was weak. Not poor, weak. It is weak because it is just a couple ticks above the Monday settlement and VAHValue Area High. If prices were to move to that extreme, I would be on the lookout for a further break there.

In both of the past two RTHRegular Trading Hours. In the /ES this means the price action from 9:30am EST to 4:15pm EST only. sessions, the volume POCPoint of Control, also known as the "fairest price to do business". It is the price level in the /ES where the greatest amount of volume in the prior RTH session traded. ShadowTrader measures the POC using volume but the traditional way is to mark off the widest point of the day's distribution where the most TPO's printed going across from left to right, indicating that that was the price where the most time was spent. It's important to pay attention to both the volume POC and the TPO POC. either migrated or held at the upper end of the range. I carry this forward as bullish.

Yesterday’s gap fill went beyond the RTHRegular Trading Hours. In the /ES this means the price action from 9:30am EST to 4:15pm EST only. high and found acceptanceWhen the market profile begins to build out or develop in a certain area, it is said that the market is accepting those prices. This can be measured either in time spent or amount of volume that is transacted. It is generally understood that ShadowTrader defines acceptance as more of a time dynamic than a volume one. A good rule of thumb is to look for at least two TPO periods to print in the accepted area. The acceptance confirms that a significant amount of market participants are transacting at those levels. Acceptance is the opposite of rejection. More within the prior day’s range before rallying back out late in the session. This is less bullish than if the gap had just filled and reversed.

Nasdaq futures are much stronger than S&P futures this morning. When I see that divergence before the bell, coupled with the overnight range within the RTHRegular Trading Hours. In the /ES this means the price action from 9:30am EST to 4:15pm EST only. range and mostly within the VA, I’m readying myself for responsive tradeA responsive trade is a counter-trend trade taken against a specific level. The theory is that when two sided trade is taking place, there will not be enough momentum to push past key levels and buyers or sellers will respond to those areas, essentially pushing prices away from them. This is the opposite of breakout or initiative trade which is more directional in nature and is generally taken in the direction of the prevailing trend. if I see the right tempoProbably one of the most important and yet overlooked concepts in the market. The tempo is simply the ‘speed’ at which the market is moving. This is also referred to as confidence. Slow tempo is typical of range bound days where there is lots of responsive activity. Fast tempo occurs when there is initiating activity, and market is breaking out of a range. This is not to say that the market can’t have fast tempo on days when it is rotational or moving between the extremes of a value area. It certainly can. Effective intraday futures trading involves gauging the tempo and knowing that opportunities are fewer and smaller when the tempo is slow. See S.O.H., internalsInternals refers to “market internals” and is a blanket term to collectively describe the advance decline, breadth, tick and cumulative tick., and lack of confidence. That means that when I look at any stock or futures to daytrade, I am going to draw horizontal and diagonal lines all over it and look to put limit orders up against those lines and play for smaller moves as I am confident that there will not be trending activity. If you can identify the day type early you are miles ahead of the competition.

Now, pursuant to the above paragraph, there might not be responsive tradeA responsive trade is a counter-trend trade taken against a specific level. The theory is that when two sided trade is taking place, there will not be enough momentum to push past key levels and buyers or sellers will respond to those areas, essentially pushing prices away from them. This is the opposite of breakout or initiative trade which is more directional in nature and is generally taken in the direction of the prevailing trend.. The market might just surprise and have a trending day. That’s fine, but I know that in order for that to happen, a lot of planets need to line up perfectly. If they do, then I am ready for that as well. I know that in order to run all the way to one side of yesterday’s RTHRegular Trading Hours. In the /ES this means the price action from 9:30am EST to 4:15pm EST only. range and higher or lower, breadthDescribing market breadth in terms of volume for the NYSE or the Nasdaq. This is a figure composed of the net sum of the amount of volume flowing into up stocks minus the amount of volume flowing into down stocks at any given moment in each of the two respective markets. Often the advance decline line is also referred to as “breadth”, but ShadowTrader differentiates between the two by using two separate terms. Generally, the Breadth is more important than the advance decline line. has to read a certain way, the a/d lines have to read a certain way, and the NYSE tickThe net cumulative tick reading on the NYSE or Nasdaq Composite. This is measured by the number of stocks ticking up minus the number of stocks ticking down at any given moment. It is the least used of the internal indicators but is discussed from time to time. Generally the tick readings are only helpful when they are at extremes such as +1000 on the NYSE to indicate that program trading is ensuing. has to be skewed firmly above or below zero with little exception.

Again, if you can identify what is actually going on (not what you want to happen because of your current portfolio), then you are almost guaranteed to succeed. For some that will mean making money daytrading and knowing when to stay out of certain plays and when to step on the gas and maximize gains because the environment is right. For others it will mean highly improved entry prices on longer term trades that will add up to huge differences in p&l at the end of the year. Whatever your timeframe, understanding market profileA way of reading the market that recognizes either time spent or volume traded at a particular price level. A market profile can be either made up of “TPO’s” (time price opportunities), or volume. TPO’s measure how much time was spent at a particular price, while volume-based market profiles measure how much volume traded at a particular price. Generally, market profile is used in the trading of futures, especially the /ES. ShadowTrader utilizes volume based profiles. is the key to better trading.

Have a wonderful day,

-peter