The Market Profile value areas and ShadowTrader Pivots for /ESH19 and /NQH19 Futures are posted free every morning

in the ShadowTrader Swing Trader newsletter.

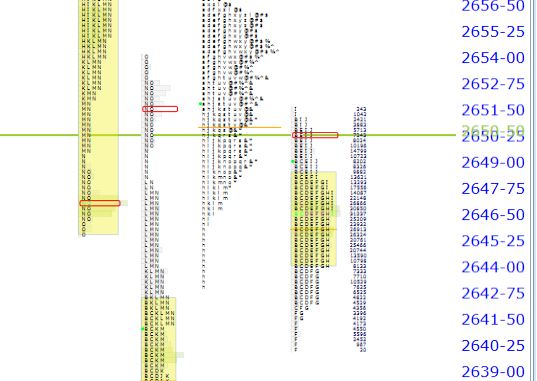

Market profileA way of reading the market that recognizes either time spent or volume traded at a particular price level. A market profile can be either made up of “TPO’s” (time price opportunities), or volume. TPO’s measure how much time was spent at a particular price, while volume-based market profiles measure how much volume traded at a particular price. Generally, market profile is used in the trading of futures, especially the /ES. ShadowTrader utilizes volume based profiles. distributions in a tight wind as a multi-day balance area is building pressure. Let’s have a closer look….

WindoTrader (702) 800-4628 Speak with Terry and ask about the ShadowTrader discount

Sometimes erratic price action can take your attention away from contextual signposts that are far more important than the sidewalk tout of price. Don’t let that happen to you. When leering at the marketIf ShadowTrader is initiating a position “at the market” it simply means that limit orders are not being used and the position is being entered with no regard to price. This is used much more often on more liquid Nasdaq issues.<market profileA way of reading the market that recognizes either time spent or volume traded at a particular price level. A market profile can be either made up of “TPO’s” (time price opportunities), or volume. TPO’s measure how much time was spent at a particular price, while volume-based market profiles measure how much volume traded at a particular price. Generally, market profile is used in the trading of futures, especially the /ES. ShadowTrader utilizes volume based profiles. chart above, keep your focus on the gaps below us and their failure to fill, even partially. We have had no solid advancement or expansion of range recently, but we haven’t found any new money sellers either. The market is clearly in balance for the last five (if you count the half day) sessions.

As such balance rulesWhen a market is in balance, meaning that it is consolidating in a tight range of two or more days, then balance rules apply. The balance rules are nothing more than a framework of scenarios that could happen which prepare us for every possible outcome.

The possible outcomes and how to trade them are:

1. Look above and go. Prices move above the high of balance and find acceptance and continue higher. The target should be double the balance area.

2. Look above and fail. Prices move above the balance high but fail to find acceptance and reverse back into the balance area. This is now a short with a stop above the high just outside of balance that was recently made, with a target to the opposing low end of the balance area.

3. Look below and go. Prices move below the ... apply and should be kept in mind. As we know, a breakout of balance in either direction requires finding acceptanceWhen the market profile begins to build out or develop in a certain area, it is said that the market is accepting those prices. This can be measured either in time spent or amount of volume that is transacted. It is generally understood that ShadowTrader defines acceptance as more of a time dynamic than a volume one. A good rule of thumb is to look for at least two TPO periods to print in the accepted area. The acceptance confirms that a significant amount of market participants are transacting at those levels. Acceptance is the opposite of rejection. More above or below the extreme of the range. On the downside, this is pretty clear where that would be at 2763.00 which is the top of the gap. On the upside, it’s less clear because we have an RTHRegular Trading Hours. In the /ES this means the price action from 9:30am EST to 4:15pm EST only. excess highA high characterized by a number of single prints that ends a move and is at the top of a daily market profile distribution. The minimum number of TPO's that is necessary to define an excess high is two, however when the excess has only a few TPO's, it is said to be "lack of material excess". An excess high is the opposite of a poor high, which has no single prints and is flat along the high where the TPO's line up next to each other. of 2790.75 (2/20), but also an overnight high at 2798.00 which occurred on the same evening. Which one decides the breakout? Good question. I would say take it piecemeal, one by one. If we find acceptanceWhen the market profile begins to build out or develop in a certain area, it is said that the market is accepting those prices. This can be measured either in time spent or amount of volume that is transacted. It is generally understood that ShadowTrader defines acceptance as more of a time dynamic than a volume one. A good rule of thumb is to look for at least two TPO periods to print in the accepted area. The acceptance confirms that a significant amount of market participants are transacting at those levels. Acceptance is the opposite of rejection. More above the RTHRegular Trading Hours. In the /ES this means the price action from 9:30am EST to 4:15pm EST only. high, then target that ONHOvernight High. A term mostly used in describing the futures market which has an overnight session and trades almost around the clock. To be precise, in the /ES this is the high made between 4:30pm EST and 9:30am EST the next day., then look for acceptanceWhen the market profile begins to build out or develop in a certain area, it is said that the market is accepting those prices. This can be measured either in time spent or amount of volume that is transacted. It is generally understood that ShadowTrader defines acceptance as more of a time dynamic than a volume one. A good rule of thumb is to look for at least two TPO periods to print in the accepted area. The acceptance confirms that a significant amount of market participants are transacting at those levels. Acceptance is the opposite of rejection. More/context above the ONHOvernight High. A term mostly used in describing the futures market which has an overnight session and trades almost around the clock. To be precise, in the /ES this is the high made between 4:30pm EST and 9:30am EST the next day. to confirm the breakout. On a move above the ONHOvernight High. A term mostly used in describing the futures market which has an overnight session and trades almost around the clock. To be precise, in the /ES this is the high made between 4:30pm EST and 9:30am EST the next day., I believe the market will be targeting 2815.00 which is the upper end of the box range that preceded the move to the December lows. If either of these fails back into range and below either of those key levels, consider putting on a short which would target the lower end of the range at the top of the gap.

As for details on how today’s open could unfold, let’s get into the nuances….

Overnight inventoryA way of measuring overnight activity in the futures market by just noting how much of the overnight activity happens to fall above the prior day's settlement value (4:15pm EST close) and how much falls below. If more activity is above the settlement, then overnight inventory is said to be net long. If more is below, then it is said to be net short. If all of the overnight activity is above the settlement, then it is said to be 100% net long. If all of the activity is below the settlement then it is said to be 100% net short. The overnight inventory situation matters most and has the most impact on early trade when it is skewed 100% in either direction because when the imbalance is very large like that then the odds of an early correction increase greatly. This is due to the fact that most... is pretty balanced with a current gap of only 6.75. As of this moment, gap rulesGuidelines to follow on any day that the futures open outside of the prior day's RTH range. Only opening outside of range is a true gap and puts gap rules in play. 1. Go with all gaps that don't fill right away. This means that if early trade doesn't start to correct the imbalance, then prices will probably move in the direction of the gap. 2. Larger gaps can often fail to fill on the first day or may fill only partially. 3. If the gap fills (meaning the prior day's RTH high is touched on a gap up or the prior day's RTH low is touched on a gap down) and value cannot get to at least overlapping, then the odds of a late day rally (on a gap up) or late day selloff (on a gap down) increase. 4. Gaps of larger than $20 in the /ES are difficult to trade and should be avoided early in the day as t... More do not apply as we are trading just inside of yesterday’s RTHRegular Trading Hours. In the /ES this means the price action from 9:30am EST to 4:15pm EST only. range. A true gapThere is a lot of discussion as to what constitutes a gap. Is it measured to the prior day's close, or to the prior day's high or low? Here at ShadowTrader, we believe that it is always and only to a prior day's high or low, thus creating a true gap or space on the chart between one day and the next. Thus a true gap is one that has price opening completely outside of the prior day's range (either above the high or below the low) and anything else is just a gap that has far less import. As a gap is a "reordering of thinking", only a true gap really changes the tone and creates opportunity to trade earlier (near the open) rather than later. More is one that is completely outside of the prior day’s range.

The overnight distribution has a decent 45 degree lineThe 45 degree line is an interesting market profile nuance. It occurs when a 45 degree line can be drawn from the lowest point of a distribution to its widest point (TPO POC). This is a sign that sellers have painted themselves into a corner near the lows of the session and creates potential for an upward reversal in the next session. As less and less time is spent the closer you get to the low of the session, sellers are essentially initiating shorts at less and less value. 45 degree line lows should be assumed to be secure until they are breached. The pattern is generally only noted in RTH sessions but they have shown to be relatively reliable signals in overnight sessions as well. The obvious question is always whether or not the 45 degree line can be drawn in from the high of the day t... from it’s low to widest point which indicates some support in that area. Watch 2772.25 this morning as it represents that widest part with the tapering of time below it. I believe the market should hold this area if it is to advance a bit today. Additionally, note that yesterday’s RTHRegular Trading Hours. In the /ES this means the price action from 9:30am EST to 4:15pm EST only. low was poor which is also indicative of a lack of sellers and that camp “painting itself into a corner” a little bit at yesterday’s low. Again, I am of the opinion that these areas should not be tested today. A breach of them would be an important nugget of information.

On any strength, 2785.00 is a VPOCVirgin Point of Control. This is a point of control level that has not yet been tested (traded through) during an RTH session. If the POC gets tested during an overnight session, it does not count and remains "virgin" until it happens during a day session. just above us and would be a proper first target for any longs. Clearing of that level starts to setup the possible breakout of balance.

Overall, remember that while inside of a balance area responsive tradeA responsive trade is a counter-trend trade taken against a specific level. The theory is that when two sided trade is taking place, there will not be enough momentum to push past key levels and buyers or sellers will respond to those areas, essentially pushing prices away from them. This is the opposite of breakout or initiative trade which is more directional in nature and is generally taken in the direction of the prevailing trend. is usually the best M.O. Dalton often uses the phrase, “traders do what works, until it doesn’t”. Keep that in mind today as you navigate the balance area and possible breakout.

The Best Market Profile Software on the Planet (mic drop)

Add the 3rd dimension to your charting with WindoTrader, the industry leader in Market ProfileA way of reading the market that recognizes either time spent or volume traded at a particular price level. A market profile can be either made up of “TPO’s” (time price opportunities), or volume. TPO’s measure how much time was spent at a particular price, while volume-based market profiles measure how much volume traded at a particular price. Generally, market profile is used in the trading of futures, especially the /ES. ShadowTrader utilizes volume based profiles. software

10% off ShadowTrader DiscountHave a nice day,

-peter