The Market Profile value areas and ShadowTrader Pivots for /ESH19 and /NQH19 Futures are posted free every morning

in the ShadowTrader Swing Trader newsletter.

Good Morning

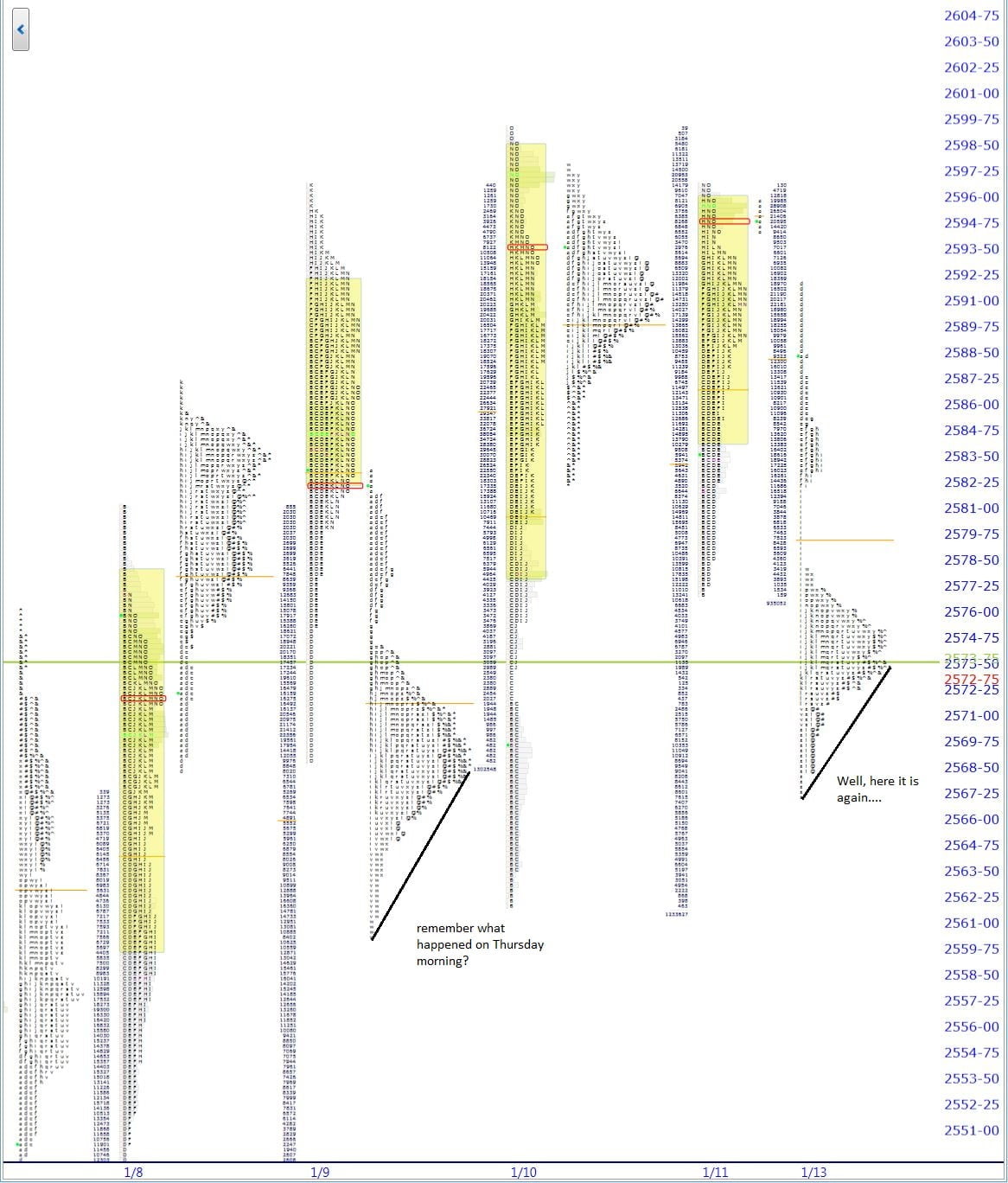

Good sized gap down which is slated to open just below Friday’s RTHRegular Trading Hours. In the /ES this means the price action from 9:30am EST to 4:15pm EST only. range creating a small gap on the chart. As we measure gaps only from prior lows or highs and not from the prior settlement, note that the actual distance from Friday’s RTHRegular Trading Hours. In the /ES this means the price action from 9:30am EST to 4:15pm EST only. low is just a couple of ticks even though we are about 20 handles below the settlement. If by the time the bell rings we are below the RTHRegular Trading Hours. In the /ES this means the price action from 9:30am EST to 4:15pm EST only. low then gap rulesGuidelines to follow on any day that the futures open outside of the prior day's RTH range. Only opening outside of range is a true gap and puts gap rules in play. 1. Go with all gaps that don't fill right away. This means that if early trade doesn't start to correct the imbalance, then prices will probably move in the direction of the gap. 2. Larger gaps can often fail to fill on the first day or may fill only partially. 3. If the gap fills (meaning the prior day's RTH high is touched on a gap up or the prior day's RTH low is touched on a gap down) and value cannot get to at least overlapping, then the odds of a late day rally (on a gap up) or late day selloff (on a gap down) increase. 4. Gaps of larger than $20 in the /ES are difficult to trade and should be avoided early in the day as t... More will apply, if we are within Friday’s RTHRegular Trading Hours. In the /ES this means the price action from 9:30am EST to 4:15pm EST only. range, then they will not.

I’ve marked off the 45 degree lineThe 45 degree line is an interesting market profile nuance. It occurs when a 45 degree line can be drawn from the lowest point of a distribution to its widest point (TPO POC). This is a sign that sellers have painted themselves into a corner near the lows of the session and creates potential for an upward reversal in the next session. As less and less time is spent the closer you get to the low of the session, sellers are essentially initiating shorts at less and less value. 45 degree line lows should be assumed to be secure until they are breached. The pattern is generally only noted in RTH sessions but they have shown to be relatively reliable signals in overnight sessions as well. The obvious question is always whether or not the 45 degree line can be drawn in from the high of the day t... in the overnight distribution. Note that the Wednesday evening pattern was the same and the market rallied early once it was apparent that the ONLOvernight Low. A term mostly used for the futures market as it trades almost around the clock. To be precise, in the /ES this would be the lowest price between 4:30pm EST and 9:30am EST the next day. was not going to be taken. Today could be a similar turn of events as the pattern is about the same. As always, I give the caveat that any pattern in an overnight distribution does not have the same import as a day timeframe one, but should always be heeded. I got a ton of emails on Thursday of last week from traders who held off on initiating shorts because of my writing. Losses saved are money earned.

In looking at the last three RTHRegular Trading Hours. In the /ES this means the price action from 9:30am EST to 4:15pm EST only. sessions, almost all of the highs are pretty poor, culminating in Friday which is an actual poor highA poor high is one which lacks excess and is the opposite of an excess high. A poor high will have less than two TPO's of excess at the top of a daily range with at least 2-3 columns of TPO's lining up to form a flat looking top. It indicates that there are short term or weak handed longs at that high of day area. We know this because every time prices rise to the top, they get sold quickly, thus forming the poor high.

The poor high has two forward looking indications. The first is that prices should back away from the poor high as there are a number of longs trapped at poor location. The second is that if the next day or in some subsequent session, the poor high is revisited, then the odds are strong that it will break and move higher. This is called repair as it repairs the structur.... I believe the current gap down has everything to do with that. As with any poor highA poor high is one which lacks excess and is the opposite of an excess high. A poor high will have less than two TPO's of excess at the top of a daily range with at least 2-3 columns of TPO's lining up to form a flat looking top. It indicates that there are short term or weak handed longs at that high of day area. We know this because every time prices rise to the top, they get sold quickly, thus forming the poor high.

The poor high has two forward looking indications. The first is that prices should back away from the poor high as there are a number of longs trapped at poor location. The second is that if the next day or in some subsequent session, the poor high is revisited, then the odds are strong that it will break and move higher. This is called repair as it repairs the structur... or low, the first move is always the counter move as the weak handed longs trapped at poor location liquidate. These counter moves are usually short lived and the highs are then repaired. As long as the ONLOvernight Low. A term mostly used for the futures market as it trades almost around the clock. To be precise, in the /ES this would be the lowest price between 4:30pm EST and 9:30am EST the next day. at 2567.25 holds in today’s RTHRegular Trading Hours. In the /ES this means the price action from 9:30am EST to 4:15pm EST only. trade, that is the scenario that I will expect. If there is acceptanceWhen the market profile begins to build out or develop in a certain area, it is said that the market is accepting those prices. This can be measured either in time spent or amount of volume that is transacted. It is generally understood that ShadowTrader defines acceptance as more of a time dynamic than a volume one. A good rule of thumb is to look for at least two TPO periods to print in the accepted area. The acceptance confirms that a significant amount of market participants are transacting at those levels. Acceptance is the opposite of rejection. More below the ONLOvernight Low. A term mostly used for the futures market as it trades almost around the clock. To be precise, in the /ES this would be the lowest price between 4:30pm EST and 9:30am EST the next day., then that theory is negated and the tone may start to change.

The VPOCVirgin Point of Control. This is a point of control level that has not yet been tested (traded through) during an RTH session. If the POC gets tested during an overnight session, it does not count and remains "virgin" until it happens during a day session. at 2605.75 which is at the top of the chart is from the 12/13 session and is still valid as it has yet to be tested. A repairA market profile term for "fixing" profile distributions that are missing parts that would make them complete or more symmetrical. This concept is most often applied to poor highs and poor lows which are profile distributions that lack excess on their endpoints and have two or more TPO's across creating tops or bottoms that look flat. Once a new session trades through these levels then it is as though the current activity was "pasted onto" the prior activity to complete the picture. It should be noted that repair can only occur in an RTH session. Overnight activity that trades through areas of poor RTH structure does not repair that structure. More of the poor highs (should it come to pass) should target this level.

In a nutshell…

-The market is short term overbought and the last three highs indicate some “crowding of the plate” at the top. As such we are seeing some overnight liquidation. As of now there is little evidence that the top is in as there is no true excess highA high characterized by a number of single prints that ends a move and is at the top of a daily market profile distribution. The minimum number of TPO's that is necessary to define an excess high is two, however when the excess has only a few TPO's, it is said to be "lack of material excess". An excess high is the opposite of a poor high, which has no single prints and is flat along the high where the TPO's line up next to each other. and valueThis value has nothing to do with valuation. It denotes prices that are "fair". Fair in this sense means a price that is common to a lot of participants. An item that you buy once per week in a store at a price that doesn't fluctuate has a "fair price". You can express this by a formula Value = Price + Time or Value = Price + Volume Either of the above are valid ways of expressing value. In the first equation, value is defined by price staying the same for a long period of time. In the futures market, this would be an area that is revisted a lot during a particular session or multiple sessions. The point of control is the price level where the most amount of time was spent during an RTH session. James Dalton refers to this level as "the fairest price to do business". Using vo... More has been unchanged for three sessions at the top of a large move. The up auction could end this way but the odds don’t favor it.

-The 45 degree lineThe 45 degree line is an interesting market profile nuance. It occurs when a 45 degree line can be drawn from the lowest point of a distribution to its widest point (TPO POC). This is a sign that sellers have painted themselves into a corner near the lows of the session and creates potential for an upward reversal in the next session. As less and less time is spent the closer you get to the low of the session, sellers are essentially initiating shorts at less and less value. 45 degree line lows should be assumed to be secure until they are breached. The pattern is generally only noted in RTH sessions but they have shown to be relatively reliable signals in overnight sessions as well. The obvious question is always whether or not the 45 degree line can be drawn in from the high of the day t... in the overnight trade is important and points to sellers painting themselves into a corner which usually ends in a counter move. Again, the ONLOvernight Low. A term mostly used for the futures market as it trades almost around the clock. To be precise, in the /ES this would be the lowest price between 4:30pm EST and 9:30am EST the next day. at 2567.25 is the key downside reference. Holding above it in today’s session will result in short covering back into the three day range, movement below would be more bearish and start to change the tone.

This blog comes out at 9am every day and is available for $20 per month HERE.

ShadowTrader Tape Reader

Provides an essential edge for successful day trading in both stocks and futures contracts. A thinkorswim add on study that can actually “read the tape” and tell you how much is being traded at bid vs offer.

Learn MoreHave a nice day,

-peter