The Market Profile value areas and ShadowTrader Pivots for /ESM19 and /NQM19 Futures are posted free every morning

in the ShadowTrader Swing Trader newsletter.

Strong gap following a strong close yesterday, leaving yet another true gapThere is a lot of discussion as to what constitutes a gap. Is it measured to the prior day's close, or to the prior day's high or low? Here at ShadowTrader, we believe that it is always and only to a prior day's high or low, thus creating a true gap or space on the chart between one day and the next. Thus a true gap is one that has price opening completely outside of the prior day's range (either above the high or below the low) and anything else is just a gap that has far less import. As a gap is a "reordering of thinking", only a true gap really changes the tone and creates opportunity to trade earlier (near the open) rather than later. More on the market profileA way of reading the market that recognizes either time spent or volume traded at a particular price level. A market profile can be either made up of “TPO’s” (time price opportunities), or volume. TPO’s measure how much time was spent at a particular price, while volume-based market profiles measure how much volume traded at a particular price. Generally, market profile is used in the trading of futures, especially the /ES. ShadowTrader utilizes volume based profiles. chart. That and much more in today’s edition of the Peter’s Premarket Perspective beginning right now!

Mouse over Futures/Market Profile tab on site, select WindoTrader market profileA way of reading the market that recognizes either time spent or volume traded at a particular price level. A market profile can be either made up of “TPO’s” (time price opportunities), or volume. TPO’s measure how much time was spent at a particular price, while volume-based market profiles measure how much volume traded at a particular price. Generally, market profile is used in the trading of futures, especially the /ES. ShadowTrader utilizes volume based profiles. software

In this weekend’s video I’m going to be discussing the three main factors that confirm that a market is in a melt up. As always, I give preference to paying customers so I’m going to discuss this with you here in this forum right now.

How to know that you are in a melt up:

1. The market makes higher highs every day and rarely makes lower lows. If it doesn’t make a higher high it still often fails to make a lower low or does so and then rejects price out of a prior day’s range quickly and builds valueThis value has nothing to do with valuation. It denotes prices that are "fair". Fair in this sense means a price that is common to a lot of participants. An item that you buy once per week in a store at a price that doesn't fluctuate has a "fair price". You can express this by a formula Value = Price + Time or Value = Price + Volume Either of the above are valid ways of expressing value. In the first equation, value is defined by price staying the same for a long period of time. In the futures market, this would be an area that is revisted a lot during a particular session or multiple sessions. The point of control is the price level where the most amount of time was spent during an RTH session. James Dalton refers to this level as "the fairest price to do business". Using vo... More unchanged.

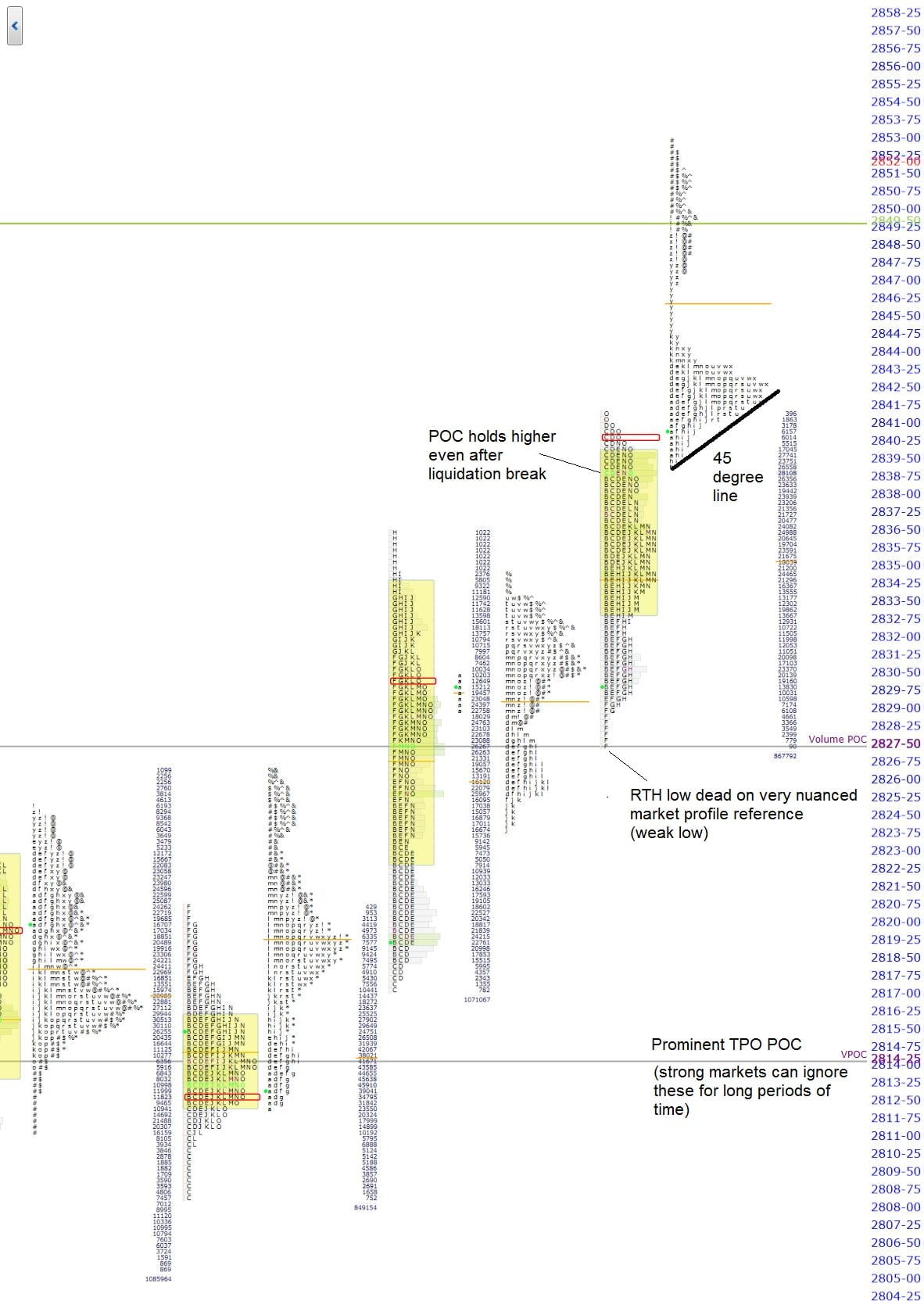

2. The only declines are liquidation breaks which happen once every few days and are short lived. These breaks strengthen the market by taking potential sellers out and are often the real reason for strength in the near future just after they happen.

3. Pullbacks are often to very mechanical and visual references, often market profileA way of reading the market that recognizes either time spent or volume traded at a particular price level. A market profile can be either made up of “TPO’s” (time price opportunities), or volume. TPO’s measure how much time was spent at a particular price, while volume-based market profiles measure how much volume traded at a particular price. Generally, market profile is used in the trading of futures, especially the /ES. ShadowTrader utilizes volume based profiles. based.

Let’s dissect each of these factors a bit further. Number one is kind of obvious. A market that is melting up, has to be going up and doing so pretty much every day. The key is the higher highs and failure of lower lows which are proof of a one-sided market.

Numbers two and three are more nuanced and probably not known to the majority of traders. I am assuming that most everyone who reads this blog daily is an active trader and thus knows that the market has been having small liquidation breaks for some time now. Yesterday’s 11am EST move was a perfect example. Some Brexit nonsense hit the wires and the market went into LIFO mode. That’s “last in first out” where those with the poorest trade location (and also shortest timeframe outlook) hit the panic button. When they were finished, the market resumed it’s rally, and returned into beast mode (I think the kids call this sicko mode nowadays).

The third factor also happened yesterday. The aforementioned liquidation breakA sudden selloff in the market that has the following characteristics:

-Often happens very early or late in the day

-Comes out of a pattern that doesn’t suggest such a break should occur

-Has no definitive catalyst or news that drives it

-Has much faster tempo than the one that has already been established

-Is often short-lived and will retrace 100% soon after or the next day

A liquidation break happens when short term traders get overly long and all panic out at once. It is different from a stronger, more lasting correction in that there are usually only very short timeframe players involved, usually those who got most recently long at poor location. stopped dead on the volume POCPoint of Control, also known as the "fairest price to do business". It is the price level in the /ES where the greatest amount of volume in the prior RTH session traded. ShadowTrader measures the POC using volume but the traditional way is to mark off the widest point of the day's distribution where the most TPO's printed going across from left to right, indicating that that was the price where the most time was spent. It's important to pay attention to both the volume POC and the TPO POC. of the prior day. This is a very nuanced and mechanical, visual trading level that only momentum traders would pay attention to. If you ask me, the majority of them don’t even know they are doing it, it’s just the way prices act when short term money takes prices back down to areas of high volume. In that type of environment it’s the end of the move. When you see these very exacting lows and highs, know that momentum traders are in control. As my mentor in the market profileA way of reading the market that recognizes either time spent or volume traded at a particular price level. A market profile can be either made up of “TPO’s” (time price opportunities), or volume. TPO’s measure how much time was spent at a particular price, while volume-based market profiles measure how much volume traded at a particular price. Generally, market profile is used in the trading of futures, especially the /ES. ShadowTrader utilizes volume based profiles. James Dalton has said many times, traders do what works until it doesn’t. I believe the key word in that phrase is “traders”. A trader is very different from a long term investor.

Ok, cut the crap and just tell me what I need to know in order to make money TODAY:

–We are currently trading on a true gapThere is a lot of discussion as to what constitutes a gap. Is it measured to the prior day's close, or to the prior day's high or low? Here at ShadowTrader, we believe that it is always and only to a prior day's high or low, thus creating a true gap or space on the chart between one day and the next. Thus a true gap is one that has price opening completely outside of the prior day's range (either above the high or below the low) and anything else is just a gap that has far less import. As a gap is a "reordering of thinking", only a true gap really changes the tone and creates opportunity to trade earlier (near the open) rather than later. More of +9.25, gap rulesGuidelines to follow on any day that the futures open outside of the prior day's RTH range. Only opening outside of range is a true gap and puts gap rules in play. 1. Go with all gaps that don't fill right away. This means that if early trade doesn't start to correct the imbalance, then prices will probably move in the direction of the gap. 2. Larger gaps can often fail to fill on the first day or may fill only partially. 3. If the gap fills (meaning the prior day's RTH high is touched on a gap up or the prior day's RTH low is touched on a gap down) and value cannot get to at least overlapping, then the odds of a late day rally (on a gap up) or late day selloff (on a gap down) increase. 4. Gaps of larger than $20 in the /ES are difficult to trade and should be avoided early in the day as t... More are in play.

–There has been a new swing high made in last night’s Globex session at 2853.00. This is your upside reference. Early liquidation breaks usually occur when ONH’s on gap days are not taken out within the first 30 minutes of trade. Frankly, in this market don’t even bother with trying to fadeWhen a stock moves opposite the direction of its gap on an intraday basis, the odds are not with you.

–Liquidation breaks like yesterday’s often take more than one day for shorts to cover. This is the real reason that the market is gapping this morning. I have observed many times that it often can set the tone for the next day’s strength and even further days after that. I can’t prove this but I believe that shorts tend to all cover way too late.

–The 45 degree lineThe 45 degree line is an interesting market profile nuance. It occurs when a 45 degree line can be drawn from the lowest point of a distribution to its widest point (TPO POC). This is a sign that sellers have painted themselves into a corner near the lows of the session and creates potential for an upward reversal in the next session. As less and less time is spent the closer you get to the low of the session, sellers are essentially initiating shorts at less and less value. 45 degree line lows should be assumed to be secure until they are breached. The pattern is generally only noted in RTH sessions but they have shown to be relatively reliable signals in overnight sessions as well. The obvious question is always whether or not the 45 degree line can be drawn in from the high of the day t... on the overnight distribution is noteworthy. As with all 45 degree lines, expect that its low “should” not be taken out. A breach of that ONLOvernight Low. A term mostly used for the futures market as it trades almost around the clock. To be precise, in the /ES this would be the lowest price between 4:30pm EST and 9:30am EST the next day. and acceptanceWhen the market profile begins to build out or develop in a certain area, it is said that the market is accepting those prices. This can be measured either in time spent or amount of volume that is transacted. It is generally understood that ShadowTrader defines acceptance as more of a time dynamic than a volume one. A good rule of thumb is to look for at least two TPO periods to print in the accepted area. The acceptance confirms that a significant amount of market participants are transacting at those levels. Acceptance is the opposite of rejection. More within yesterday’s RTHRegular Trading Hours. In the /ES this means the price action from 9:30am EST to 4:15pm EST only. range might change the tone a bit.

The market may be starting to price in some good news (read: ratcheting the dot plot down to 1 or 0 hikes in 2019) that it is expecting tomorrow afternoon at 2pm EST when the FOMC holds their monster truck rally. The chances of a hike tomorrow are slim to none as evidenced HERE. When you click on that link, go out to all the meetings for the rest of the year and see how the Fed Funds futures are already assuming no hikes at all this year. If so, expect the market to follow on higher as monetary policy is the biggest driver, bar none.

Have a great day,

-peter