The Market Profile value areas and ShadowTrader Pivots for /ESZ18 and /NQZ18 Futures are posted free every morning

in the ShadowTrader Swing Trader newsletter.

Good Morning

WindoTrader

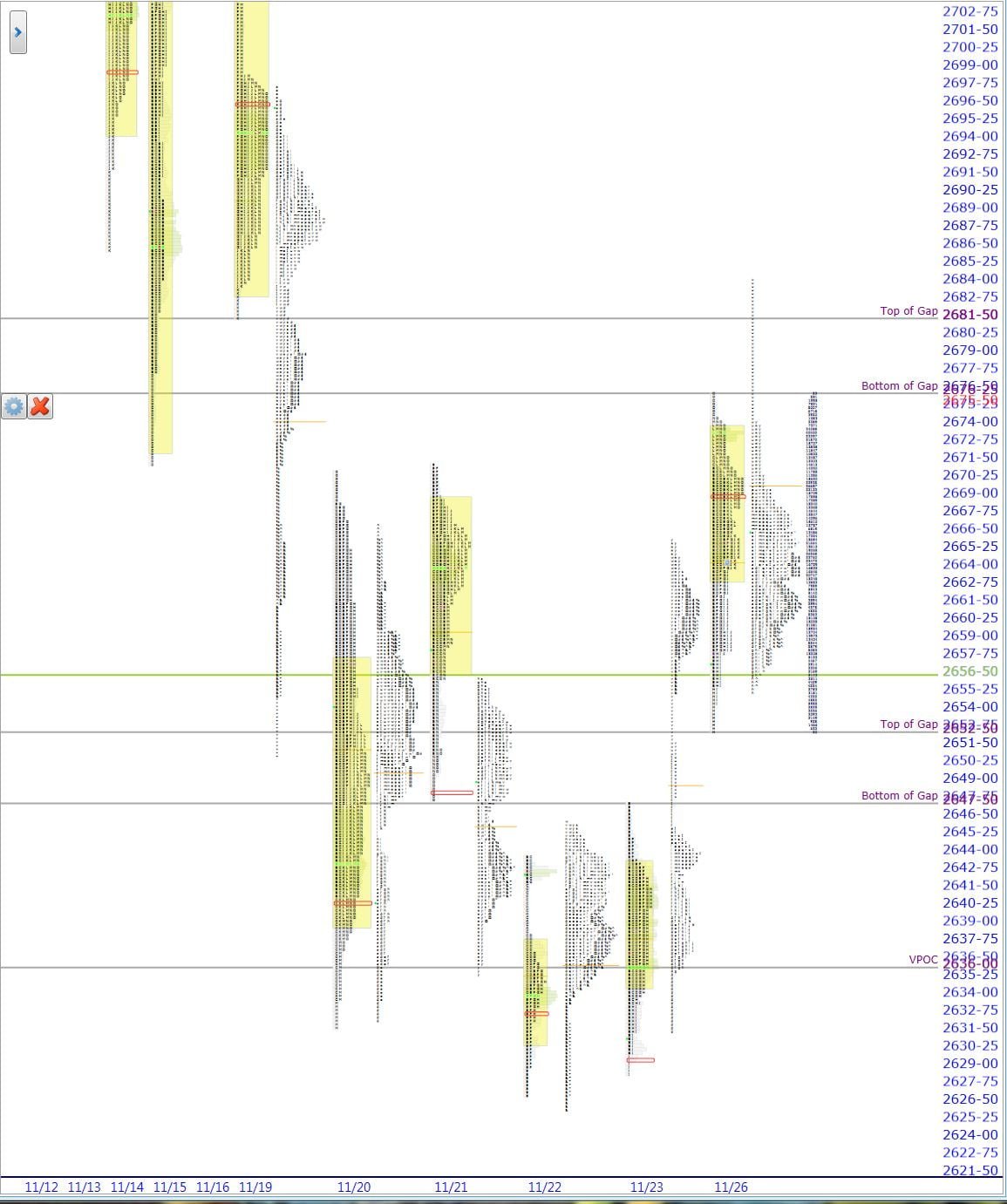

A gap and hold was moving definitively towards the 2680 gap fill area when more tariff talk out of nowhere scuttled bulls ambitions for the umpteenth time. The gap was filled on a spikeA set of single prints that are created in the last 30 minute session of the day which form at the top or bottom of a range. move overnight but that doesn’t count towards filling the gap.

Yesterday’s action also left a gap below us which has resulted in the rare awkward turtle pattern where there is a gap above yesterday’s range and a gap below. Which one will fill, we don’t know! Day timeframe hard row to hoe, ShadowTrader is real and never faux! (insert beatbox sounds here).

The premarket trade thus far is also trading on a gap although not one that will result in any true gapThere is a lot of discussion as to what constitutes a gap. Is it measured to the prior day's close, or to the prior day's high or low? Here at ShadowTrader, we believe that it is always and only to a prior day's high or low, thus creating a true gap or space on the chart between one day and the next. Thus a true gap is one that has price opening completely outside of the prior day's range (either above the high or below the low) and anything else is just a gap that has far less import. As a gap is a "reordering of thinking", only a true gap really changes the tone and creates opportunity to trade earlier (near the open) rather than later. More on the chart. Currently ticking down about 11, futures are trading well inside of yesterday’s range and the ONLOvernight Low. A term mostly used for the futures market as it trades almost around the clock. To be precise, in the /ES this would be the lowest price between 4:30pm EST and 9:30am EST the next day. is well above the RTHRegular Trading Hours. In the /ES this means the price action from 9:30am EST to 4:15pm EST only. low. This is of note. I believe that a market that was more panicked or got itself too long yesterday would have fallen apart further. Why didn’t overnight trade at least test the RTHRegular Trading Hours. In the /ES this means the price action from 9:30am EST to 4:15pm EST only. low? Beyond these dynamics we need to note that the overnight inventoryA way of measuring overnight activity in the futures market by just noting how much of the overnight activity happens to fall above the prior day's settlement value (4:15pm EST close) and how much falls below. If more activity is above the settlement, then overnight inventory is said to be net long. If more is below, then it is said to be net short. If all of the overnight activity is above the settlement, then it is said to be 100% net long. If all of the activity is below the settlement then it is said to be 100% net short. The overnight inventory situation matters most and has the most impact on early trade when it is skewed 100% in either direction because when the imbalance is very large like that then the odds of an early correction increase greatly. This is due to the fact that most... situation is solidly net shortThe concept of being more short than long in an options spread by creating options spreads where you are selling more structures than you are buying or selling wider structures than the ones you are buying. Example would be a broken wing butterfly. This spread is made up of two structures, one long vertical and one short vertical. In the BWB, the short vertical is wider than the long vertical. When you are long this spread, you are said to be in an options position that is "net short"

. Putting those together I would expect a rotational day today which may well hold inside of yesterday’s RTHRegular Trading Hours. In the /ES this means the price action from 9:30am EST to 4:15pm EST only. range.

Note that before the aforementioned news came out, the volume POCPoint of Control, also known as the "fairest price to do business". It is the price level in the /ES where the greatest amount of volume in the prior RTH session traded. ShadowTrader measures the POC using volume but the traditional way is to mark off the widest point of the day's distribution where the most TPO's printed going across from left to right, indicating that that was the price where the most time was spent. It's important to pay attention to both the volume POC and the TPO POC. managed to migrate to the upper end of yesterday’s distribution. Carry that forward at least for today.

There won’t be any development of anything meaningful on the downside unless we can find acceptanceWhen the market profile begins to build out or develop in a certain area, it is said that the market is accepting those prices. This can be measured either in time spent or amount of volume that is transacted. It is generally understood that ShadowTrader defines acceptance as more of a time dynamic than a volume one. A good rule of thumb is to look for at least two TPO periods to print in the accepted area. The acceptance confirms that a significant amount of market participants are transacting at those levels. Acceptance is the opposite of rejection. More below the 2652.50 level (top of lower gap) and on to the 2647.50 which would represent the fill. AcceptanceWhen the market profile begins to build out or develop in a certain area, it is said that the market is accepting those prices. This can be measured either in time spent or amount of volume that is transacted. It is generally understood that ShadowTrader defines acceptance as more of a time dynamic than a volume one. A good rule of thumb is to look for at least two TPO periods to print in the accepted area. The acceptance confirms that a significant amount of market participants are transacting at those levels. Acceptance is the opposite of rejection. More below that level puts the 2636.00 VPOCVirgin Point of Control. This is a point of control level that has not yet been tested (traded through) during an RTH session. If the POC gets tested during an overnight session, it does not count and remains "virgin" until it happens during a day session. into play. On the upside, the gap was shortened a bit by yesterday’s action but about 5 handles still remain starting at 2676.25. Obviously, a breach there puts the 2681.50 opposite end of the gap into play. Anything higher than that and you’re targeting 2694.50 which is the VPOCVirgin Point of Control. This is a point of control level that has not yet been tested (traded through) during an RTH session. If the POC gets tested during an overnight session, it does not count and remains "virgin" until it happens during a day session. from 11/19.

Ok, enough with the jargon, just give it to me in a nutshell:

-Futures should be weaker overnight after having a look above and failA specific type of market movement where prices rise above the high of a balance area and then fall back into the balance area. The theory is that if this happens, there are strong odds that there will be price rotation back down to the low of the balance area. Look above and fail is specific to activity around balance areas only. Rising above a prior day's high or any technical level and falling back below is not a "look above and fail". More yesterday. That being said, since they are still trading well inside of yesterday’s range and didn’t even move to the RTHRegular Trading Hours. In the /ES this means the price action from 9:30am EST to 4:15pm EST only. low, my thought is that we could rally today or at least hold yesterday’s range in a rotational manner. If we don’t, there are clear and obvious signposts above and below yesterday’s range which should be used as targets.

A Bet and a Victor eBook

Best way to dip your toe into the ocean of Trading Psychology for a tiny price. Follow protagonist Victor and see how many of his trading psychology pitfalls you recognize!

$20 - Get Yours TodayHave an excellent day,

-peter