Today’s ES and NQ Market Profile and Pivot Point Numbers

| Value Area HighThe high end of the range of the value area. | 3993.50 | 12122.00 |

| Point of ControlAlso called “POC” for short. The level in the futures inside the value area where either the greatest amount of volume traded in the prior session, or the greatest amount of time was spent as measured by the number of TPO’s going across. Measured this way, the POC would be the widest part of any given market profile. While ShadowTrader calculates its value areas and points of control using volume exclusively, we are always very aware of where the TPO POC is and it’s relation to current prices or patterns in the profile. Both are very important. | 3982.00 | 12088.00 |

| Value Area LowThe low end of the range of the value area. | 3977.00 | 12060.00 |

| R3 | 4036.00 | 12301.75 |

| R2 | 4019.75 | 12237.25 |

| R1 | 3997.50 | 12154.75 |

| Pivot | 3981.25 | 12090.25 |

| S1 | 3959.00 | 12007.75 |

| S2 | 3942.75 | 11943.25 |

| S3 | 3920.50 | 11860.75 |

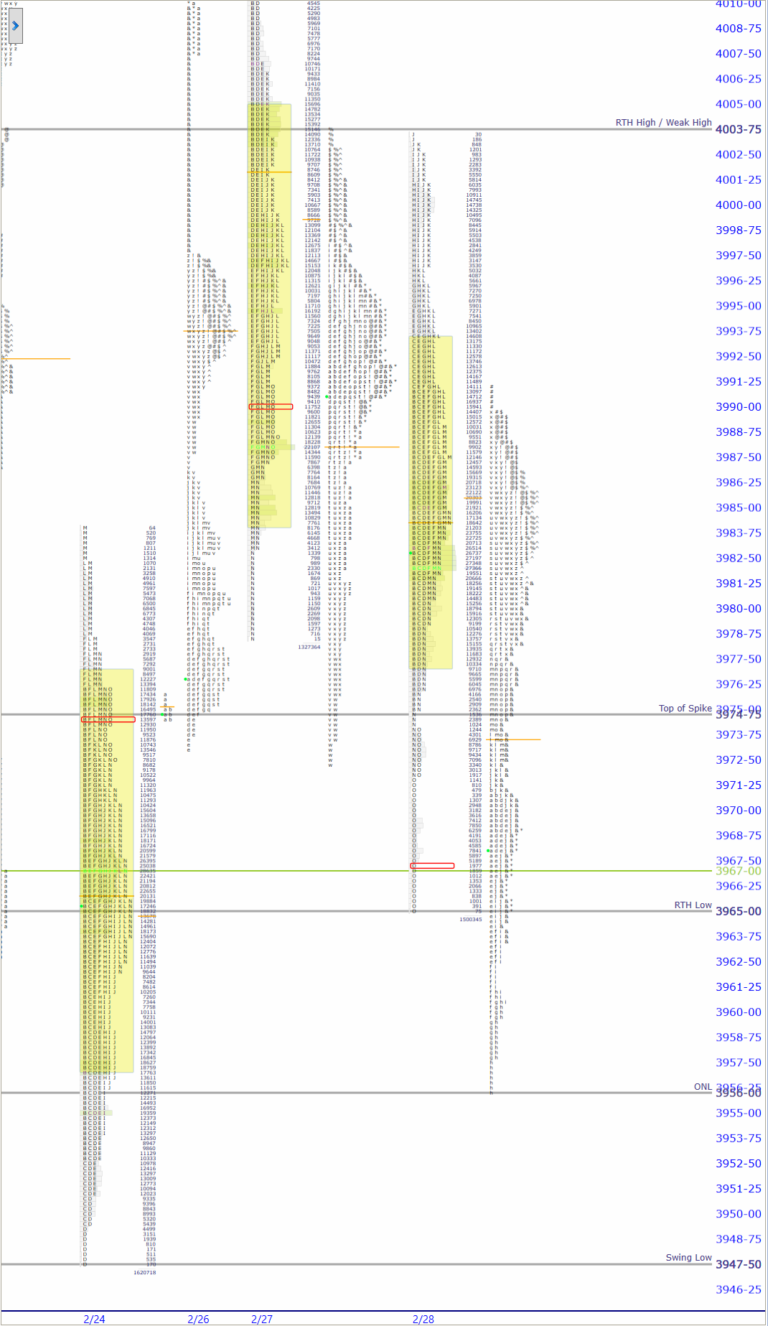

Today’s Market Profile Chart

The above chart is from WindoTrader | Call 702-800-4628 and speak with Terry about the ShadowTrader discount or CLICK HERE to learn more.

Click HERE for a market profile key that will help you interpret the chart above.

Pre market indications

| Opening In/Out Balance | in balalnce |

|---|---|

| Overnight InventoryA way of measuring overnight activity in the futures market by just noting how much of the overnight activity happens to fall above the prior day's settlement value (4:15pm EST close) and how much falls below. If more activity is above the settlement, then overnight inventory is said to be net long. If more is below, then it is said to be net short. If all of the overnight activity is above the settlement, then it is said to be 100% net long. If all of the activity is below the settlement then it is said to be 100% net short. The overnight inventory situation matters most and has the most impact on early trade when it is skewed 100% in either direction because when the imbalance is very large like that then the odds of an early correction increase greatly. This is due to the fact that most... | balanced |

| Current Price/Overnight Range | middle third |

| Shock and AweA term Peter uses to describe what overnight futures traders may be feeling when faced with an open that is wildly divergent from what they expected. Large gaps in either direction that are opening well outside of range are examples of this. The approach is that when the market opens in such a manner, there is often opportunity to trade earlier rather than later because of the large contingent of traders who will be forced to reverse their positions quickly. | no |

| Potential for Early Trade | no |

| Short Term Bias | neutral, market looking for more information |

Key Levels for Today

| 4034.25 | Poor HighA poor high is one which lacks excess and is the opposite of an excess high. A poor high will have less than two TPO's of excess at the top of a daily range with at least 2-3 columns of TPO's lining up to form a flat looking top. It indicates that there are short term or weak handed longs at that high of day area. We know this because every time prices rise to the top, they get sold quickly, thus forming the poor high. The poor high has two forward looking indications. The first is that prices should back away from the poor high as there are a number of longs trapped at poor location. The second is that if the next day or in some subsequent session, the poor high is revisited, then the odds are strong that it will break and move higher. This is called repair as it repairs the structur... 2.23 |

|---|---|

| 4003.75 | RTHRegular Trading Hours. In the /ES this means the price action from 9:30am EST to 4:15pm EST only. High (Weak) |

| 3971.50 | Top of SpikeA set of single prints that are created in the last 30 minute session of the day which form at the top or bottom of a range. |

| 3965.00 | RTHRegular Trading Hours. In the /ES this means the price action from 9:30am EST to 4:15pm EST only. Low |

| 3956.00 | ONLOvernight Low. A term mostly used for the futures market as it trades almost around the clock. To be precise, in the /ES this would be the lowest price between 4:30pm EST and 9:30am EST the next day. |

| 3947.50 | Swing Low |

Ongoing Narrative / Commentary

Market stayed on brand yesterday with an early grind higher that was negated and then some by afternoon selling. This selling closed on the LODLow of Day leaving a spikeA set of single prints that are created in the last 30 minute session of the day which form at the top or bottom of a range. in its wake. Spike rulesA framework for analyzing a spike on the next trading day after it is formed.

Because the spike forms late in the day, it is impossible to gauge whether or not the higher or lower prices that have run quickly away from value will be deemed fair later. Thus we employ the spike rules in the next session.

Everything below is assuming a spike at the TOP of a daily range (reverse for a spike at the BOTTOM of a range)

-If prices open above the spike, that is considered bullish and tells us that prices didn't auction high enough in the spike to attract sellers and cut off buying activity. Monitor to see if there is acceptance above the spike.

-Prices opening within the spike confirm the higher prices of the spike. This tells us that the prices are fair enough for two sided... are in play and as such we are currently slated to open within the spikeA set of single prints that are created in the last 30 minute session of the day which form at the top or bottom of a range. which is bearish as it confirms the lower prices of the spikeA set of single prints that are created in the last 30 minute session of the day which form at the top or bottom of a range.. Get familiar with spike rulesA framework for analyzing a spike on the next trading day after it is formed.

Because the spike forms late in the day, it is impossible to gauge whether or not the higher or lower prices that have run quickly away from value will be deemed fair later. Thus we employ the spike rules in the next session.

Everything below is assuming a spike at the TOP of a daily range (reverse for a spike at the BOTTOM of a range)

-If prices open above the spike, that is considered bullish and tells us that prices didn't auction high enough in the spike to attract sellers and cut off buying activity. Monitor to see if there is acceptance above the spike.

-Prices opening within the spike confirm the higher prices of the spike. This tells us that the prices are fair enough for two sided... if you are not already.

In yesterday’s commentary and video, I spoke of the market developing a balance area over the last 4-5 sessions. Yesterday’s action remained within this range. Traders should always keep in mind that balance leads to excess and thus a larger move is coming at some point when prices move out of this range. I discuss this again in the video below.

As Bone Thugs n Harmony have taught us, the first of the month is important. I would not be surprised to see a bit more volatilaty come in as the calendar flips today. Let’s see if we can get out of this balance area and what that might bring.

VPOC’s

- none

Scenarios

- Spike rulesA framework for analyzing a spike on the next trading day after it is formed.

Because the spike forms late in the day, it is impossible to gauge whether or not the higher or lower prices that have run quickly away from value will be deemed fair later. Thus we employ the spike rules in the next session.

Everything below is assuming a spike at the TOP of a daily range (reverse for a spike at the BOTTOM of a range)

-If prices open above the spike, that is considered bullish and tells us that prices didn't auction high enough in the spike to attract sellers and cut off buying activity. Monitor to see if there is acceptance above the spike.

-Prices opening within the spike confirm the higher prices of the spike. This tells us that the prices are fair enough for two sided... are in play. Current premarket indication is to open within the spikeA set of single prints that are created in the last 30 minute session of the day which form at the top or bottom of a range. which is bearish as it confirms the spikeA set of single prints that are created in the last 30 minute session of the day which form at the top or bottom of a range.. I will use the Top of the SpikeA set of single prints that are created in the last 30 minute session of the day which form at the top or bottom of a range. as my initial bullish/bearish line and will bias short today if this level is not breached. - Any acceptanceWhen the market profile begins to build out or develop in a certain area, it is said that the market is accepting those prices. This can be measured either in time spent or amount of volume that is transacted. It is generally understood that ShadowTrader defines acceptance as more of a time dynamic than a volume one. A good rule of thumb is to look for at least two TPO periods to print in the accepted area. The acceptance confirms that a significant amount of market participants are transacting at those levels. Acceptance is the opposite of rejection. More above the Top of the SpikeA set of single prints that are created in the last 30 minute session of the day which form at the top or bottom of a range. is more bullish and should target the POCPoint of Control, also known as the "fairest price to do business". It is the price level in the /ES where the greatest amount of volume in the prior RTH session traded. ShadowTrader measures the POC using volume but the traditional way is to mark off the widest point of the day's distribution where the most TPO's printed going across from left to right, indicating that that was the price where the most time was spent. It's important to pay attention to both the volume POC and the TPO POC..

- Taking out the ONLOvernight Low. A term mostly used for the futures market as it trades almost around the clock. To be precise, in the /ES this would be the lowest price between 4:30pm EST and 9:30am EST the next day. puts the recent swing low into play. Monitor for continuation and make sure that internalsInternals refers to “market internals” and is a blanket term to collectively describe the advance decline, breadth, tick and cumulative tick. confirm.

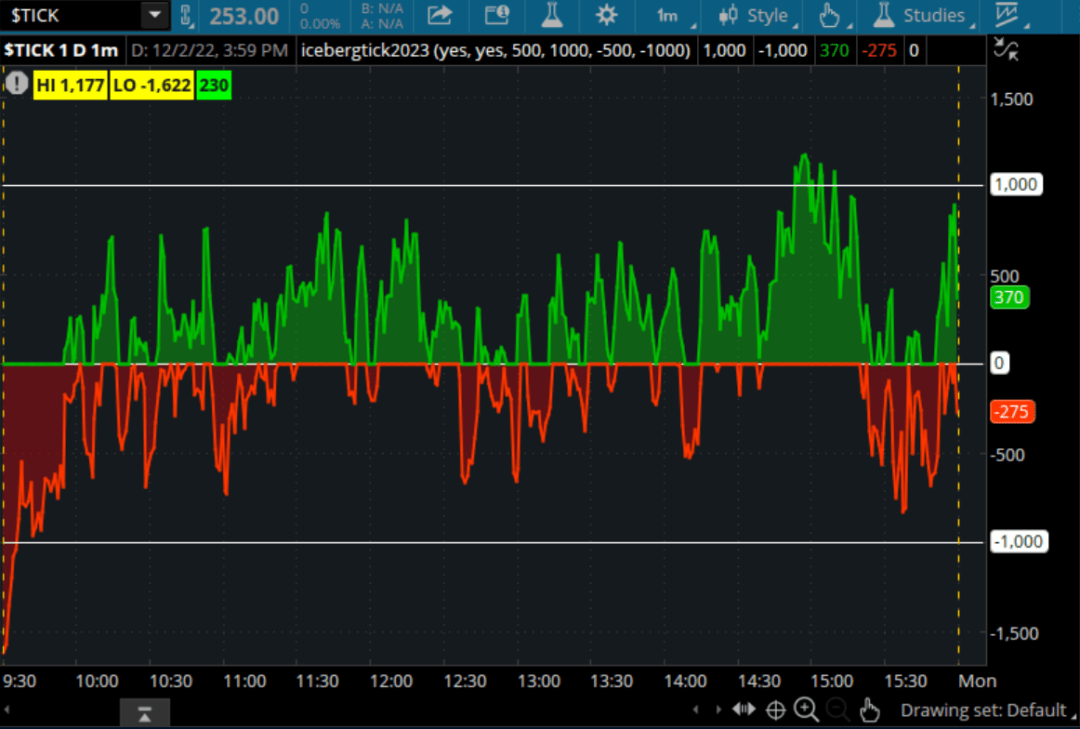

Iceberg Tick

A game changer if you use the TICKThe net cumulative tick reading on the NYSE or Nasdaq Composite. This is measured by the number of stocks ticking up minus the number of stocks ticking down at any given moment. It is the least used of the internal indicators but is discussed from time to time. Generally the tick readings are only helpful when they are at extremes such as +1000 on the NYSE to indicate that program trading is ensuing. as a market internal. Paints time spent above zero in green and time below in red. Traders who know how to use the TICKThe net cumulative tick reading on the NYSE or Nasdaq Composite. This is measured by the number of stocks ticking up minus the number of stocks ticking down at any given moment. It is the least used of the internal indicators but is discussed from time to time. Generally the tick readings are only helpful when they are at extremes such as +1000 on the NYSE to indicate that program trading is ensuing. know that this is what really matters in terms of sustaining intraday direction, not how high or low the extremes are.

LEARN MORE