Details

Overview, Trading Philosophy, and FAQ: CLICK HERE

View a sample trade: CLICK HERE

Listen to a sample What’s Peter Thinking: CLICK HERE

Listen to a sample What’s Peter Thinking: CLICK HERE

View sample of daily email (part 1): CLICK HERE

View sample of daily email (part2): CLICK HERE

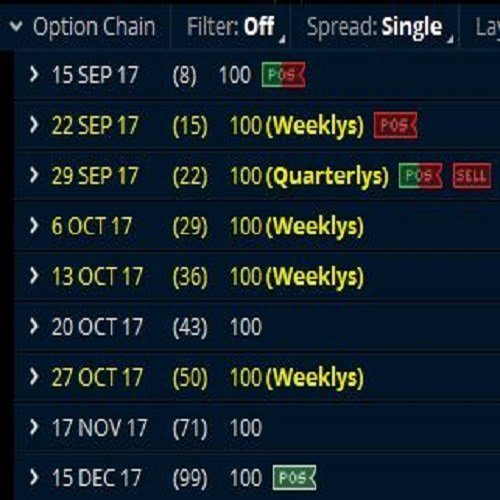

The ShadowTrader Weekly Options Advisory looks to capture short term profits using weekly options with durations of no longer than two weeks. While most options advisories focus only on spreads such as covered writes or verticals, ShadowTrader thinks outside the box and utilizes risk reversals, broken wing butterflies, unbalanced butterflies, and other esoteric spread combinations to take advantage of direction, volatility, and time on a short term basis.

Managed by Peter Reznicek, ShadowTrader’s Chief Strategist, the advisory sends out 8-12 trades per month via text message in real-time. Options trades are cut and pasted directly from the filled orders section of a real money thinkorswim account. At the end of each trading day, subscribers will receive an email detailing all trade activity that for that day. All trades including p&l on all options bought and sold are recorded and tracked and emailed to subscribers in a .pdf nightly.

Options Advisory subscribers also receive daily (sometimes multiple times per day) VIDEO clips from Peter called “What’s Peter Thinking”. These are short (from 30 seconds to 5 minutes) videos that Peter records on the fly when he is seeing something that warrants a “heads up!”. Many traders have written us that these alone are worth the price of the service.

Additionally, subscription to the advisory includes admission to our weekly “Members Only” webinar which is held on Thursdays at 4:15pm EST and is closed to the general public. These webinars, moderated by Peter Reznicek and Scott Gillam, will include a full technical analysis of all major averages including market profile on the /ES, all of our ideas for new options trades that we are looking to enter in the coming week, a detailed update on all trades currently open in the advisory, and a Q&A session where traders can ask anything they like about the strategies and trades.