The Market Profile value areas and ShadowTrader Pivots for /ESU19 and /NQU19 Futures are posted free every morning

in the ShadowTrader Swing Trader newsletter.

WindoTrader 702-800-4628 Speak with Terry about the ShadowTrader discount

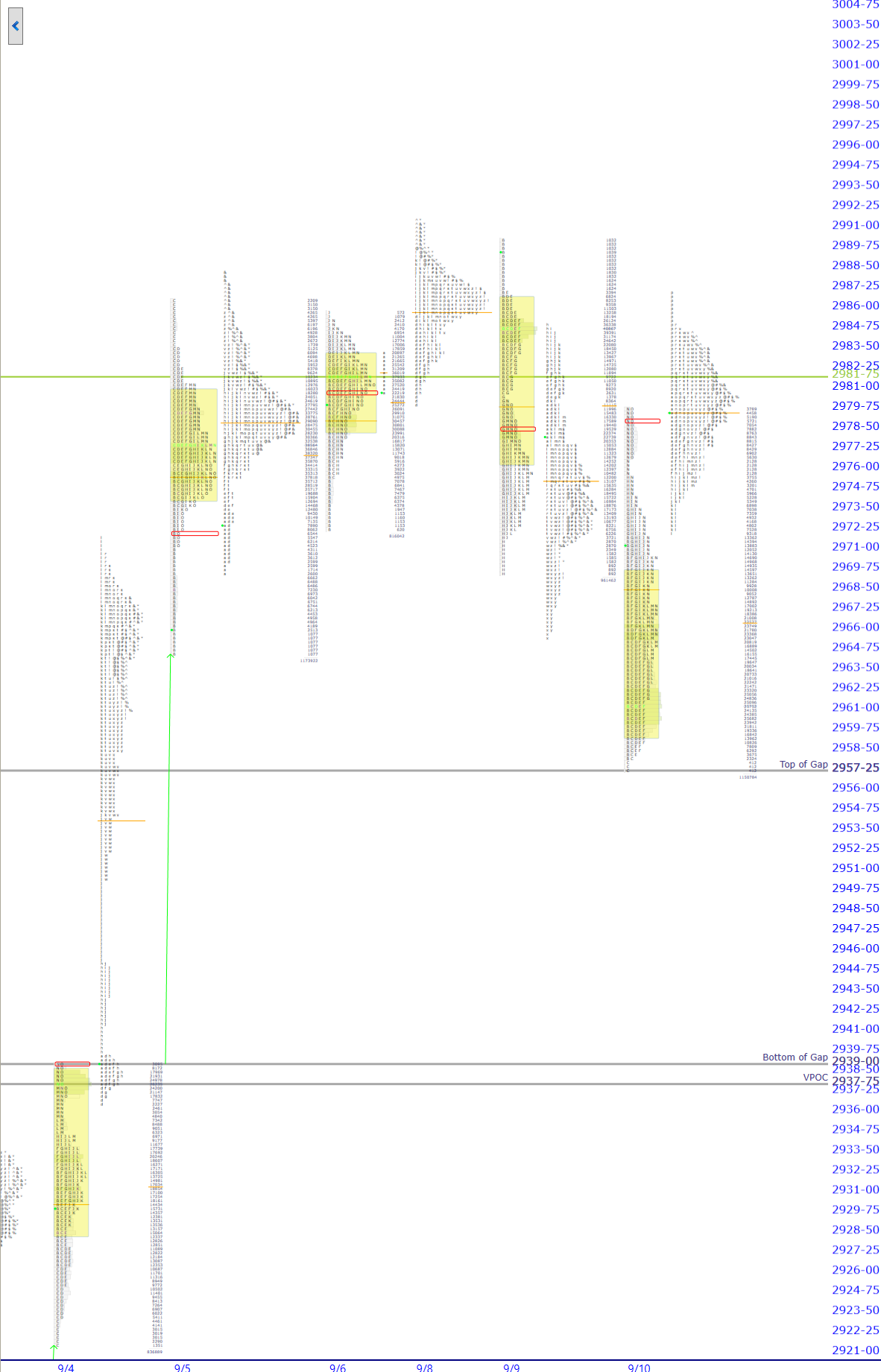

| 2990.25 | RTHRegular Trading Hours. In the /ES this means the price action from 9:30am EST to 4:15pm EST only. Balance Area High |

|---|---|

| 2981.25 | Prominent TPO(MP) Stands for “Time Price Opportunity”. It is the smallest unit of measure displayed any market profile graphic, denoted by a single letter. Each TPO represents a point of time where the market being charted trades at a specific price. A single TPO is printed on the chart every time that a certain price is touched during any time period. Typically, the periods are set to 30 minutes. Therefore, every different letter that you see in the market profile distribution denotes a different 30 minute period. POCPoint of Control, also known as the "fairest price to do business". It is the price level in the /ES where the greatest amount of volume in the prior RTH session traded. ShadowTrader measures the POC using volume but the traditional way is to mark off the widest point of the day's distribution where the most TPO's printed going across from left to right, indicating that that was the price where the most time was spent. It's important to pay attention to both the volume POC and the TPO POC. from 9/6 |

| 2957.25 | New Top of Gap / Balance Area low |

Yesterday’s action gave us a good amount of M.G.I.Market Generated Information. to add to our narrative, mostly in the form of a look below and failA specific type of market movement where prices fall below the low of a balance area and then rise back into the balance area. The theory is that if this happens, there are strong odds that there will be price rotation back up to the high of the balance area. Look below and fail is specific to activity around balance areas only. Falling below a prior day's low or any technical level and rising back above it is not a "look below and fail". More which took prices into the gap but still left a large portion of it unfilled. As always pay attention to what should happen and then note when the opposite happens. What should have happened is that new sellers should have been attracted once the top of the gap was pierced. It was like a party that started off pretty good and then some fool said “Let’s play charades!” and it fizzled quickly from there.

Which brings us to current action overnight which is a small true gapThere is a lot of discussion as to what constitutes a gap. Is it measured to the prior day's close, or to the prior day's high or low? Here at ShadowTrader, we believe that it is always and only to a prior day's high or low, thus creating a true gap or space on the chart between one day and the next. Thus a true gap is one that has price opening completely outside of the prior day's range (either above the high or below the low) and anything else is just a gap that has far less import. As a gap is a "reordering of thinking", only a true gap really changes the tone and creates opportunity to trade earlier (near the open) rather than later. More higher on overnight inventoryA way of measuring overnight activity in the futures market by just noting how much of the overnight activity happens to fall above the prior day's settlement value (4:15pm EST close) and how much falls below. If more activity is above the settlement, then overnight inventory is said to be net long. If more is below, then it is said to be net short. If all of the overnight activity is above the settlement, then it is said to be 100% net long. If all of the activity is below the settlement then it is said to be 100% net short. The overnight inventory situation matters most and has the most impact on early trade when it is skewed 100% in either direction because when the imbalance is very large like that then the odds of an early correction increase greatly. This is due to the fact that most... that is almost perfectly balanced. Beyond that, the open is slated to be in the larger balance area, in fact right in the meat of it where the prominent POCProminent Point of Control. This is a point of control level measured by time and not volume which is very wide relative to other areas of the distribution. It is a price level where every single (or almost every) TPO period traded. Prominent POCs are important as they have greater odds of being tested in subsequent sessions than less prominent POC levels. When measuring the POC by time and not volume, note that there can be a number of levels that are the same width. In the snapshot above, the green line of TPO's is where the most volume traded in the session. This is a good level to use as the prominent POC, keeping in mind that any of the wide areas can be turning points. If you look closely at the graphic, you can see the in the circled area, every TPO period (from B to O) is represent... More printed from three sessions ago. This means that if you are an /ES cowboy (or cowgirl) you will probably want to trade later rather than earlier as there is no “shock and awe” to overnight inventoryA way of measuring overnight activity in the futures market by just noting how much of the overnight activity happens to fall above the prior day's settlement value (4:15pm EST close) and how much falls below. If more activity is above the settlement, then overnight inventory is said to be net long. If more is below, then it is said to be net short. If all of the overnight activity is above the settlement, then it is said to be 100% net long. If all of the activity is below the settlement then it is said to be 100% net short. The overnight inventory situation matters most and has the most impact on early trade when it is skewed 100% in either direction because when the imbalance is very large like that then the odds of an early correction increase greatly. This is due to the fact that most... and the open is smack dab in the middle of the larger balance area. I honestly cannot stress that last sentence enough. I know from my own experience and thousands of emails from traders that one of the things that is most detrimental is thinking that just because you have heard that familiar 5 tone bell ringing, there must be something to do and it must be done now. Pavlov would be proud, and there will probably be responsive setups later in the morning if we remain within the larger balance area.

In the bigger picture the balance area is still intact and the balance area high and (new) top of the gap are still our reference points. Anything between is noise.

Scenarios

- Balance rulesWhen a market is in balance, meaning that it is consolidating in a tight range of two or more days, then balance rules apply. The balance rules are nothing more than a framework of scenarios that could happen which prepare us for every possible outcome.

The possible outcomes and how to trade them are:

1. Look above and go. Prices move above the high of balance and find acceptance and continue higher. The target should be double the balance area.

2. Look above and fail. Prices move above the balance high but fail to find acceptance and reverse back into the balance area. This is now a short with a stop above the high just outside of balance that was recently made, with a target to the opposing low end of the balance area.

3. Look below and go. Prices move below the ... are still in play. There could be some push/pull today as the volume POCPoint of Control, also known as the "fairest price to do business". It is the price level in the /ES where the greatest amount of volume in the prior RTH session traded. ShadowTrader measures the POC using volume but the traditional way is to mark off the widest point of the day's distribution where the most TPO's printed going across from left to right, indicating that that was the price where the most time was spent. It's important to pay attention to both the volume POC and the TPO POC. never migrated higher with price yesterday closing at the high, against the context of some shorts probably trapped from the look below and failA specific type of market movement where prices fall below the low of a balance area and then rise back into the balance area. The theory is that if this happens, there are strong odds that there will be price rotation back up to the high of the balance area. Look below and fail is specific to activity around balance areas only. Falling below a prior day's low or any technical level and rising back above it is not a "look below and fail". More. Given those two nuances, I put more weight on the trapped sellers and would continue to favor longs. - As usual, only a breach of the top of the gap which is the new balance area low would bring upon potential for change.

Recording of the market profileA way of reading the market that recognizes either time spent or volume traded at a particular price level. A market profile can be either made up of “TPO’s” (time price opportunities), or volume. TPO’s measure how much time was spent at a particular price, while volume-based market profiles measure how much volume traded at a particular price. Generally, market profile is used in the trading of futures, especially the /ES. ShadowTrader utilizes volume based profiles. Q&A from yesterday…

ShadowTrader Tape Reader

Provides an essential edge for successful day trading in both stocks and futures contracts. A thinkorswim add on study that can actually “read the tape” and tell you how much is being traded at bid vs offer.

Learn More