Details

Eight hours of market profile instruction

Comprehensive course starting from most basic concepts to advanced

Excellent starting point for those new to market profile

Introduction

00:00 – Welcome and thank you

00:39 – Course contents

01:38 – What is a market?

02:59 – Why Market Profile?

04:43 – Price is an advertising mechanism

05:42 – Time regulates all opportunities

06:06 – Value judges the success or failure of any auction

06:46 – Value equation

Part I – Basics

00:00:00 – Introduction, Framework, Signposts

00:01:17 – Market profile vs candlesticks

00:03:05 – Why are most profiles on futures?

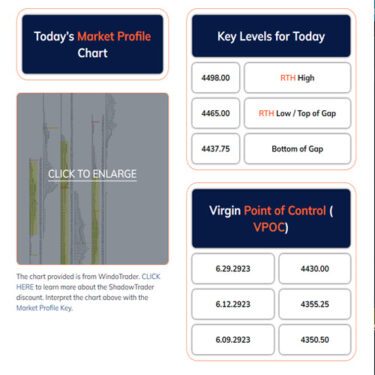

00:03:50 – Overnight and RTH distributions

00:04:56 – TPO’s: the building blocks of profile

00:08:37 – Market profile elements

00:19:16 – Single vs double distribution

00:21:55 – Single prints

00:24:26 – Letter “p” and “b” formation

00:27:55 – Prominent POCs

00:31:50 – Virgin points of control (VPOCs)

00:36:22 – Highs & Lows: excess, poor, lack of material excess

00:42:25 – 45 degree line

00:51:40 – Spikes

00:53:38 – Anomalies

00:57:21 – Squat profile vs expansion of range

01:02:15 – Value area placement

01:10:13 – Volume at price

Part II – Theory

00:00:00 – Timeframes and who controls?

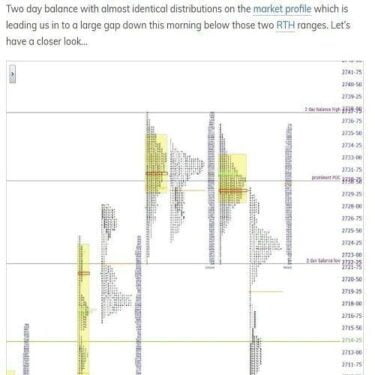

00:01:10 – Balance and excess

00:07:52 – Overnight inventory

00:11:15 – The three premarket questions

00:26:08 – Shock and awe, Trading early vs later, inventory corrections, old business vs new business

00:45:23 – Gaps and gap fills

00:51:31 – Acceptance vs rejection

01:00:41 – The power of WWSHD

01:10:48 – Gap rules

01:25:32 – Spike rules

01:32:16 – Balance rules

01:41:20 – Eighty percent rule

01:49:59 – Three questions, value development & migration, range expansion

02:05:06 – Poor highs and poor lows

02:18:58 – Weak highs and lows

02:24:04 – Small vs large value areas

02:28:38 – Prominent POCs vs less prominent POCs

02:33:27 – POC migration

02:46:07 – Prices being drawn to POC and holding

02:51:18 – VPOCs, VPOC stacking, trending markets

02:59:50 – What to do with VPOCs on rollover

03:07:26 – Double distributions, how to trade single prints

03:15:35 – One time framing

03:23:10 – Swing highs & lows created in overnight sessions

03:27:41 – Holiday activity

03:20:20 – Volume at price, the taper

03:38:30 – Why /ES is the preferred future for profile

03:41:54 – Building and maintaining narrative

03:54:58 – Confluence of profile nuances

Part III – Application

00:00:00 – Applying the profile concepts to actual markets

00:00:46 – Weak high (live trade)

00:09:24 – Bounce from base of spike

00:12:42 – Gap fill, gap rule #3

00:23:55 – Rejection from top of single prints (live trade)

00:29:02 – Breakout through confluence of profile nuance (live trade)

00:35:20 – Waiting for the taper (live trade)

00:43:58 – Old business vs new business, gap fill, WWSHD

00:57:41 – Developing poor low

01:03:14 – Liquidation break, taper of volume

01:08:30 – Gap rules #2, #4, overnight high unsecure

01:21:40 – Gap rule #3 (live trade)

01:36:41 – POC Migration

01:44:54 – Double Distribution

01:51:43 – 80 percent rule (live trade)

01:56:42 – The three premarket questions

02:04:53 – PPP One

02:12:04 – PPP Two

02:17:08 – PPP Three

02:30:11 – Outro