The Market Profile value areas and ShadowTrader Pivots for /ESH20 and /NQH20 Futures are posted free every morning

in the ShadowTrader Swing Trader newsletter.

WindoTrader 702-800-4628 Speak with Terry about the ShadowTrader discount

| 3244.75 | RTHRegular Trading Hours. In the /ES this means the price action from 9:30am EST to 4:15pm EST only. High |

|---|---|

| 3231.75 | RTHRegular Trading Hours. In the /ES this means the price action from 9:30am EST to 4:15pm EST only. Low |

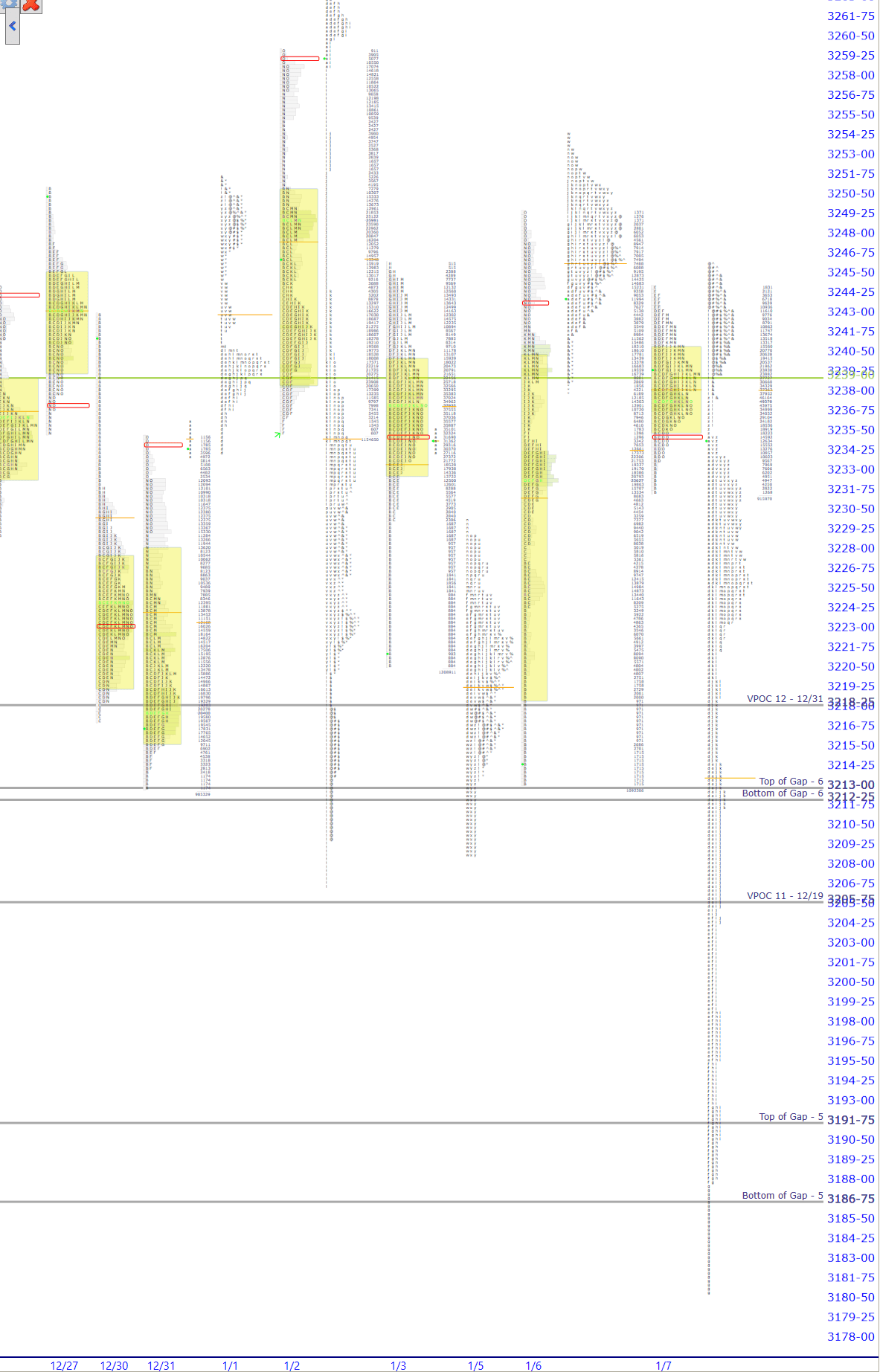

Huge range in the overnight session on further news out of the Middle East. Recovery was swift off of the lows and we are now trading on a decent sized gap higher. Currently, I’m seeing indications that we are inside of yesterday’s range so the gap is not true and gap rulesGuidelines to follow on any day that the futures open outside of the prior day's RTH range. Only opening outside of range is a true gap and puts gap rules in play. 1. Go with all gaps that don't fill right away. This means that if early trade doesn't start to correct the imbalance, then prices will probably move in the direction of the gap. 2. Larger gaps can often fail to fill on the first day or may fill only partially. 3. If the gap fills (meaning the prior day's RTH high is touched on a gap up or the prior day's RTH low is touched on a gap down) and value cannot get to at least overlapping, then the odds of a late day rally (on a gap up) or late day selloff (on a gap down) increase. 4. Gaps of larger than $20 in the /ES are difficult to trade and should be avoided early in the day as t... More are not in play for now.

You’re probably wondering with all the fireworks last night how can there be only two Key Levels listed above? I chose this purposely to get your attention away from the overnight session and onto the RTHRegular Trading Hours. In the /ES this means the price action from 9:30am EST to 4:15pm EST only. sessions which are all that really matter. Yesterday’s distribution was small and the value areaA range where approximately 70% of the prior days volume traded. The range is derived from one standard deviation on either side of the mean which is roughly 70%. See: Market Profile was very compacted. This tighter consolidation is within a much larger balance area. As such, I believe that the endpoints of yesterday’s range are the main action points for today’s trade. I’m only concerned with the overnight range in the context that I see it as a very large liquidation breakA sudden selloff in the market that has the following characteristics:

-Often happens very early or late in the day

-Comes out of a pattern that doesn’t suggest such a break should occur

-Has no definitive catalyst or news that drives it

-Has much faster tempo than the one that has already been established

-Is often short-lived and will retrace 100% soon after or the next day

A liquidation break happens when short term traders get overly long and all panic out at once. It is different from a stronger, more lasting correction in that there are usually only very short timeframe players involved, usually those who got most recently long at poor location. and know that liquidation breaks strengthen a market. See it as the fact that it happened and recovered is bullish going forward.

The main question today to be asking is whether or not this larger balance area is ready to resolve higher or not. While it would be convenient to assume that over yesterday’s high it is and under it is not, it’s simply not that clear because of yesterday’s range being tucked into a larger balance. If you recall, in yesterday’s Premarket Perspective I laid out the case that the odds favored a tight market. This was confirmed by what I saw early on in market internalsInternals refers to “market internals” and is a blanket term to collectively describe the advance decline, breadth, tick and cumulative tick., tempoProbably one of the most important and yet overlooked concepts in the market. The tempo is simply the ‘speed’ at which the market is moving. This is also referred to as confidence. Slow tempo is typical of range bound days where there is lots of responsive activity. Fast tempo occurs when there is initiating activity, and market is breaking out of a range. This is not to say that the market can’t have fast tempo on days when it is rotational or moving between the extremes of a value area. It certainly can. Effective intraday futures trading involves gauging the tempo and knowing that opportunities are fewer and smaller when the tempo is slow. See S.O.H., and lack of follow through to early moves. In today’s session, I will simply be monitoring the same parameters to see if the market presents something different. If so, I want to see acceptanceWhen the market profile begins to build out or develop in a certain area, it is said that the market is accepting those prices. This can be measured either in time spent or amount of volume that is transacted. It is generally understood that ShadowTrader defines acceptance as more of a time dynamic than a volume one. A good rule of thumb is to look for at least two TPO periods to print in the accepted area. The acceptance confirms that a significant amount of market participants are transacting at those levels. Acceptance is the opposite of rejection. More outside of yesterday’s range to the upside for long trades and acceptanceWhen the market profile begins to build out or develop in a certain area, it is said that the market is accepting those prices. This can be measured either in time spent or amount of volume that is transacted. It is generally understood that ShadowTrader defines acceptance as more of a time dynamic than a volume one. A good rule of thumb is to look for at least two TPO periods to print in the accepted area. The acceptance confirms that a significant amount of market participants are transacting at those levels. Acceptance is the opposite of rejection. More below for possible short trades.

Though it’s not listed above, you should continue to carry forward the fact that for like the umpteenth time there is still an all time high made in an overnight session up at 3263.50. Odds don’t favor it holding. As this has worked many times in the past, we should continue to expect it be true again unless OTFOther Time Frame - This is a term from the early days of market profile that simply denotes those market participants that are not active in the day time frame. Think: longer term buyers and sellers like swing or core. sellers arrive in the market.

Lastly, with the rather squat profile distribution yesterday, it left a prominent TPO(MP) Stands for “Time Price Opportunity”. It is the smallest unit of measure displayed any market profile graphic, denoted by a single letter. Each TPO represents a point of time where the market being charted trades at a specific price. A single TPO is printed on the chart every time that a certain price is touched during any time period. Typically, the periods are set to 30 minutes. Therefore, every different letter that you see in the market profile distribution denotes a different 30 minute period. POCPoint of Control, also known as the "fairest price to do business". It is the price level in the /ES where the greatest amount of volume in the prior RTH session traded. ShadowTrader measures the POC using volume but the traditional way is to mark off the widest point of the day's distribution where the most TPO's printed going across from left to right, indicating that that was the price where the most time was spent. It's important to pay attention to both the volume POC and the TPO POC. at its middle. That level is at 3239.25. Watch it today as a signpost for a market that is not ready to break out of balance just yet. More prominent POC’s (read: more value) act as magnets and not only pull prices to them but tend to hold prices there as the price is obviously deemed “fair” by a disproportionate number of market participants. A market that wants to remain in balance today will probably trade through and around the level multiple times.

Scenarios

- As of now we are trading dead in the middle of a small balancing day. As such, use the extremes of that session as potential triggers for long or short bias in today’s session. Overall, I believe that there should be at least some “shock and awe” at the open from those who may still be short in from the overnight session which would support prices today. If it doesn’t, then I’m going to monitor selling very carefully to see if it’s real or that the market is simply still balancing.

ShadowTrader Intraday Volume Measure

COMPARE INTRADAY VOLUME IN ANY TIMEFRAME

Fully Customizable Settings!

$20 Buy Now